Last year was an important year for foreign direct investments (FDIs) across global economies. According to the OECD FDI report1, in the first quarter of 2022, global foreign direct investment flows had increased by 20% when compared with the previous year, before dropping in Q2.

Countries that are receiving foreign direct investment are likely to experience economic growth, which can have a positive effect on the domestic stock market2 and currency.

With this in mind, we decided to dive a little deeper into the FDI markets to gain some insight into FDI by country.

What are foreign direct investments?

Foreign direct investments are financial investments made by companies or individuals into business interests located in overseas jurisdictions.

Some FDI examples are building new factories in foreign countries, purchasing existing companies, and investing in companies in foreign markets.

Foreign investment essentially means that money is coming into a country, which in turn can help to drive economic growth. An increase in inward FDI flows typically leads to improved infrastructure, the creation of jobs3 and an increase in currency value4. For this reason, FDI markets can be used to assess a country’s projected growth and development, particularly in emerging global financial markets.

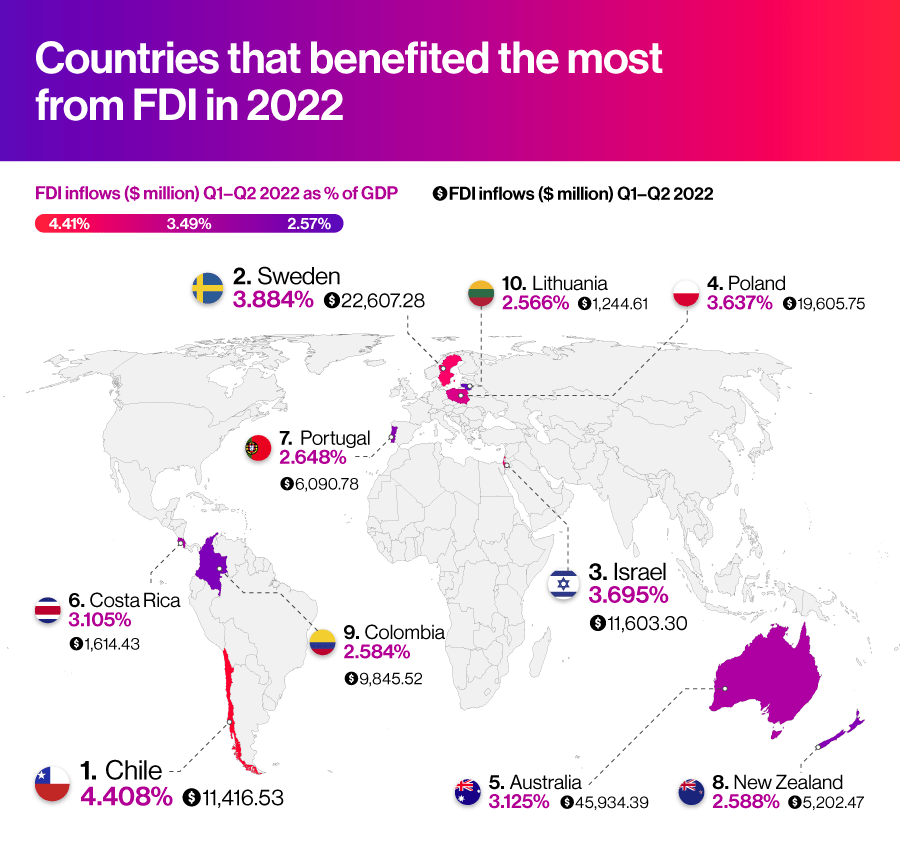

Countries that benefited the most from foreign direct investment in 2022

To explore FDI by country, FDI data for 36 countries from Q1 to Q2 in both 2021 and 2022 was gathered from the OECD investment report. This was then compared against each country’s GDP5 to determine the ranking of foreign direct investment received as a percentage of GDP.

1. Chile

By examining the FDI by country, it was discovered that the country which gained the most foreign direct investment in 2022 was Chile, receiving $11,416.53 million US dollars. These 2022 FDI inflows equated to 4.408% of the country’s gross domestic product (GDP).

Chile’s success in attaining more foreign direct investment in 2022 could be attributed to the appointment of new president Gustavo Petro. Petro advocates for the development of sustainable energy which has seen Chile move away from non-renewable energy sources, such as oil and natural gas. This is a major attraction for any businesses looking to invest in renewable energy sources. Popular FDI examples in Chile include solar, wind, geothermal or bioenergy. In the last seven years alone, Chile has brought in $20.8 billion in clean energy investment6.

2. Sweden

In 2022, Sweden received 3.884% of its GDP in foreign direct investment, with a total of $22,607.28 million. This country is particularly appealing to foreign investors because of its multilingual and skilled workforce. The main countries investing in Sweden are the UK, Luxembourg, the Netherlands, Germany and the US7.

3. Israel

Israel follows closely behind in the countries benefiting the most from FDI inflows in 2022. A total of $11,603.30 million was received in FDI, equating to 3.695% of Israel’s total GDP.

Israel is a particularly popular country for research and development in technology. Several of the largest corporations in the world have opened offices in Israel, including Google, Apple and IBM. The former CEO of Google, Eric Schmidt, has even said: “The decision to invest in Israel was one of the best that Google has ever made”8.

4. Poland

In 2022, Poland received $19,605.75 million in FDI. This total FDI inflow is equivalent to 3.637% of Poland’s GDP. According to the World Bank9, Poland has one of the most resilient economies within the EU, making a strong recovery after the events of 2020. This resilience could be attributed to Poland’s strong macroeconomic framework, effective use of EU investment funds and solid financial sector.

5. Australia

Australia received $45,934.39 million in foreign direct investment in 2022, which is 3.125% of the country’s GDP. As the 13th largest national economy by GDP10, these 2022 FDI inflows indicate Australia is popular with those looking to invest overseas. The country offers a wealth of investment opportunities in resources and energy, agribusiness and digital technologies.

6. Costa Rica

Costa Rica received a total of $1,614.43 million in foreign direct investment in 2022. Though a smaller figure, this equates to 3.105% of Costa Rica’s GDP. Over 200 multinational companies are doing business in Costa Rica, which can be attributed - in part - to the country’s strong business relationship with the US11.

7. Portugal

Portugal received $6,090.78 million in foreign direct investment in 2022, which was 2.648% of Portugal’s GDP. Despite challenging global conditions, Portugal’s economy has remained stable in recent years and continues to see gradual growth12.

8. New Zealand

FDI inflows in New Zealand totalled $5,202.47 million, equating to 2.588% of its GDP. According to the World Economic Forum Global Competitiveness Report13, New Zealand was the first out of 141 countries for macroeconomic stability. This indicates low volatility in key indicators such as economic growth, interest rates, investment and trade.

9. Colombia

Following very closely behind was Colombia with a total of $9,845.52 million in foreign direct invesment, equating to 2.584% of Colombian GDP. The Colombian government actively encourages foreign investments and even offers incentives for foreign investors in some fields. For example, a special tax rate of 9%14 applies to the hotel and tourism industry. This includes investing in new hotels, theme parks and ecotourism projects.

10. Lithuania

Lithuania received a total sum of $1,244.61 million in FDI, which was 2.566% of its GDP. With 85% of young professionals being proficient in English15, Lithuania is a popular destination for investment due to its reputation for a talented and motivated workforce.

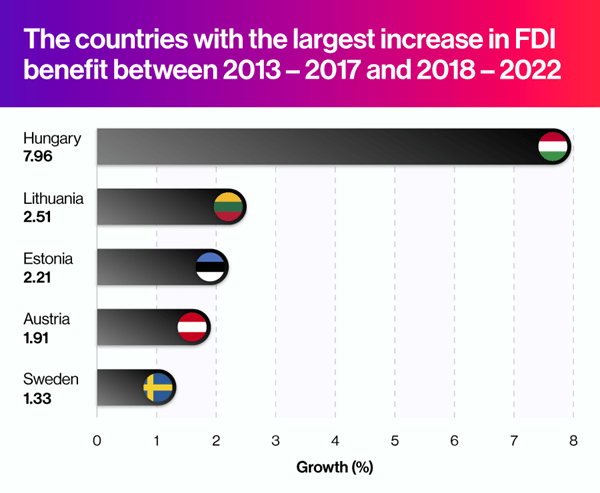

Countries with the largest increase in FDI benefit

When looking at FDI by country, in addition to the countries benefiting the most from FDI inflows in 2022, we also examined FDI data to determine the countries with the largest difference between 2013–2017 FDI inflows and 2018–2023 FDI inflows.

To do so, the average FDI inflows as a percentage of GDP were gathered for each year between 2013 and 2022. These figures were then averaged over 2013–2017 and 2018–2022 so we could compare FDI benefit during the past five years with the previous five years for each country.

The difference in average FDI inflows as a percentage of GDP was ranked to find the country with the largest growth in FDI benefit between 2013–2017 and 2018–2022.

1. Hungary

Hungary experienced an average 7.96% FDI increase between 2018 and 2022 when compared with the figures between 2013 and 2017. As a result of its location, Hungary is widely considered the gateway to Central and Southeast Europe. Its main foreign investors are Canada, the Cayman Islands, the Netherlands, Germany, Luxembourg and Austria16.

2. Lithuania

Lithuania underwent the second-largest growth in FDI inflows as a percentage of GDP, with a 2.51% increase. This growth saw Lithuania reach the list of the top 10 countries benefitting from foreign investment in 2022, indicating that more people are opting to invest in this EU country.

Lithuania has strong international relations, which provides foreign investors with good access to international markets. In addition, tax rates for companies are low and foreign investors are offered the same protection as those from Lithuania17.

3. Estonia

Estonia’s average growth in FDI inflows as a percentage of GDP stands at 2.21%, just 0.3% lower than that of Lithuania. Estonia offers a favourable business environment, with all reinvested corporate profits being exempt from income tax. Its geographical position also makes it an accessible country from many areas. The main foreign investors in Estonia are Sweden, Finland, the Netherlands and Lithuania18.

4. Austria

Austria has experienced a 1.91% growth in FDI inflows in the last five years — which was at its highest in 2021, with an increase of 1.37%. Investments in this country are often directed towards technical and scientific activities, finance and insurance, trade, real estate and the pharmaceutical industry19.

5. Sweden

Sweden has seen an average growth of 1.33% in FDI inflows over the last five years, placing it fifth overall. Over the last ten years, the political and economic situation in Sweden has remained stable. It was also ranked by the World Bank in 2020 as 10th in the world in terms of ease of doing business20.

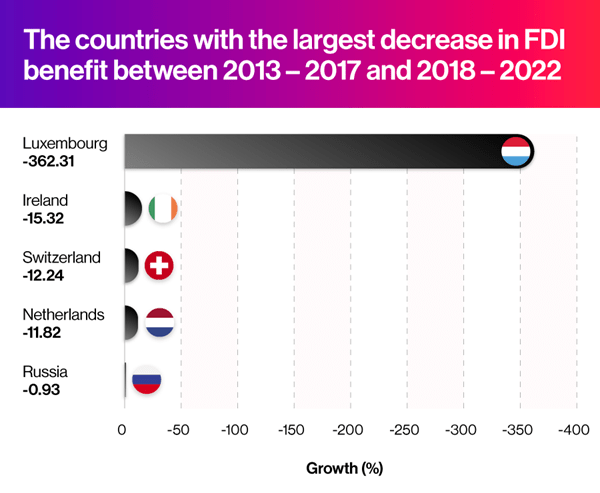

Countries with the largest decrease in FDI benefit

In contrast, some countries have experienced a decrease in how much they benefited from FDI in 2018–2022 when compared with 2013–2017. Consulting the same dataset that we used to find the largest increase in FDI benefit, we were able to determine the countries with the largest decrease, looking at those countries with growth scores in the negative figures.

These are the countries with the largest decrease in FDI benefit between 2013–2017 and 2018–2022.

1. Luxembourg

Luxembourg has seen a dramatic decline in FDI benefit over the last five years when compared with the five previous. Between 2013 and 2017, Luxembourg’s FDI inflow was equivalent to an impressive 269.36% of GDP. In 2014, a reported 74% of all economic activity in this country was dependent on foreign markets21, the highest in the OECD.

Between 2018 and 2022, these figures dropped leaving Luxembourg’s FDI inflows at 92.95% of GDP, a -362.31% drop from the previous 5 years. This could be attributed to Luxembourg having a weakly diversified economy and heavy reliance on the banking and financial sector22.

Economic activity is thought to have slowed in Luxembourg because of broadening inflation pressures and falling manufacturing activity23.

2. Ireland

Ireland experienced a lesser, but still significant, decrease of -15.32% after dropping from 14% in 2013–2017 to -1.32% between 2018 and 2022. Despite having one of the lowest corporate tax rates in Europe24, businesses are choosing to invest elsewhere. The economy in Ireland is very open and highly dependent on the European economy, particularly the UK - which has led to Ireland being exposed to the consequences of Brexit.

3. Switzerland

Switzerland wasn’t far off Ireland, with a decrease of -12.24%. Between 2018 and 2022, Switzerland’s average inflow was reported to be -$4.2 billion.

Since 2018, the Swiss Parliament has been instructing the Federal Council to create a legal framework for the screening of FDI. A draft of the Foreign Investment Screening Act (“FISA”) is currently being considered in Parliament 25. This uncertainty may have deterred many foreign investors away from Switzerland until the draft bill is either accepted or rejected.

4. Netherlands

A decrease of -11.82% was recorded in the Netherlands. Between 2013 and 2017 the Netherlands reported FDI inflows at 10.95% of GDP, however, those figures have since dropped to -0.87%. Inward FDI flows in the Netherlands have been negative for some years now. Significantly, 2021 saw the multinational oil company Shell move its headquarters26 and tax residence, from the Netherlands over to the UK.

5. Russia

Russia had a decrease of -0.93%, but still brought in a positive figure of $3 billion in FDI inflow. In 2022 alone, major oil groups such as BP27, Shell,28 and ExxonMobil29 have all withdrawn from this country following Russia’s invasion of Ukraine. However, many major brands continue to operate in this country including TGI Fridays, Tom Ford and Lacoste30.

The advantages and disadvantages of FDI

There are advantages and disadvantages of FDI for both foreign investors and recipient countries. These can be broken down as follows.

Advantages of FDI

Economic growth

Economic growth in the country being invested in is arguably one of the greatest advantages of FDI. Countries with high FDI inflows are likely to see economic growth soon because of the influx of money from other countries.

This is particularly beneficial for developing countries, where economic growth is especially valuable. Money coming into these developing countries through FDI results in the growth of businesses, human capital development and an increase in corporate tax revenues.

Increased employment opportunities

Inward FDI flows also increase employment opportunities. Investing in businesses overseas offers companies the resources needed to grow. This business growth generally means more personnel are required to keep the company functioning.

Creating more jobs reduces unemployment rates and provides workers with an income that can be spent on other local goods and services, boosting the overall economy of the country.

Tax incentives

Tax incentives are sometimes offered to potential foreign investors. Examples of tax incentives include tax holidays (where investors will not have to pay any tax for a set period) and reduction of corporate income tax rates. For example, Switzerland offers tax holidays for new or additional businesses for the year of establishment plus up to nine subsequent years31.

Countries offering tax incentives like these are more appealing to foreign investors and are likely to draw in increased FDI inflow. This, in turn, can strengthen the domestic currency and other financial markets.

Disadvantages of FDI

Displacement of local companies

Displacement of local companies is one of the disadvantages of FDI. As a result of foreign investment, domestic companies often find it difficult to survive. This is because foreign investment usually brings in new products at lower prices, creating competition. Local businesses will then need to lower their prices to keep up with competitors, which isn’t always sustainable. At this point, many domestic investors lose interest in investing in these local businesses and opt for the new, more prosperous businesses instead.

Risk of political instability

Political instability is another one of the disadvantages of FDI. This has been linked to reduced foreign investment and the speed of economic development32.

According to research33, most firms combat this by avoiding investing in politically unstable countries. Those that do choose to invest mitigate these risks by partnering with local firms, diversifying foreign investments across countries and relying on political risk insurance.

This political unrest can be damaging to financial markets by destabilising the county's economy and weakening its currency.

Repatriation of profits

Another issue with FDI is the risk that large corporations will return all profits to the country where the business is owned, rather than the country being invested in. This results in large outflows of money from the FDI-receiving country.

The relationship between trading and FDI markets

FDI markets can be used as an indicator of the direction of the long-term outlook for currency markets. Significant organisations (including UNCTAD, OECD and IMF) use the FDI markets as a monitoring tool to assess the economy in receiving countries.

Typically, an increase in foreign investments will have a positive impact on a country’s currency for a number of reasons, including:

- Investors are required to use their domestic currency to buy the foreign currency, thus increasing demand

- Foreign investment creates more jobs, and this results in increased productivity and efficiency in the receiving country, which in turn benefits the economy

Taking a position on whether a country’s currency is going to rise or fall in value is done via forex trading. This involves buying one currency while selling another, in what are known as FX pairs – such as USD/SEK, GBP/AUD and EUR/CHF.

It’s important to note that FDI markets are a long-term indicator. Traders should use them as one part of an overall strategy, alongside macroeconomic data and current news.

Trade currency pairs with City Index

With City Index, you can trade currency pairs, such as the NZD/CAD and EUR/AUD, to speculate on rising or falling economies.

It’s always a good idea to carefully manage your risks when it comes to forex trading, as the market is inherently volatile, which means your profits can turn to losses quickly. This is especially true if you’re trading on margin, as your profits and losses will be magnified.

Although these risks cannot be eliminated entirely, there are ways to manage them, including attaching take profits and stop losses.

We also offer free demo accounts so you can gain a better understanding of forex trading with zero risk. You can use virtual funds to trade thousands of markets.

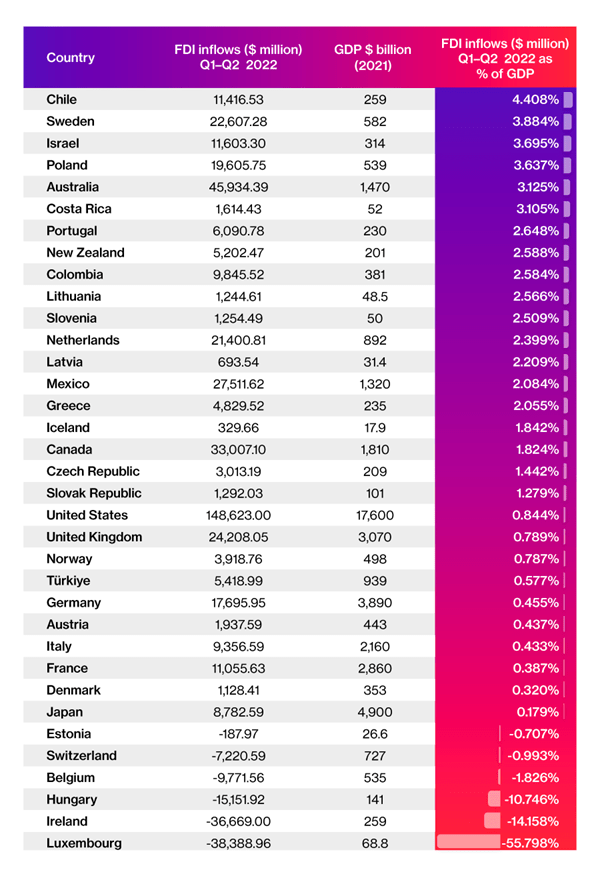

Full results:

Methodology:

- City Index sought to find out which countries received the highest amount of FDI inflows in 2022 and therefore benefitted the most.

- Statistics on foreign direct investment inflows for 36 countries in 2021–2022 were obtained from oecd.org.

- To adjust for any possible seasonal trends, as only Q1–Q2 of 2022 data is available, Q1-Q2 of 2021 was compared. Additionally, the GDP of each country as of 2021 was obtained via World Bank.

- FDI inflows per $1 billion GDP were calculated for each country and ranked.

- Additionally, the GDPs of each country were obtained for 2013-2021 (with 2021 figures being used for both 2021 and 2022). These GDP figures were averaged over 2013-2017 and 2018–2022 to compare the past 5 years with the previous 5 years.

- The average FDI inflows over 2013–2017 and 2018–2022 were divided by the corresponding average GDPs for those periods and then the difference in inflows as a % of GDP were ranked to find which country has had the biggest improvement in foreign direct investments.

References

1. Global FDI flows up overall by 20% in the first half of 2022, but this masks a 22% drop in the second quarter. oecd.org

2. FDI inflows are a source of technological progress and increasing employment in most developing countries, which increases the production of goods and services and, ultimately, increases GDP. Economic growth then has a positive effect on the development of stock markets and the rise of share prices. https://papers.ssrn.com

3. With more jobs and higher wages, the national income normally increases which promotes economic growth. https://researchfdi.com

4. An increase in FDI will increase the demand for the currency of the receiving country, and raise its exchange rate. www.economicsonline.co.uk).

6. Chile is the most attractive country for investment in renewables.

http://blog.investchile.gob.cl

7. The UK, Luxembourg, the Netherlands, Germany, the U.S., and Norway are the main investing countries in Sweden. https://international.groupecreditagricole.com

8. “The decision to invest in Israel was one of the best that Google has ever made” - Eric Schmidt, Former CEO. https://investinisrael.gov.il

9. Poland’s well-diversified economy has proven to be one of the most resilient economies in the EU. www.worldbank.org

10. https://data.worldbank.org

11. The United States is Costa Rica’s largest trading partner, accounting for 38% of Costa Rica’s imports and 42% of its exports. www.state.gov

12. https://data.worldbank.org

13. Page 422 New Zealand – Macroeconomic Stability, 1st.

weforum.org

14. Special tax rate of 9% for income related to tourism. https://investincolombia.com.co

15. 85% of young professionals are proficient in English.

16. The main investors are Canada, the Cayman Islands, the Netherlands, Germany, Luxembourg, and Austria. www.lloydsbanktrade.com.

17. Good international relations (member of the European Union since 2004 and NATO) giving it good access to international markets. The tax rate for companies is low and Lithuanian legislation offers foreign and Lithuanian investors the same protections.

18. The main investor countries are Sweden, Finland, the Netherlands and Lithuania. www.lloydsbanktrade.com

19. Investments are mainly oriented towards professional, technical and scientific activities, finance and insurance, trade, real estate, chemistry and pharmacy. www.lloydsbanktrade.com

20. Ease of doing business in Sweden DB rank 10. www.doingbusiness.org

21. Almost three-quarters (74% in 2014) of economic activity (GDP) in Luxembourg depends on foreign markets, the highest in the OECD. www.oecd.org

22. The main obstacles to investment in Luxembourg are: A weakly diversified economy and extremely dependent on its banking and financial sector.

23. Activity has slowed due to broadening inflationary pressures, falling manufacturing activity, and the uncertain outlook on the back of the Russian war of aggression against Ukraine. www.oecd.org

24. Hungary (9%), Ireland (12.5%), and Lithuania (15%) have the lowest corporate income tax rates. taxfoundation.org

25. In 2018, Parliament instructed the Federal Council to create the legal basis for the screening of foreign direct investment. In May 2022, the Federal Council presented a preliminary draft of the so-called Foreign Investment Screening Act ("FISA"). Following an extensive public consultation process, the draft is currently being revised before it will be submitted to Parliament for debate and, possibly, adoption. iclg.com

26. Shell plans to move headquarters to the UK.

27. Bps position in Russia. www.bp.com

28. Shell announces intent to withdraw from Russian oil and gas. www.shell.com

29. Exxon to exit Russia. www.reuters.com

30. Out of these, 223 companies are considered to be operating "business as usual" in Russia, including prominent firms from Italy (Boggi, Benetton, Calzedonia), France (Clarins, Etam, Lacoste), Germany (Siemens Healthineers, B. Braun), and the Netherlands (Philips).

The "business as usual" list also features some well-known American firms, like Tom Ford, Tupperware and TGI Friday's, as well as numerous Chinese enterprises, like Alibaba, Tencent and ZTE, and air passenger carries, like Emirates Airlines, Egyptair, Qatar Airways and Turkish Airlines. www.euronews.com

31. Switzerland - Tax holidays granted for the year of establishment of the business and up to nine subsequent years. uk.practicallaw.thomsonreuters.com)

32. The uncertainty associated with an unstable political environment may reduce investment and the speed of economic development. dash.harvard.edu.