Asian Indices:

- Australia's ASX 200 index fell by -14.8 points (-0.21%) and currently trades at 7,133.90

- Japan's Nikkei 225 index has fallen by -298.66 points (-1.09%) and currently trades at 27,228.46

- Hong Kong's Hang Seng index has fallen by -96.17 points (-0.49%) and currently trades at 19,354.50

- China's A50 Index has fallen by -110.34 points (-0.83%) and currently trades at 13,118.47

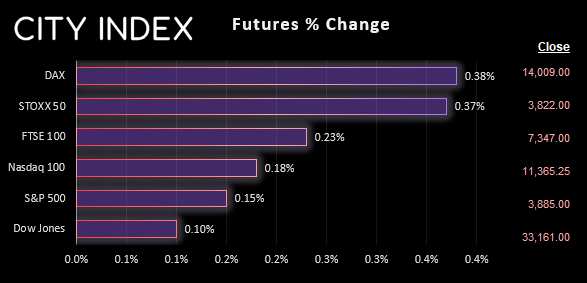

UK and Europe:

- UK's FTSE 100 futures are currently up 15 points (0.2%), the cash market is currently estimated to open at 7,347.12

- Euro STOXX 50 futures are currently up 13 points (0.34%), the cash market is currently estimated to open at 3,817.02

- Germany's DAX futures are currently up 49 points (0.35%), the cash market is currently estimated to open at 13,942.07

US Futures:

- DJI futures are currently up 26 points (0.08%)

- S&P 500 futures are currently up 17.5 points (0.15%)

- Nasdaq 100 futures are currently up 5 points (0.13%)

Asian equities took the predictable path of following Wall Street’s weak lead on Friday, as last week’s hawkish Fed and contracting PMI’s brough along with it fresh concerns of a US recession. If Santa really needs to get his socks on fast if there is any chance of a Santa’s rally forming, although the general feeling is it will not happen. However, there was a similar vibe in 2018 which then resulted in strong gains heading into the new year, and as fund managers will be squaring up their books for the year it also means that price action can easily become detached from fundamentals.

The Japanese yen was stronger overnight on local reports that Japan’s PM was to review a 10-year accord with the BOJ, and request flexibility around the 2% inflation a target. As financial regulators recently announced they were looking into the risks for the bond market for in case the BOJ pivots, it certainly feels like the slow winds of change for the BOJ’s policy. They’re due to meet this week and not expected to change policy, but we could be getting much closer. And just over half of the economists polled by Reuters now see the BOJ unwinding their ultra-dovish policy between March and October next year.

Australia’s minister of foreign affairs, Penny Wong, visited China today which is a big step in the right direction for China-AU relations, and that’s also having a positive impact on ASX mining stocks. She is the first minister to visit China since November 2019.

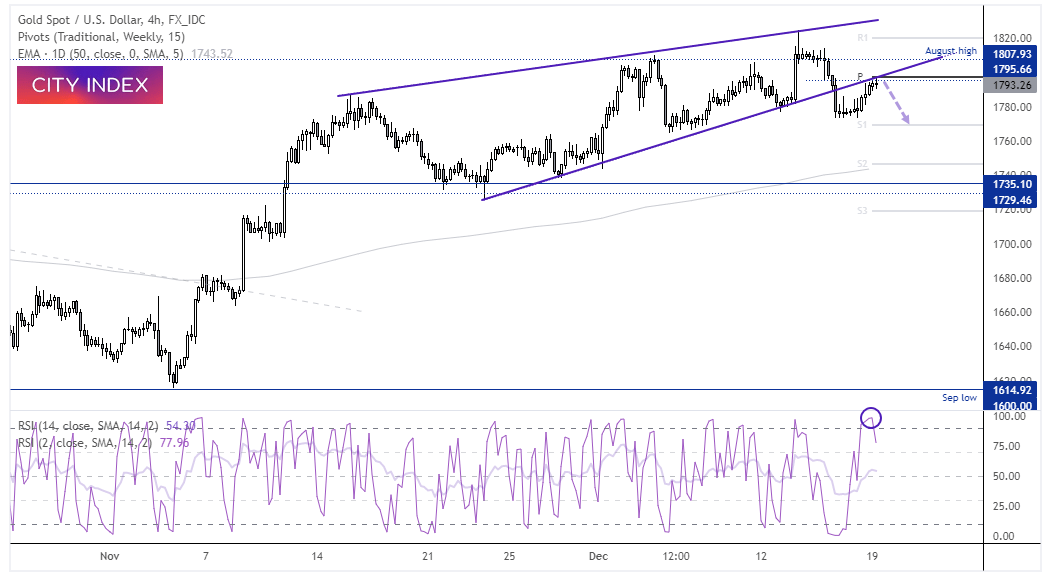

Gold 4-hour chart:

We looked at gold in this week’s livestream, and highlighted a potential rising wedge pattern (albeit a rather sketchy one). However, prices have drifted higher and into the weekly pivot point and lower trendline of the pattern. RSI(2) reached overbought and turned lower and the current candle is trying to form a bearish Doji. If the rising wedge is to stand any chance of success then momentum needs to turn lower soon. The pattern projects a target around its base near 1730, but for now the initial area of focus for bears is around the weekly S1 pivot / last week’s low.

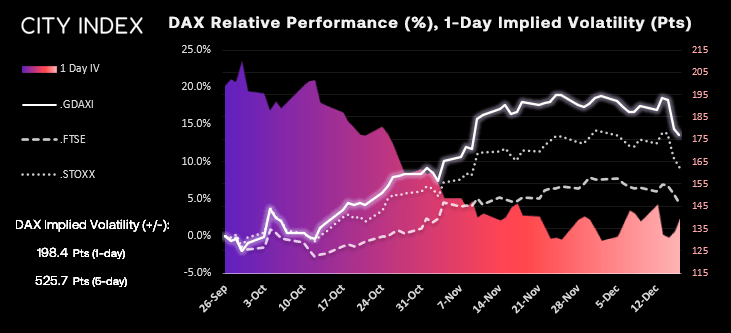

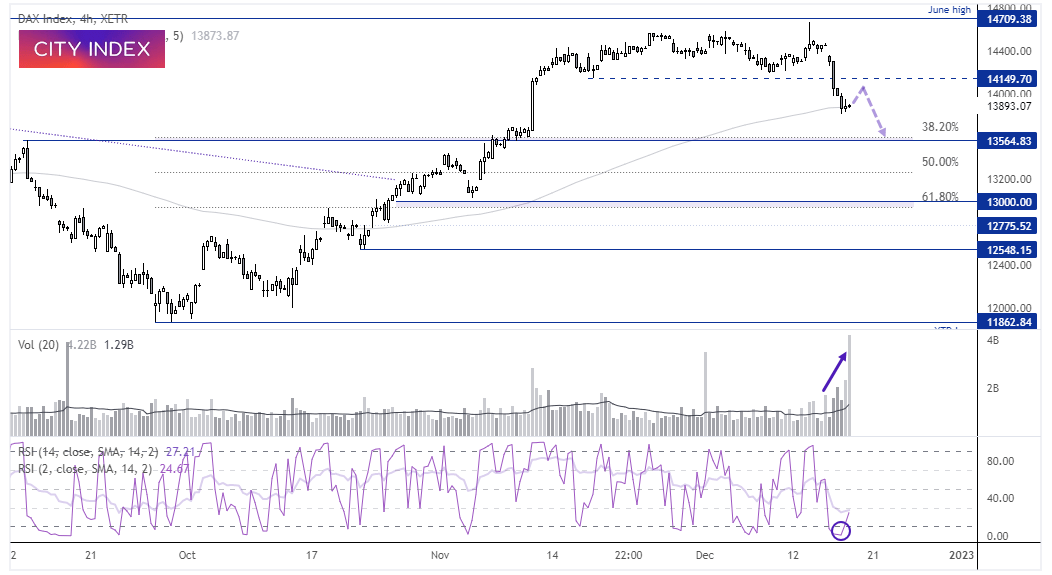

DAX implied volatility and 4-hour chart:

The DAX suffered its worst week in three months after failing to break above the June high. The 50-day EMA came to the rescue on Friday, and downside volatility subsided at the end of the week. The 4-hour chart shows that volumes were increasing as prices declined, which shows initiative bears entering the market. However, the small Doji at the end of Friday was on very high volume which can suggest a ‘change in hands’, hence the bias for a retracement higher before loses resume. Should prices move higher, we’d then look for evidence of a swing high around the 14,000 to 14,150 area and subsequent move down to the 13,500 area / 38.2% Fibonacci retracement.

FTSE 350 market internals:

FTSE 350: 4048.95 (0.66%) 16 December 2022

- 229 (65.43%) stocks advanced and 112 (32.00%) declined

- 0 stocks rose to a new 52-week high, 8 fell to new lows

- 12.57% of stocks closed above their 200-day average

- 50.57% of stocks closed above their 50-day average

- 5.43% of stocks closed above their 20-day average

Outperformers:

- + 16.16% - Games Workshop Group PLC (GAW.L)

- + 3.01% - Premier Foods PLC (PFD.L)

- + 2.66% - A G Barr PLC (BAG.L)

Underperformers:

- -9.40% - Sirius Real Estate Ltd (SRET.L)

- -8.16% - Trainline PLC (TRNT.L)

- -7.56% - Currys PLC (CURY.L)

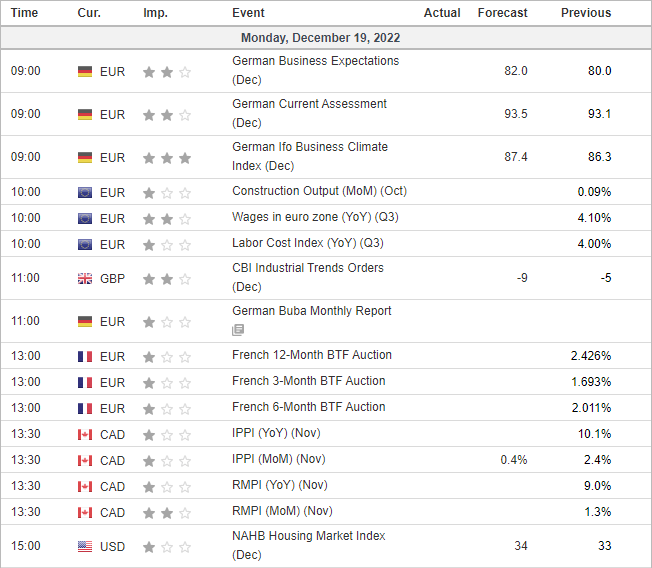

Economic events up next (Times in GMT)