UK and Europe:

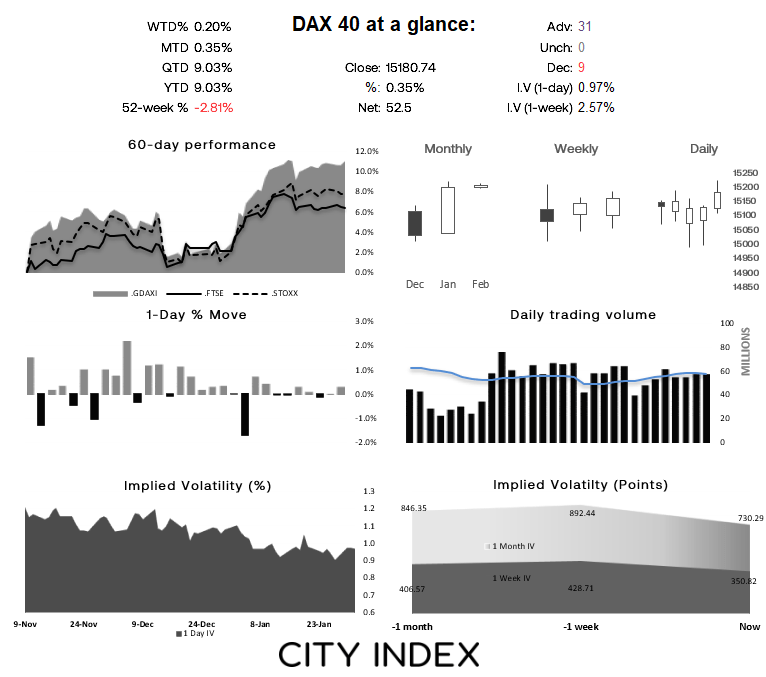

- UK's FTSE 100 futures are currently up 37 points (0.48%), the cash market is currently estimated to open at 7,798.11

- Euro STOXX 50 futures are currently up 32 points (0.77%), the cash market is currently estimated to open at 4,203.44

- Germany's DAX futures are currently up 118 points (0.78%), the cash market is currently estimated to open at 15,298.74

US Futures:

- DJI futures are currently down -37 points (-0.11%)

- S&P 500 futures are currently up 128.75 points (1.04%)

- Nasdaq 100 futures are currently up 15.5 points (0.38%)

Today’s main events are clearly the BOE and ECB meeting, where both central banks are expected to hike by 50bps. Whilst the BOE hinted at a 25bp in December, subsequent data likely justifies the full 50 to take rates from 4% to 4.5%. However, there is also a decent chance the BOE may signal a pause in rates, given Governor Bailey tipped his hat to market pricing being ‘about right’ with a terminal rate of 4.5% to 4.75%. So even if there’s no pause today, we’re close to the terminal rate. And that could be the difference to whether GBP closes higher or lower today.

- A 50bp hike with a pause could send GBP lower, whilst no hint of a pause could keep it supported

- The FTSE 100 still looks appealing to bullish eyes (please see yesterday’s report), and the analysis remains unchanged

- View yesterday’s livestream which includes notes on today’s BOE and ECB meetings (from 6mins onwards)

- The ECB are also expected to hike by 50bp today and ion March

- It is unlikely they will lower their inflation forecasts, but that could be perceived as a dovish hike if they do (and weigh on EUR pairs)

- But as data remains mixed across the Euro area, I suspect they’re more likely to keep forecasts relatively unchanged and put fire on any talks of a rate cut

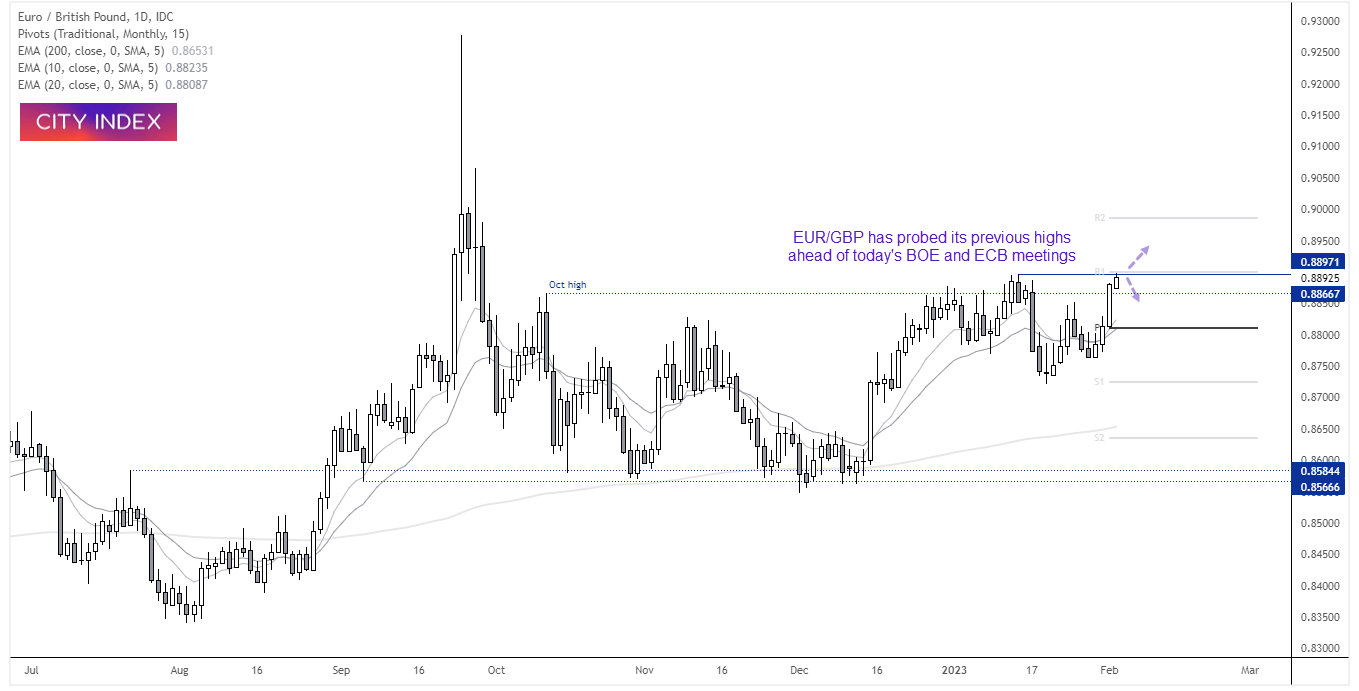

EUR/GBP daily chart:

EUR/GBP has continued higher overnight and probed the January high, presumably in anticipation that the ECB’s meeting will be more hawkish than BOE’s. With two central banks whilst prices test a key level, it marks a clear line in the sane for traders to decide which bank wins the ‘most hawkish’ award, with a more directional movement likely linked to the divergent theme between the two meetings.

For example:

- 25bp BOE hike and pause, with 50bp ECB hike and no hint of pause / cut would likely be the most bullish scenario for EUR/GBP

- Taking the same situation but with a 50bo may still send EUR/GBP higher, but to a lesser degree

- If ECB were to downgrade CPI forecasts with a 50bp hike with a 50bp BOE hike, it could send EUR/GBP lower form resistance

- If ECB were to hike by 50bp, hint at a slower pace in March (less likely) and downgrade inflation forecast, we might see a volatile move to the downside on EUR/GBP

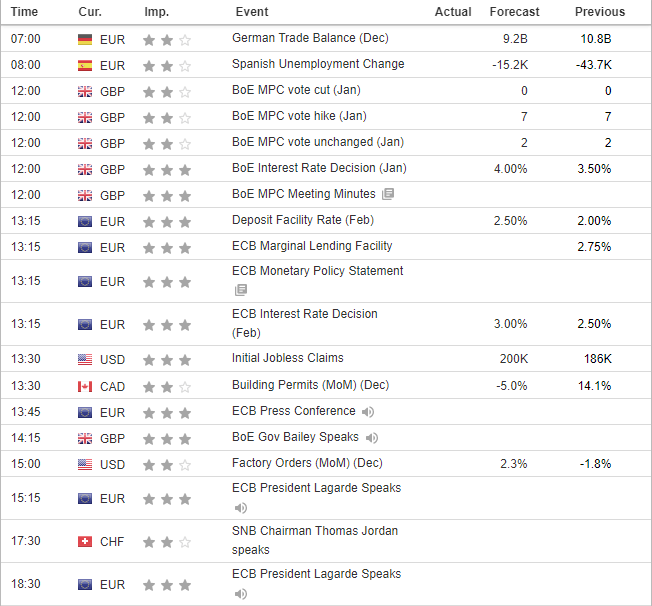

Economic events up next (Times in GMT)