- GBP/USD outlook could be impacted significantly by UK CPI data this week

- Markets calm as Iran tensions ease

- GBP/USD outlook bearish as US dollar likely to remain supported on dips

GBP/USD outlook could be impacted significantly by UK CPI data this week

The GBP/USD is among the key major FX pairs to watch this week, owing to the release of important macro data from the UK which could set the near-term direction for the pound. On Monday, sterling was actually one of the strongest currencies, as risk assets stabilised following Friday’s dump when markets were in a risk off mode ahead of the weekend’s anticipated attacks by Iran. However, with the Middle East tensions unlikely to ease materially, this is likely to keep risk appetite low, and the dollar supported. With an unfavourable macro backdrop, the GBP/USD’s rebound could be short-lived, especially when you consider the fact that the dollar has been finding renewed support thanks to signs of sticky inflation and stronger-than-expected US data.

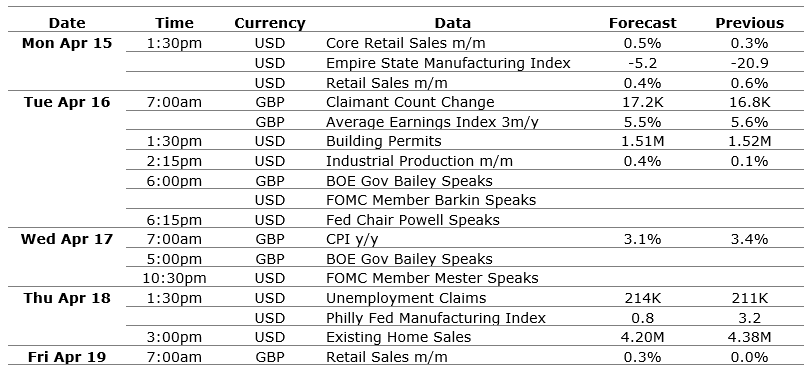

So, this week, the primary concern for the GBP/USD and broader markets arises from geopolitical tensions involving Iran, Israel, and their allies. On a macroeconomic level, GBP/USD traders will also need to factor in significant UK data releases, including wage figures on Tuesday, CPI on Wednesday, and retail sales on Friday. From the US, attention will be on retail sales and the Empire State Manufacturing Index on Monday, industrial production on Tuesday, and the Philly Fed Index and Existing Home Sales on Thursday.

Markets calm as Iran tensions ease

There was a sense of calm in the first half of Monday after the initial panic during the weekend (as evidenced, for example, by crypto prices falling on Saturday). Stock markets rebounded strongly in Europe, the dollar eased back, and crude oil prices fell in the aftermath of the Iranian strike against Israel. Brent oil fell below $90 per barrel, suggesting there was no evidence of panic.

With Iran, a significant oil producer, directly involved in the conflict, there's a prevailing sentiment that the market has already factored in this development. Traders are now closely monitoring how the situation unfolds. While Iran has indicated that its missile and drone attack was a retaliatory response to the strike on its consulate in Syria, Israeli Prime Minister Netanyahu’s warning that whoever hurts Israel, “we will harm them" means there is a risk of further escalation in the situation.

GBP/USD outlook bearish as US dollar likely to remain supported on dips

The key hazard facing all risk assets, including GBP/USD, is the situation in the Middle East right now. This is likely to keep the dollar supported on the dips, while elevated oil prices are always dollar positive. The greenback has found renewed support in recent days after strong inflation data and unexpected resilience in economic data helped to push back expectations of Federal Reserve rate cuts. Consequently, several Fed officials have that there is no immediate need to implement interest rate cuts. This has caused the gap between expected rate cuts from the Fed versus the rest of the world, including the BoE, to widen. We have a few US data releases this week (see below), but the key data is the Core PCE index next week, which means there is plenty of time for the dollar to find fresh support.

GBP/USD outlook: Economic calendar highlights for the cable

As the likes of the ECB and BoE get closer to cutting interest rates, possibly in June, the Fed’s timeline has lengthened, which has been the main reason behind the GBP/USD decline. This narrative may get even more relevant should the upcoming data from the UK disappoint expectations, or if US data shows further resilience. With that in mind, here are the key data highlights to watch in the week ahead:

A key highlight among the data releases is the UK CPI, scheduled for publication on Wednesday, at 07:00 BST. There has been considerable speculation regarding potential rate cuts by the Bank of England, prompting the central bank to push back against what it perceives as excessively dovish market expectations. Despite core CPI registering a 0.6% increase last month, more than double the BOE's 2% target, annual inflation rates for both CPI and core CPI are showing signs of moderation, which is encouraging. Nonetheless, it may still be premature to anticipate easing measures from the BOE in June. The upcoming CPI data would need to indicate a further weakening trend to sustain such expectations.

While a few US macroeconomic indicators are on the agenda for the upcoming week, the next major US data release is not expected until later in the month, with the Fed's preferred inflation gauge set to be published on April 26th – i.e., Core PCE index. Until then, the dollar may find support on any short-term declines, especially considering that both US interest rates and those of other major economies, such as the ECB and the Bank of Canada, have recently taken a more favourable turn for the greenback.

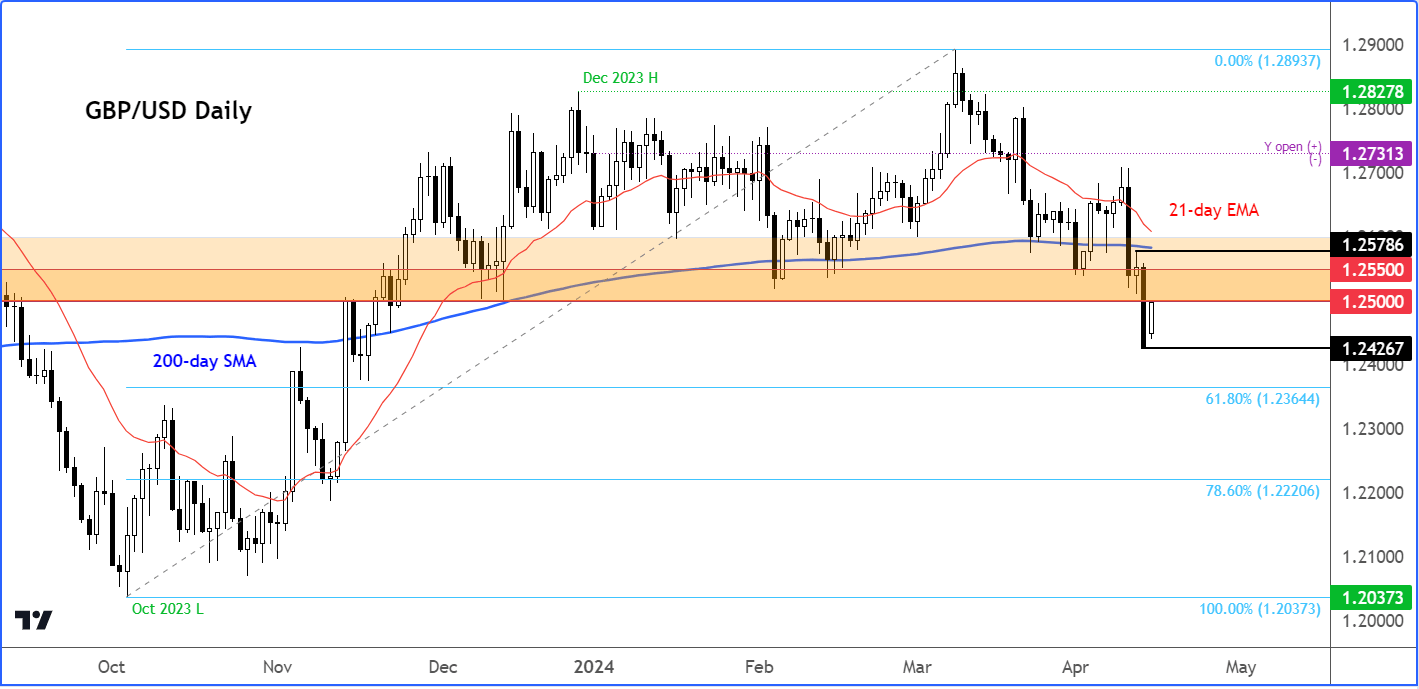

GBP/USD technical outlook and levels to watch

Source: TradingView.com

After breaking and closing below key support area around 1.2500 to 1.2550 on Friday, the GBP/USD was bouncing back along with other risk assets at the time of writing on Monday. This area was previously support back in December, a couple of times in February and again in early April. Once key support, will this zone now turn into support following its breakdown on Friday?

If resistance holds here, then watch out for potential continuation initially targeting last week’s low at 1.2426, followed by key round handles like 1.24 and 1.23 etc. An additional level to watch is the 61.8% Fibonacci extension level at 1.2365 as derived from the rally that started in October and ended and March.

However, if the GBP/USD goes back above that broken 1.2500 - 1.2550 support area then this will complicate the short-term directional bias as that could signal a possible false break scenario.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade