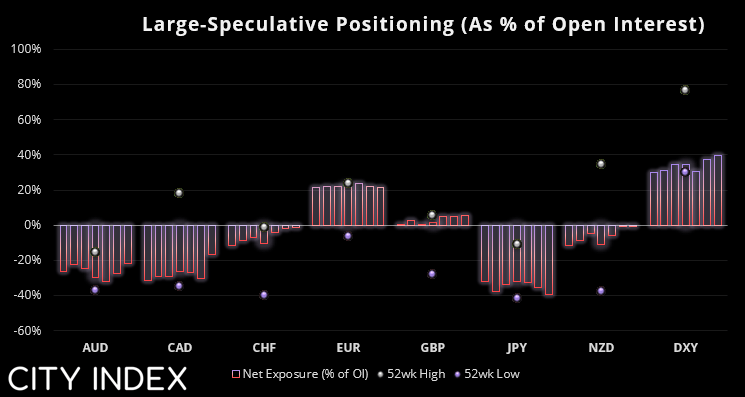

Commitment of traders – as of Tuesday 30th May:

- Net-short exposure to CAD futures fell at its fastest pace in 12-months

- Net-long exposure to EUR/USD futures fell for a second week after reaching a bullish sentiment extreme

- Large speculators were their most bullish on GBP/USD futures on nearly two years

- Traders were on the cusp of flipping to net-long exposure on CHF/USD and NZD/USD futures

- Net-short exposure to JPY/USD futures rose to its most bearish level in 31 weeks

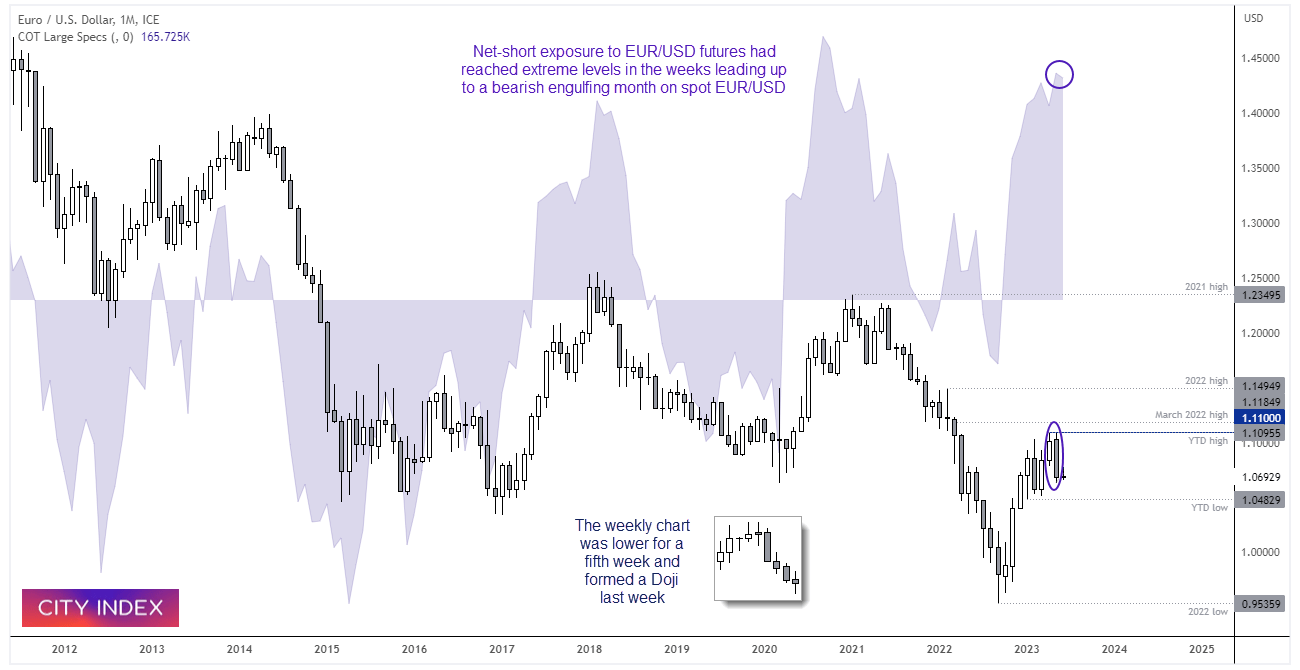

EUR/USD - Commitment of traders:

Large speculators trimmed gross-long exposure to EUR/USD futures for a third week which took net-long exposure to an 8-week low. We had warned of a sentiment extreme in recent weeks, and it looks like some traders agreed. Although by historical standard positioning remains at extreme levels for the bull camp. We can see on the monthly chart that EUR/USD printed a prominent bearish engulfing candle which formed part of a double top at its YTD (year to date) high, which suggests a swing high on this timeframe has formed. However, as EUR/USD has retraced for five consecutive weeks and formed a Spinning Top Doji last week, we suspect a retracement within the monthly bearish candle is a possibility, or at least a pause around current levels and for prices to trade within last week’s indecision candle.

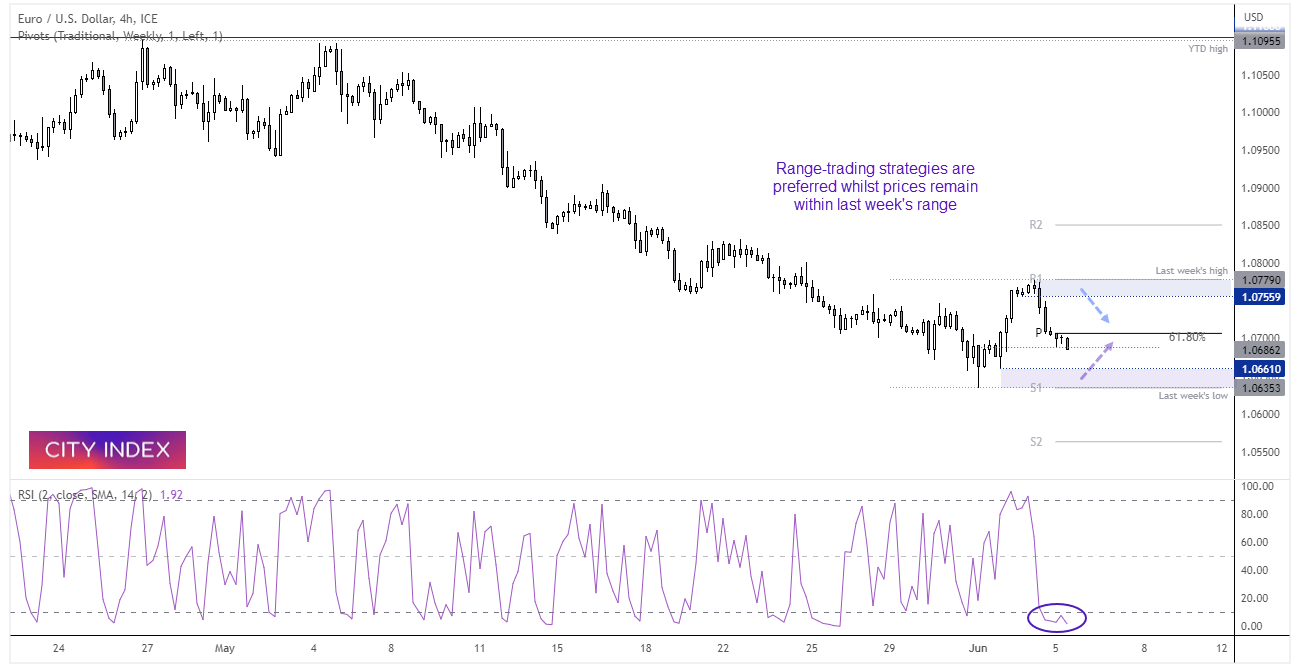

EUR/USD 4-hour chart

With prices having fallen for five consecutive weeks, we are open to the idea that the downside potential could be limited and / or near and inflection point. RSI (2) is oversold on the 4-hour chart and momentum currently points lower, but prices are trying to form a base around a 61.8% Fibonacci level whilst the weekly pivot point caps as resistance. But we note that the weekly S1 and R1 pivots coincide with last week’s high and lows, so for now we prefer range-trading strategies whilst prices remain within last week’s range, which means bulls could consider dips closer towards the lows or seek to fade rallies closer to the range highs.

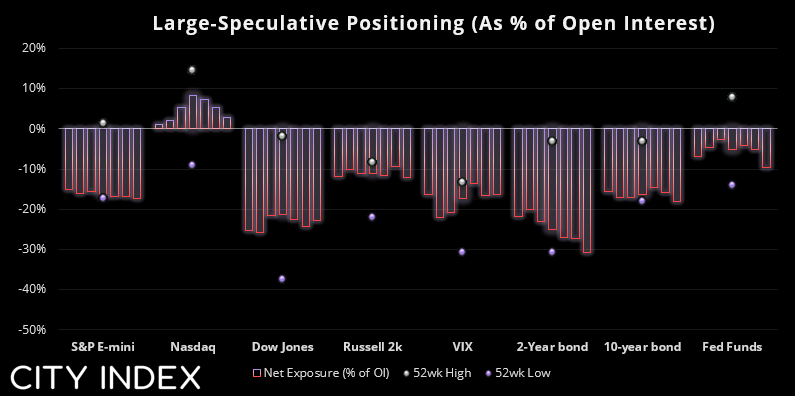

Commitment of traders – as of Tuesday 30th May:

- Net-short exposure to S&P 500 futures rose to a fresh record high

- Large speculators trimmed net-long exposure to Nasdaq futures for a third consecutive week

- Net-short exposure to the 2-year note and 10-year bond rose to a fresh record high

- Net-short exposure to 30-day Fed Fund futures rose to a 12-week high (suggesting higher rate expectations)

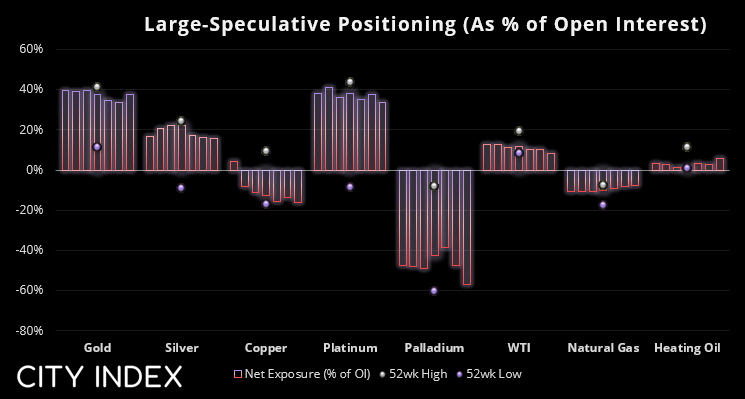

Commitment of traders – as of Tuesday 30th May:

- Net-short exposure to copper futures rose to a 3-year high

- Managed funds trimmed net-long exposure to gold futures for a fourth consecutive week

- Large speculators decreased net-long exposure to WTI future for a third week

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade