Asian Indices:

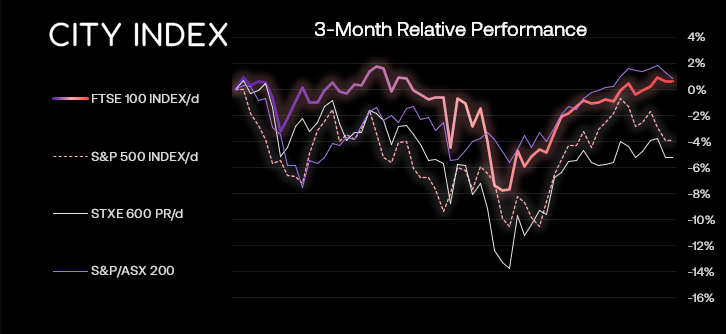

- Australia's ASX 200 index fell by -45.4 points (-0.61%) and currently trades at 7,444.70

- Japan's Nikkei 225 index has fallen by -448.64 points (-1.64%) and currently trades at 26,901.66

- Hong Kong's Hang Seng index has fallen by -289.22 points (-1.31%) and currently trades at 21,791.30

- China's A50 Index has fallen by -99.87 points (-0.71%) and currently trades at 13,868.31

UK and Europe:

- UK's FTSE 100 futures are currently down -4 points (-0.05%), the cash market is currently estimated to open at 7,583.70

- Euro STOXX 50 futures are currently down -6 points (-0.16%), the cash market is currently estimated to open at 3,818.69

- Germany's DAX futures are currently down -37 points (-0.26%), the cash market is currently estimated to open at 14,114.69

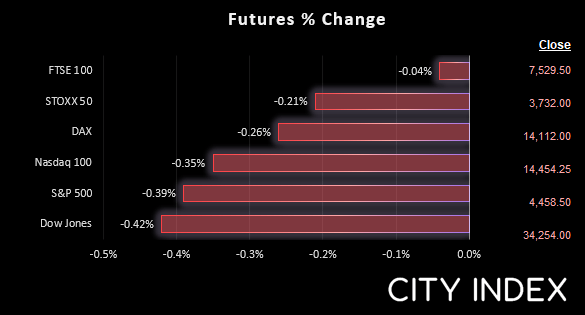

US Futures:

- DJI futures are currently down -148 points (-0.43%)

- S&P 500 futures are currently down -53.5 points (-0.37%)

- Nasdaq 100 futures are currently down -18.25 points (-0.41%)

The FOMC-induced selloff seen on Wall Street weighed on Asian equities for a second day, with the Nikkei leading the way lower and falling to a near 3-week low. All major Asian benchmark we track were in the red and futures markets point to another weak open.

FTSE: Market Internals

Yesterday’s price action was not overly kind to our analysis. Prices pullback to (and broke beneath) the 7575 support level and erased all of Tuesday’s gains. Yet it held above Tuesday’s low and recouped around 2/3rd of the day’s losses, leaving a hammer candle by the close. A break of its low confirms it as a 1-bar bearish reversal (hanging man) whilst a break of its high confirms it as a bullish hammer.

FTSE 350: 4249.45 (-0.34%) 06 April 2022

- 81 (23.08%) stocks advanced and 265 (75.50%) declined

- 22 stocks rose to a new 52-week high, 8 fell to new lows

- 34.47% of stocks closed above their 200-day average

- 56.98% of stocks closed above their 50-day average

- 7.69% of stocks closed above their 20-day average

Outperformers:

- + 5.96% - Premier Foods PLC (PFD.L)

- + 5.64% - Syncona Ltd (SYNCS.L)

- + 4.02% - Indivior PLC (INDV.L)

Underperformers:

- -8.57% - Capricorn Energy PLC (CNE.L)

- -7.54% - Aston Martin Lagonda Global Holdings PLC (AML.L)

- -7.51% - 888 Holdings PLC (888.L)

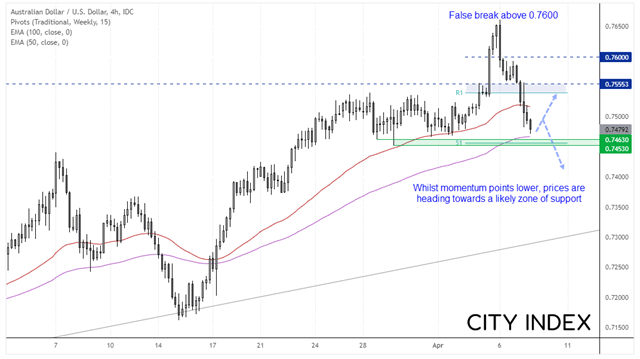

Commodity currencies continue to feel the weight of the Fed

We seem to be seeing plenty of countertrend moves across currency markets at present. Commodity FX continued to pull back from their highs as it becomes the more apparent that RBA and RBNZ are trailing behind the Fed’s hawkish trajectory, which sees AUD and NZD as today’s weakest majors.

At current levels, AUD/USD has erased all of this week’s gains and is on track for a bearish pinbar. The high of the week failed at the upper Keltner channel, and a cursory glance at lower timeframe momentum suggests it could do well to close the week at current levels. But that doesn’t mean it can’t bounce ahead of a break lower.

We can see on the four-hour chart that momentum points lower on AUD/USD, yet it is heading for a strong area of support around 0.7453/67 with swing lows, weekly S1 pivot and the 100-bar eMA in the area.

Commodities trade in tight ranges

Despite the volatility across commodity currencies, commodity markets themselves traded in relatively tight ranges. WTI is back above 97 after falling to a 14-day low yesterday, yet prices are treading water in the lower third of yesterday’s bearish range. Natural gas is holding above 6.10 in a tight range within yesterday’s bearish pinbar candle. Copper is beneath its 20-day eMA and gold is holding above 1916 support yet with little to no appetite from buyers. Ultimately, it’s a lacklustre session for commodity traders in Asia.

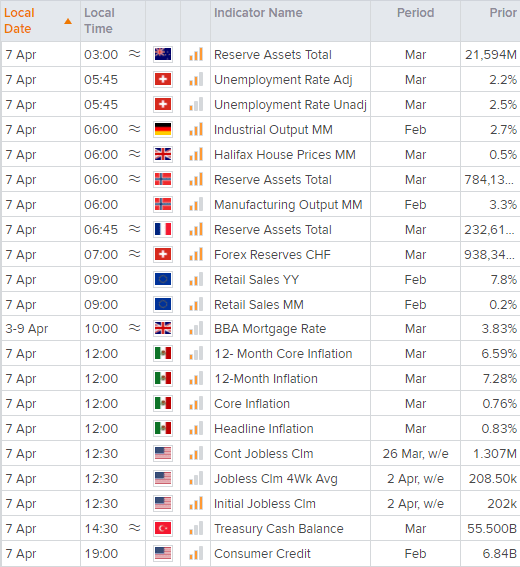

Up Next (Times in GMT)

Data-wise we have no top-tier economic releases for today, when compared against the backdrop of the hawkish Fed and strong NFP print from last Friday. Sure, we may be able to squeeze a few pips from European retail sales but we should remember that the biggest driver right now is the Fed, and markets are essentially retracing against their recent moves. Then again, with the euro trading higher across the board, a stronger retail print may be more meaningful for the euro against commodity currencies.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

- Open an account, or log in if you’re already a customer

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade