- Gold and silver have broken long-running resistance zones, potentially explaining the bullish price action seen recently

- Geopolitics, central bank purchases, limited mine development, higher inflation expectations and unsustainable government fiscal positions are also providing tailwinds

- While gold and silver may be overbought and overextended near-term, it’s hard to ague with the price action – it’s been definitively bullish

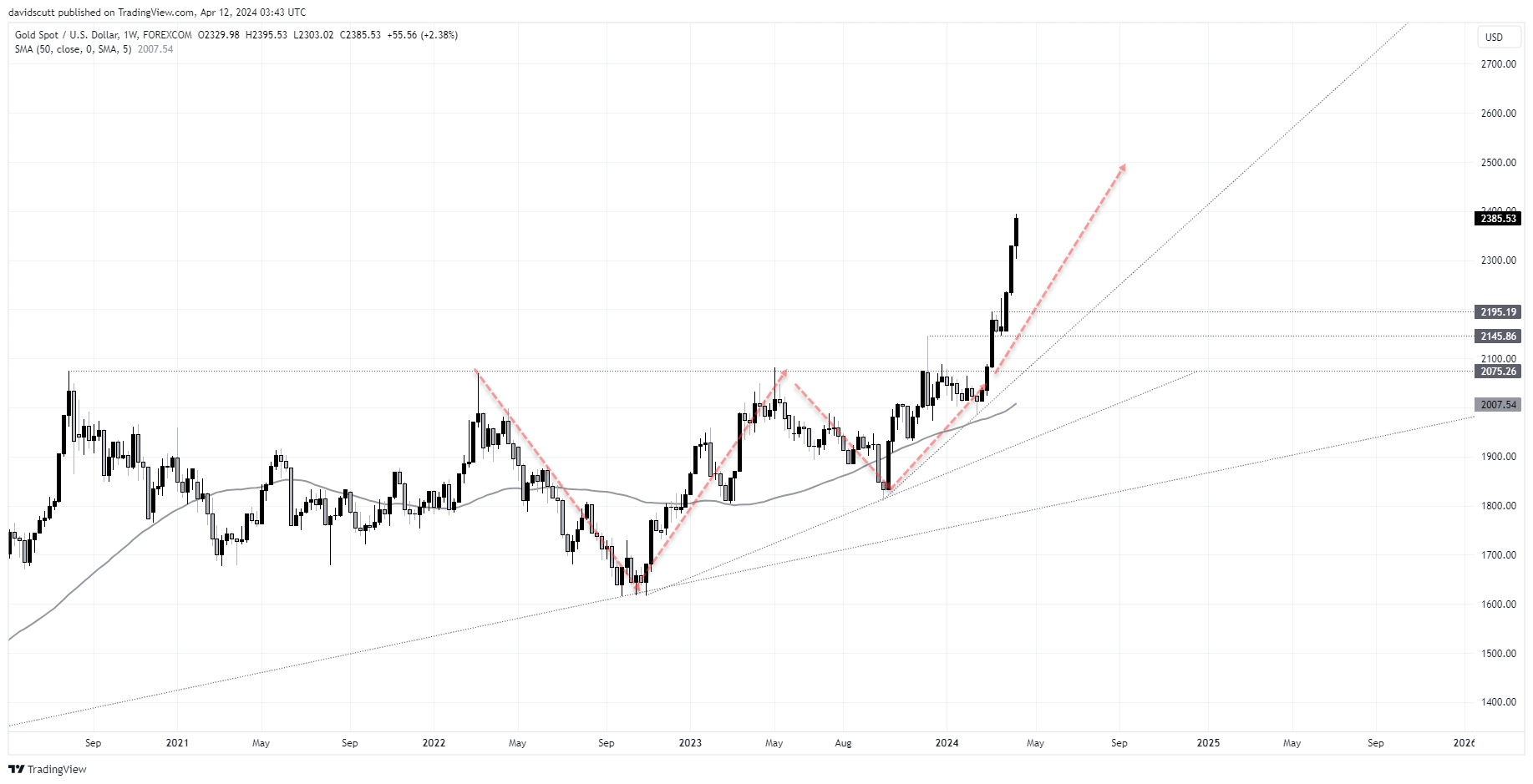

Gold stages textbook breakout

Gold and silver are doing exactly what you’d expect from a market that’s just broken long-running horizontal resistance.

Gold had been bumping up against resistance around $2075 since late 2020, coiling within a series of uptrends. After a false break in December 2023, the puncturing of the long-running resistance zone fared better second time around, taking out the former high before a period of consolidation before launching higher yet again.

Considering how long the price was coiling below $2075, even a conservative estimate suggests the break could extend to above $2500.

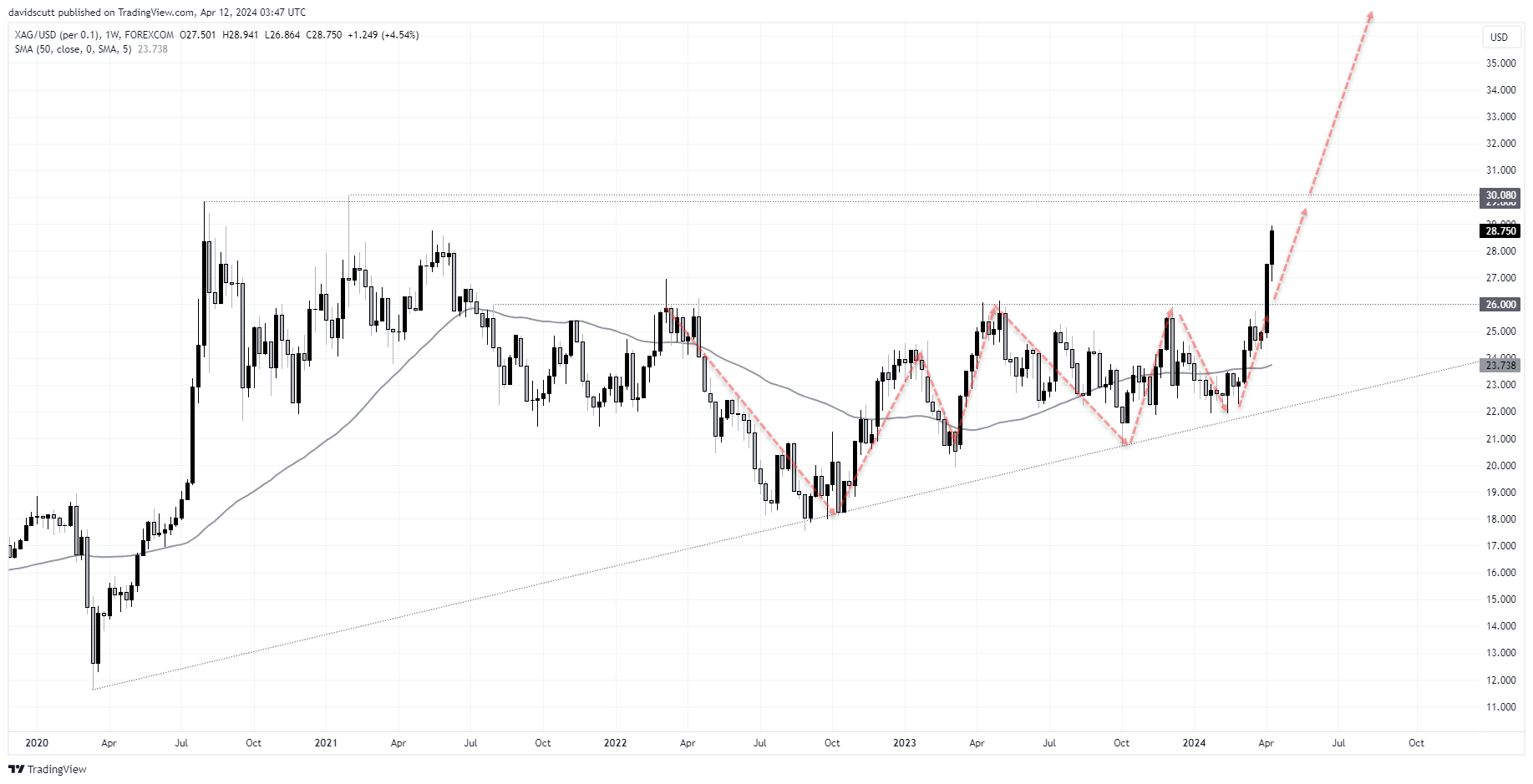

Silver eyeing pandemic squeeze highs

Silver’s move is not dissimilar, although it remains someway off taking out the record high set in 2011. It had been battling sellers above $26 since 2021, coiling up within a triangle pattern dating back to the start of the pandemic. After breaking resistance, the explosive we’ve seen has put the price on track to retest the pandemic era highs around $30. That’s silver squeeze territory, for those who remember.

An extension of where the price started coiling suggests such a test is likely, with a break above the pandemic highs opening the door to a possible extension towards the record highs just below $50.

Elevated holding costs are not deterring buyers

As such, even before you consider fundamentals such as geopolitics, central bank purchases, limited mine development given previously depressed prices, rising inflation expectations and troubling fiscal outlooks from some of the world’s largest nations, what we’ve witnessed can be explained by technical factors.

Given the relentless nature of the move, it also suggests many traders believe that even with elevated holding costs stemming from higher interest rates, the benefits of buying gold and silver far outweigh the costs right now.

Positive, inflation-adjusted real bond yields and a stronger US dollar – traditional headwinds precious metals – are being overrun by other factors. That may not last, but you can’t dispute the price action. It’s definitive. Until that changes, dips are likely to remain shallow and infrequent.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade