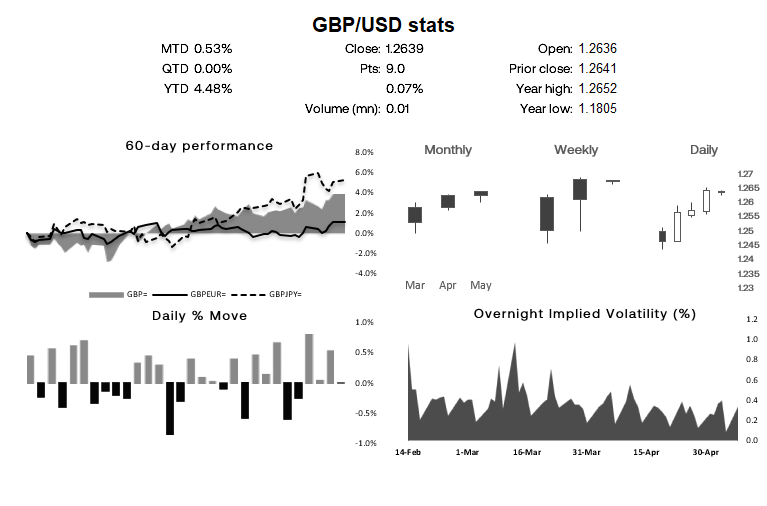

The pound has been a strong performer this year, having risen against all its G10 currency peers YTD. It has rallied over 7% against the yen, nearly 13% against the Norwegian Krone and the only FX major to give it a run for its money is the Swiss franc, with GBP/CHF currently up 0.7% for the year.

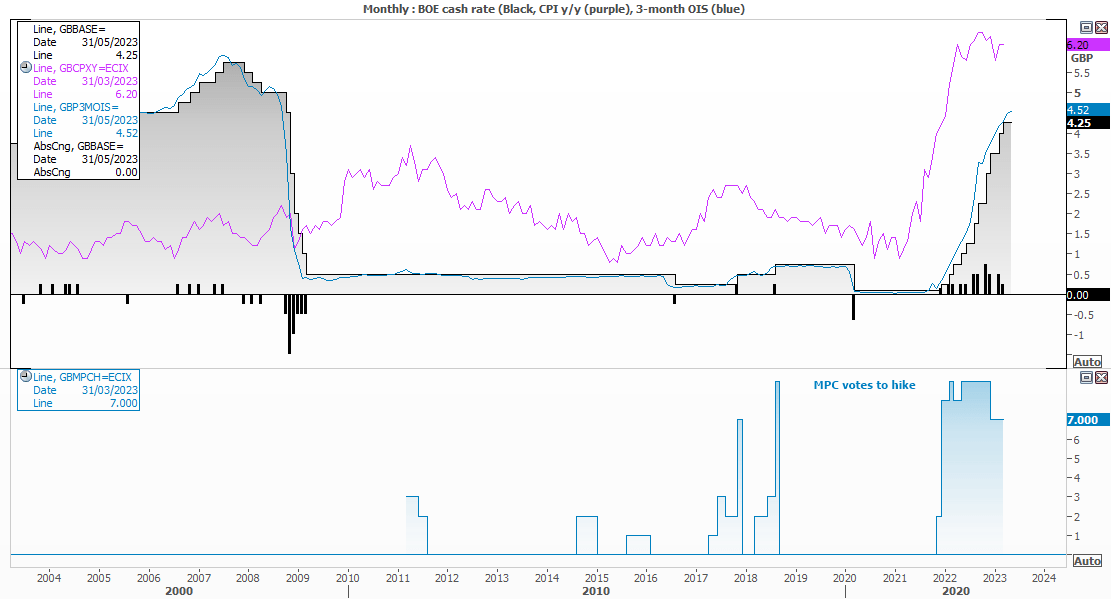

Expectations of BOE tightening has been the key driver, thanks to double-digit CPI prints, higher wages, low unemployment and the alleged “demand shock” supporting higher prices, according to the BOE (Bank of England). And with another 25bp hike expected on Thursday’s BOE meeting, the question is how many more hikes can we expect going forward? But first, we have a US inflation report to contend with.

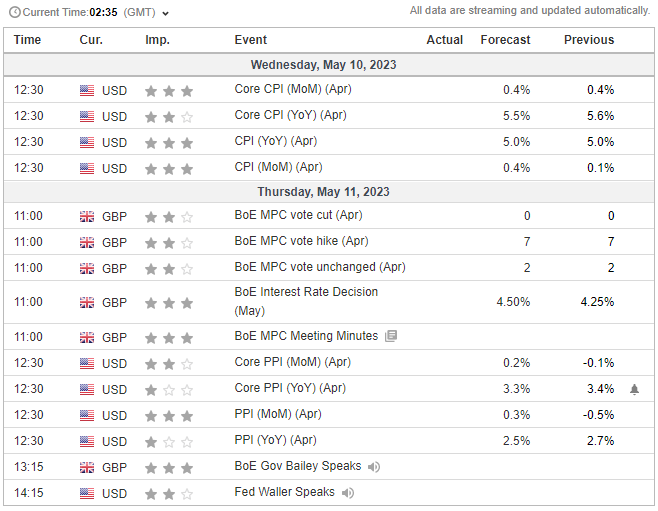

US inflation data and BOE meeting are key events for GBP/USD traders this week:

The UK is on a public holiday today due to the King’s Coronation over the weekend, which means the London Stock Exchange is closed and trading volumes for GBP pairs will be lower. But we won’t need to wait too long for the calendar to pick up, with US inflation data on Wednesday and the BOE (Bank of England) meeting on Thursday.

With the Fed having hiked by 25bp last week and signalled a pause, this week’s inflation report is more about how long the Fed will keep rates at 5.25% before cutting. A hot print would presumably be bullish for the US dollar as traders push potential cuts further into the future, and that could weigh on GBP/USD. But if we are to be treated to a softer-than-expect CPI figures, it could further support GBP/USD.

The BOE are expected to hike by 25bp on Thursday:

Attention would then shift over to Thursday’s BOE meeting, where the consensus is for a 25bp hike. This would be their 12th hike this cycle to take rates to 4.75%, and second consecutive 25bp hike (having pulled back forma 50bp increment prior).

Whilst economists favour a 25bp hike, the 1-month OIS (overnight index swap) has not fully priced it in. In fact we have to look at the three-month OIS before a 25bp hike is fully priced in, so perhaps this is a closer call than some expect.

Still, I very much doubt it is within the BOE’s interest to signal a pause even if they do hike, as not to keep inflation expectations elevated. But if the BOE appear confident in the statement or press conference that inflation is to fall sharply, the pound could come under pressure as markets will likely take it as a sign that the BOE have reached their peak rate of 4.47%.

Something to also look out for is how the MPC members vote. The final four meetings of 2022 saw all voting members vote for a hike, yet the two meetings this year has seen two dissenters who wanted to pause. If we’re to see the number of dissenters rise then it signals further disagreement amongst the ranks and feeds into the ‘peak rate’ theme. Yet another 7-2 in favour of a hike, alongside a relatively hawkish statement could propel GBP/UD higher as traders increase bets of another 25bp hike in June.

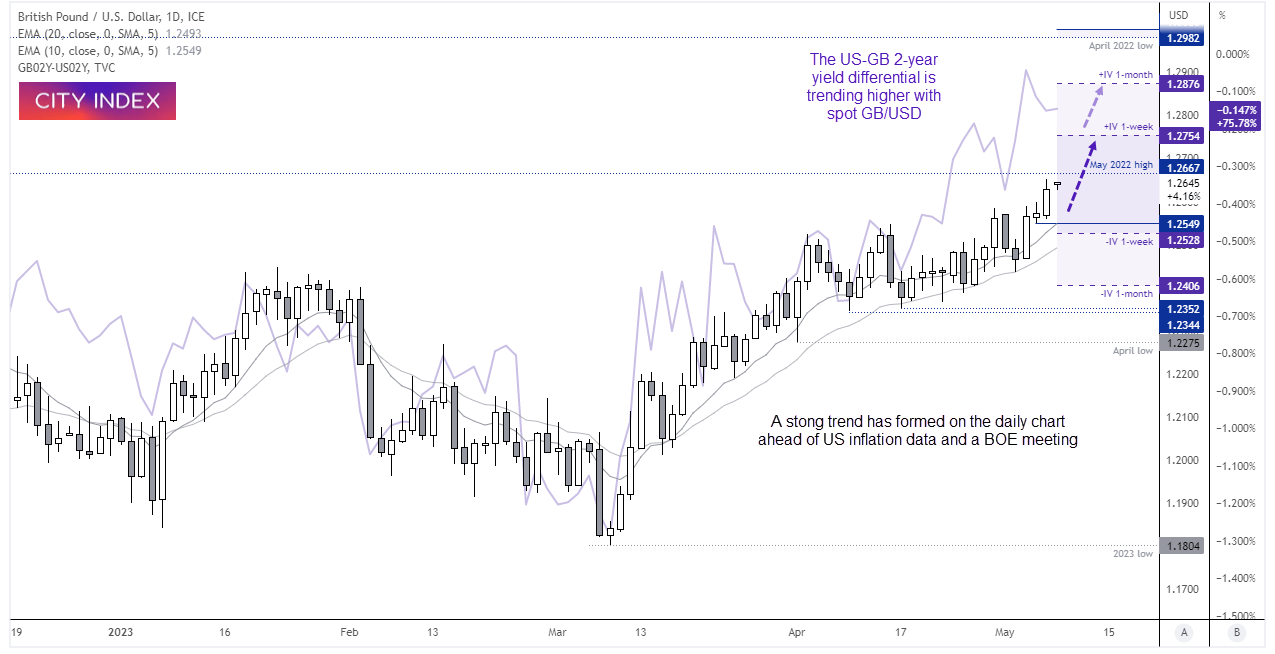

GBP/USD daily chart:

The daily chart has formed a bullish trend, and price action is accelerating away from the 10 and 20-day EMA’s to show an increase in bullish momentum. The 2-year yield differential for US-GB bonds is also trending higher which is supportive of spot GBP/USD prices. However, we’re very close to the May 1.2667 high, a level which may provide resistance during quiet trade unless we see a US dollar materially weaken later today. Hopefully we’ll see a pullback below 1.2700 to increase the potential reward to risk ratio.

- The bias is bullish above 1.2550 and for an initial move to 1.2750, near the upper band of the +1-week implied volatility range.

- Should we see a soft US inflation report and hawkish BOE hike, prices could potentially move to the April 2022 high, just below 1.3000.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade