GBP/USD looks to US data for clues on the Fed’s next move

- UK mortgage and credit lending data due

- US ADP payrolls in focus after weaker JOLTS job openings

- GBP/USD remains below its 6-week falling trendline

GBP/USD is edging lower, snapping a two-day winning run amid a stronger USD which is tracking US treasury yields higher.

The pound will be focused on credit conditions with mortgage approvals and lending data due to be released amid a deteriorating economic backdrop. Banks often tighten credit terms in tougher economic environments to limit potential bad loans. A sharp decline in mortgage approvals could point to a gloomier outlook for the UK economy.

Expectations are for the BoE consumer credit report to fall to £1.3 billion from £1.66 billion and mortgage approvals to fall to 51k down from 54.66k.

The data comes in a quiet week for UK data. There has been little in the way of fresh data shedding light on the health of the economy.

US data this week has been a bigger driver of the pair, and this is likely to continue today. Investors will keep their attention on the US jobs market with the release of US ADP payroll data, which is expected to show that private payrolls increased by 195k in August after soaring by 324k in July.

The data comes after JOLTS job openings yesterday fell below 9 million for the first time since March 2021, signaling that the US labour market could be weakening. US consumer confidence also fell by more than expected.

A weakening labour market and softening consumer confidence could result in slowing consumption, which would see inflationary pressures ease, supporting the view that peak rates could be near.

US Q2 GDP data and housing sector figures are also due. GDP data is a second revision, so unless there is a considerable change, it is unlikely to impact the USD.

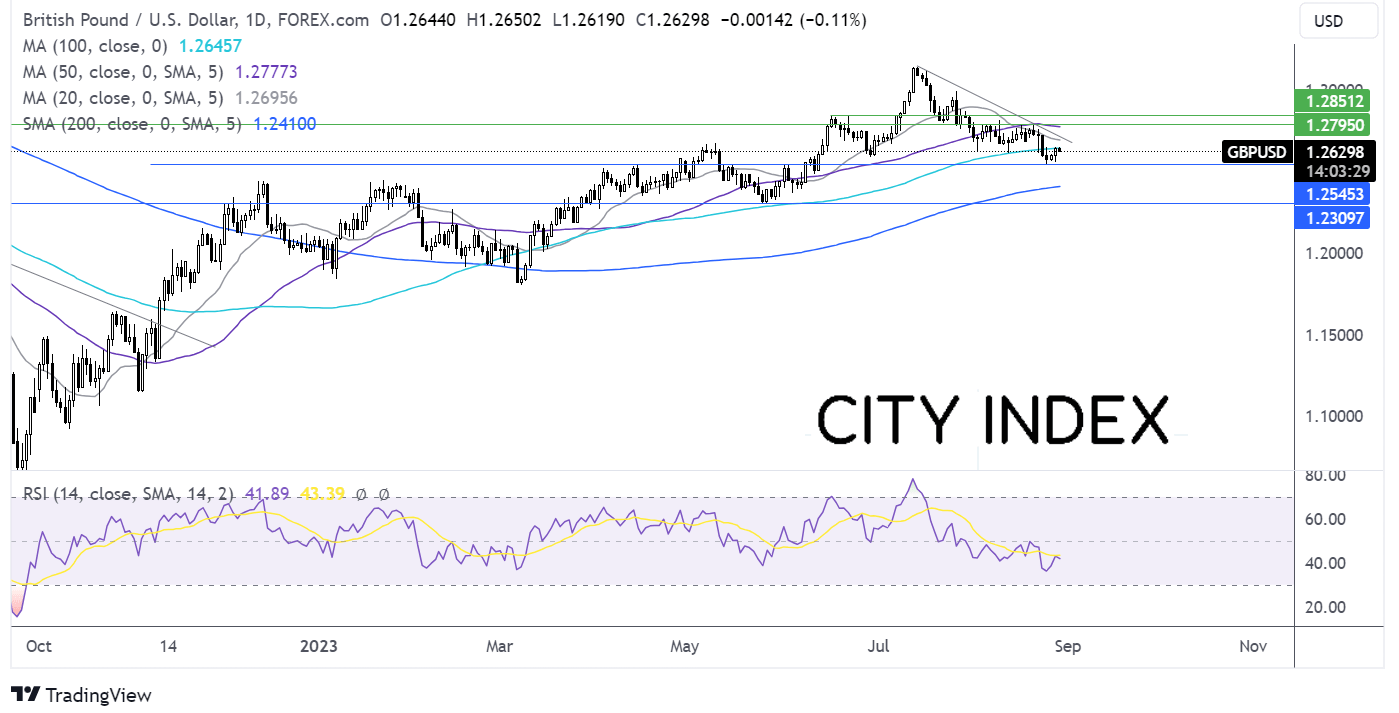

GBP/USD forecast – technical analysis

GGBP/USD has risen off its recent low of 1.2550 but remains below its falling trendline dating back to mid-July. The RSI also supports further downside while it remains out of overbought territory.

Sellers will look for a break below 1.2550 to extend its bearish trend towards 1.24 the 200 sma and 1.2308 the Mat low.

On the flipside, buyers could look for a rise above 1.2730 the falling trendline resistance ahead of 1.28 the August high and the 50 sma. A rise above here brings 1.2840, the June high into play.

EUR/GBP holds steady ahead of German inflation

- German inflation is expected to ease to 6% from 6.2%

- Eurozone consumer confidence is set to slip

- EUR/GBP rises above 100 sma but remains in a familiar range

EUR/GBP is holding steady after gains yesterday, as investors look ahead to a busy day on the eurozone economic calendar with German inflation figures and eurozone consumer confidence data due.

German inflation is expected to cool again in August to 6% from 6.2%, in a sign that the ECB's rate hikes could be working. However, data this week also showed that German wages rose at a record rate in Q2, boosting spending, which could mean that inflation may not cool quickly.

Hotter-than-expected consumer prices will keep pressure on the ECB to raise interest rates again next month against an increasingly gloomy economic backdrop.

German consumer confidence unexpectedly fell, which is often a sign of slower spending. Eurozone consumer confidence data is due to be released today and is also expected to show that morale deteriorated to -16 in August from -15.1.

Meanwhile, GBP is struggling to attract buyers amid a quiet week for economic data and amid growing concerns over the outlook for the UK economy.

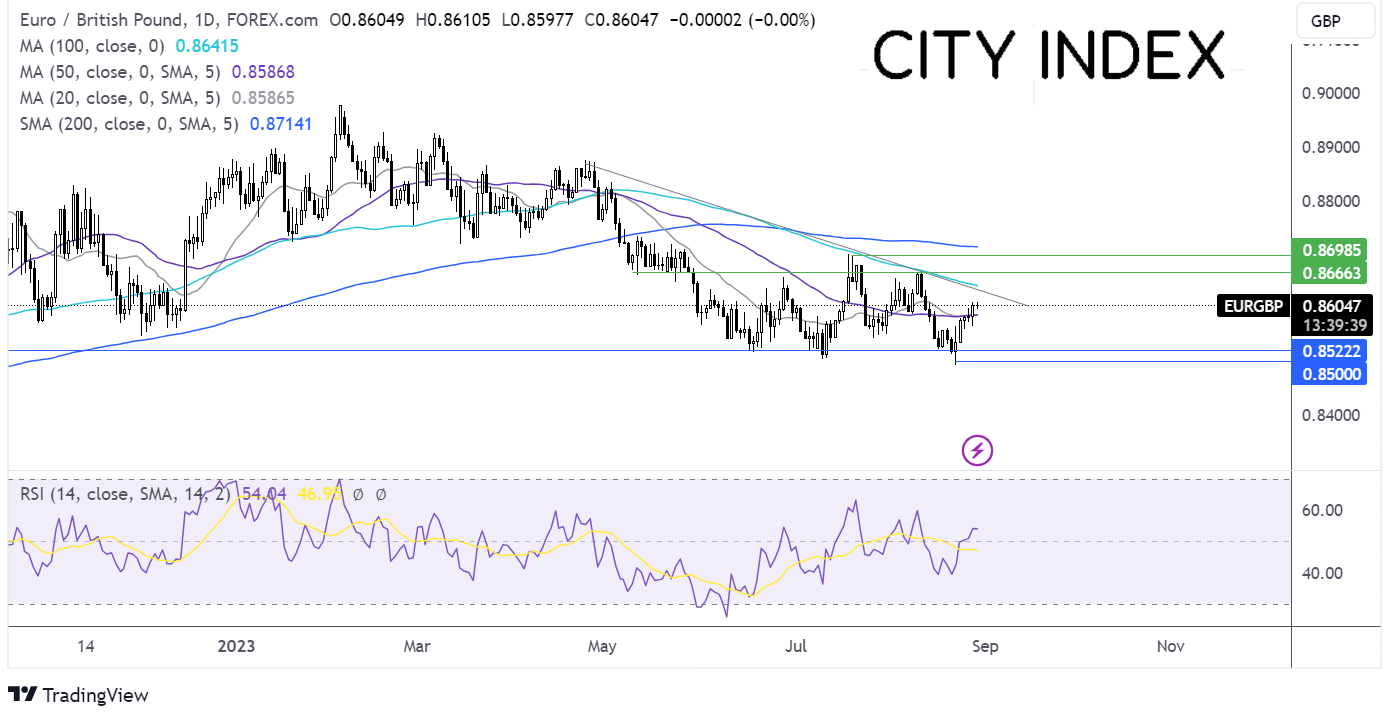

EUR/GBP forecast - -technical analysis

EUR/GBP has been consolidating between 0.8525 and 0.8665. The pair has risen off its recent low and has retaken the 100 sma, which, together with the bullish RSI, keeps buyers hopeful of further upside.

The next hurdle for buyers could be 0.8640, the 100 sma and multi-month falling trendline. A rise above here could see buyers test 0.8665, the August high, with a rise above here creating a higher high. Above here, 0.87 is the next target.

On the downside, the 100 sma is the immediate support at 0.8565, with a break below here opening the door towards 0.8525, the June low, and 0.85, the August low.