Gold recovered from its earlier lows to turn flat on the session and silver drifted into the positive territory. Following their gains on Monday, and impressive gains for silver in particular, both metals fell on Tuesday amid profit taking and as the strength in US dollar discouraged traders. The greenback was higher again at the time of writing, which partly explains the earlier weakness in metals prices. Despite that, though, gold and silver recovered from their earlier weaknesses along with equity indices once US investors entered the fray. So, our gold forecast remains bullish despite the dollar strength this week.

Gold forecast: why did the metal bounce back?

Well, the US dollar also run into some mild pressure, with the EUR/USD bouncing along with gold to trade back to 1.0750 and GBP/USD was nearing 1.25 handle after dipping earlier to 1.2465. So, that partly explains why the metals bounced back. That said, these currency pairs were still holding losses on the session late in the day here in London. Apart from a couple of Fed speakers, there wasn’t much in the way of US data to trigger the small drop in USD from its earlier highs or the recovery in gold prices.

So, gold’s recovery appears to be more aligned with equities than the major FX pairs.

It is apparent that many traders are happy to buy any dips they can get their hands on. Given the strong trend on precious metals this year, you wouldn’t blame them either.

The metals have been driven this year by strong demand amid ongoing central bank purchases and increased inflation hedging demand. Years of above-forecast inflation has reduced the purchasing powers of global currencies, and in some cases drastically so, increasing the need for alternative to fiat currencies.

China’s apparent economic recovery is also helping the cause given that they are the top consumers of gold as a nation.

Before discussing key US macro highlights that are due to come over the next week or so, let’s have a quick look at gold’s chart.

Gold technical analysis

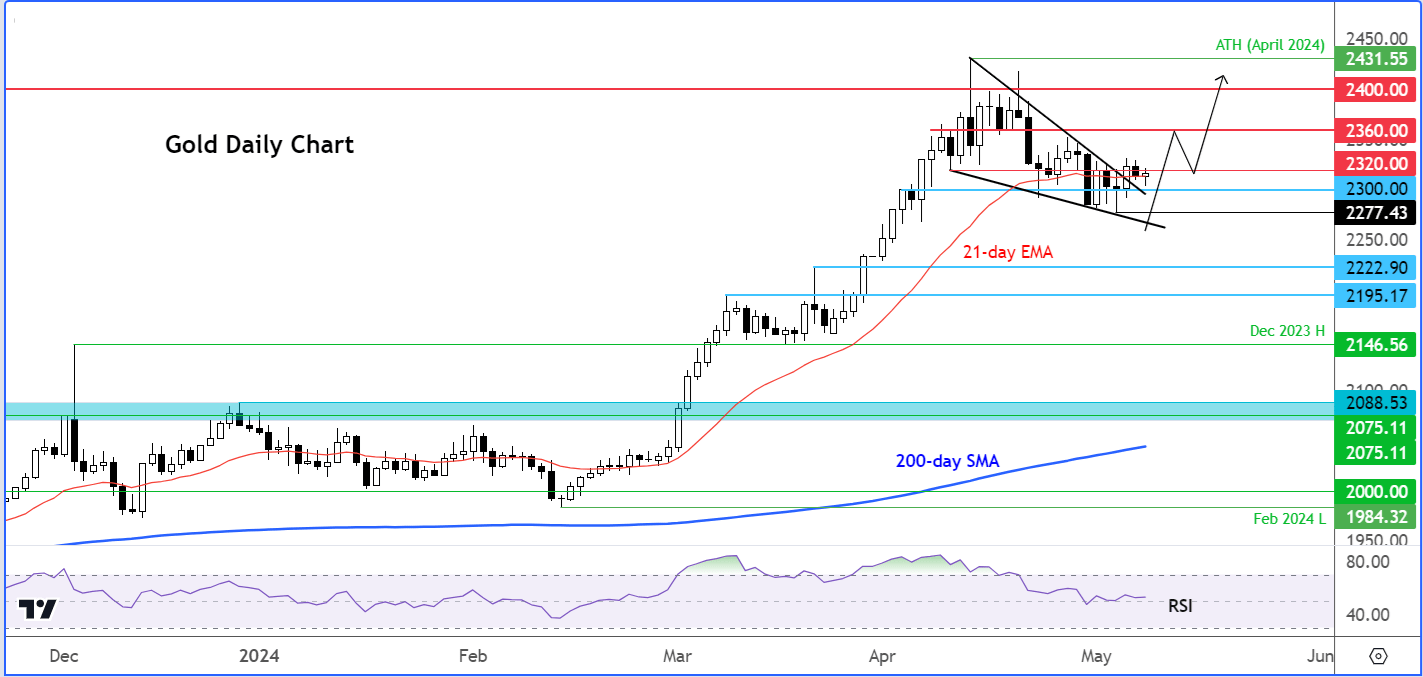

Source: TradingView.com

Our XAUUSD forecast remains bullish from a technical viewpoint. The metal had been confined within a descending wedge pattern in recent weeks, following its earlier record-breaking breakout. This week however, it has broken out of this continuation pattern, suggesting that the metal is potentially ready to take off again especially as the recent consolidation has allowed momentum indicators like the RSI to reset from their "overbought" levels through both time and price.

The bulls now have the breakout above the wedge pattern's resistance trend to signal a continuation of the uptrend, so I wouldn’t be surprised if gold starts to chip away at the next resistance in around the $2320-$2330 area.

A potential break above the $2320-$2330 area could pave the way for an initial rise towards the most recent local high at $2352.

Subsequent bullish targets above $2353 include $2460 followed by $2400. The record high that was hit earlier in April comes in at $2431. But the potential rally could easily extend far beyond that level once the ball gets rolling.

However, if bearish price action persists instead, then we could see a lengthier phase of consolidation. While the metal remains below the most recent local high of $2352, I wouldn’t rule out the potential for another drop despite the breakout from the falling wedge pattern.

If the sellers re-emerge, then the next big support level below $2300 comes in all the way down around the $2222 to $2195 range. But this is not by base case scenario as I am expecting to see continued bullish price action instead.

Gold forecast: UoM surveys in focus before attention turns to CPI

It had been a quiet week for US data, especially following the recent Fed policy decision, NFP, and other economic indicators. The only notable event on the US economic calendar is on Friday at 15:00 BST, when the University of Michigan releases its consumer sentiment and inflation expectations surveys.

After the Fed's meeting last week, investors were uncertain. Powell dismissed expectations of another hike this year, but also indicated no rush to start cutting rates, contrary to expectations. Despite recent weak survey-based data, concerns about persistent inflation remain.

This puts University of Michigan’s Inflation Expectations survey into focus. It has climbed steadily from 2.9% in January to 3.2% in April. With recent economic data weakening, will inflation expectations also ease?

Meanwhile, the UoM will also release its consumer sentiment data simultaneously, potentially overshadowing the inflation expectations survey. This gauge has disappointed expectations recently and is expected to print 76.3 compared to 77.2 previously.

CPI coming up in week ahead

Despite the recent weakness in several survey-based data, ongoing concerns about persistent inflationary pressures that have been reflected in various economic indicators, remain. Ahead of CPI on Wednesday, we will have seen the latest PPI figures the day before. Together, the PPI and CPI data for April have the potential to intensify or reduce inflation concerns significantly depending on the direction of the surprise. CPI has consistently beaten expectations since the turn of the year. The Fed and dollar bears will be hoping to see a softer print for a change, else rate cut expectations could be pushed out further.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade