Asian Indices:

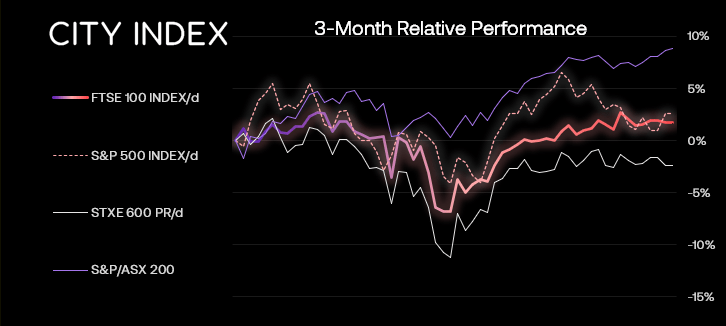

- Australia's ASX 200 index rose by 7.8 points (0.1%) and currently trades at 7,573.00

- Japan's Nikkei 225 index has risen by 207.42 points (0.77%) and currently trades at 27,192.51

- Hong Kong's Hang Seng index has risen by 30.11 points (0.14%) and currently trades at 21,057.87

- China's A50 Index has fallen by -101.57 points (-0.74%) and currently trades at 13,622.65

UK and Europe:

- UK's FTSE 100 futures are currently up 10 points (0.13%), the cash market is currently estimated to open at 7,611.28

- Euro STOXX 50 futures are currently up 12 points (0.32%), the cash market is currently estimated to open at 3,842.76

- Germany's DAX futures are currently up 48 points (0.34%), the cash market is currently estimated to open at 14,201.46

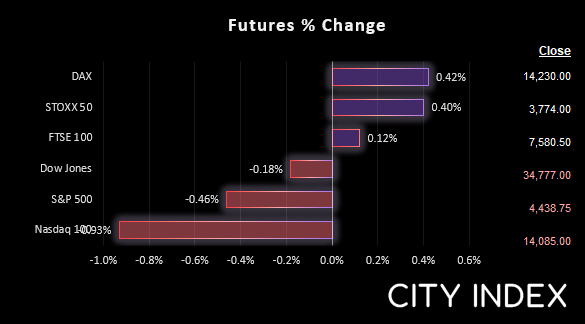

US Futures:

- DJI futures are currently down -61 points (-0.18%)

- S&P 500 futures are currently down -122.25 points (-0.86%)

- Nasdaq 100 futures are currently down -19.25 points (-0.43%)

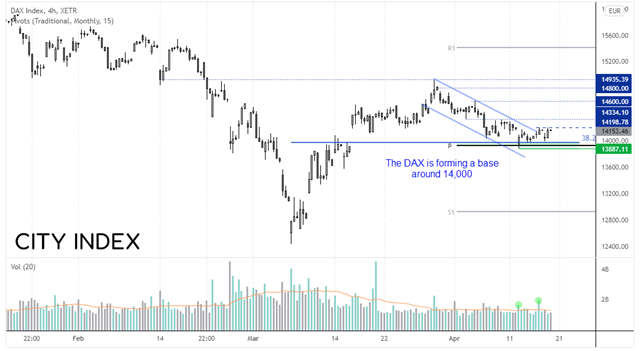

DAX builds a base around 14k

Whilst many US and European indices have pulled back over the last couple of weeks we suspect they’re ready for a bounce. Whether it will be a small bounce or break to new cycle highs remains to be seen, but we do see several key indices holding above support levels.

If we look at the DAX we can see it has mostly held above 14k, and two of the highest volume days were bullish to show demand. Furthermore, since an intraday break failed to hold below (one of the higher volume days) prices have since held above 14k and momentum is now trying to turn higher. A break above 14200 brings 14,335 into focus initially, but also cements our suspicion that a corrective low is in place. If so, we’d then look for prices to rally back to the highs around 14,800 – 14,935.

DAX 30 trading guide

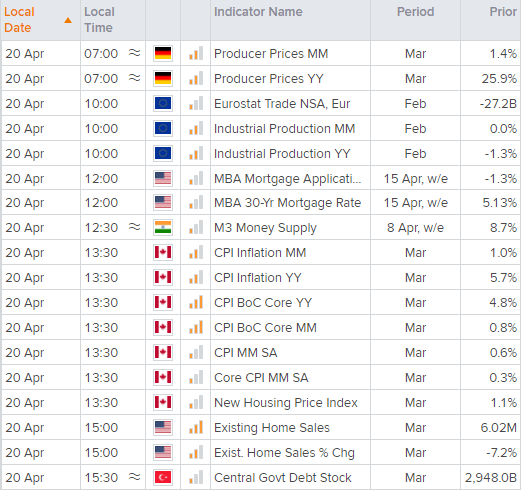

Canadian inflation a hot topic for the BOC

Whilst the BOC raised interest rates by 50-bps and began quantitative tightening last week, they also warned that they’ll need to raise rates further on fears that inflation may become “entrenched”. So that makes Canada’s inflation later today of high importance, as it could tip the scales between another 25 or 50-bps hike at their next meeting.

Like inflation in the US, Canada’s headline CPI data sets all point aggressively higher. So whilst there is little chance of a downside surprise, traders should equally be prepared for another upside surprise.

FTSE: Market Internals

FTSE 350: 4251.45 (-0.20%) 19 April 2022

- 234 (66.67%) stocks advanced and 105 (29.91%) declined

- 10 stocks rose to a new 52-week high, 7 fell to new lows

- 35.04% of stocks closed above their 200-day average

- 53.56% of stocks closed above their 50-day average

- 10.26% of stocks closed above their 20-day average

Outperformers:

- + 5.29% - Darktrace PLC (DARK.L)

- + 4.65% - Spectris PLC (SXS.L)

- + 4.06% - John Wood Group PLC (WG.L)

Underperformers:

- -12.08% - Jtc PLC (JTC.L)

- -6.34% - SSP Group PLC (SSPG.L)

- -5.54% - Syncona Ltd (SYNCS.L)

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

- Open an account, or log in if you’re already a customer

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade