EUR/GBP rises ahead of the BoE rate decision

- BoE expected to raise rates by 25bps

- After shock inflation a 50 bps can’t be discounted

- EUR/GBP extends rebound from 2023 low

The pound is edging lower as investors look ahead to the Bank of England interest rate decision later today.

The central bank is widely expected to raise interest rates for a 13th straight meeting to 4.75% from the current rate of 4.5%.

While a 25-basis point rate hike is widely expected, a 50 basis point hike has returned as a possibility after yesterday's shock inflation.

Data yesterday showed that inflation in the UK is proving to be much stickier than expected as it held steady at 8.7% YoY. Core inflation rose to 7.1%, indicating that peak core inflation still needs to be reached.

The market is now expecting the central bank to lift interest rates to a peak of 6%, which is believed would send the UK economy into recession. As a result, we have a situation with the pound where higher interest rates don’t necessarily mean ongoing gains in sterling. Instead, the pound could start to fal reflecting concerns over a deeper recession later in the year, a similar reaction to yesterday’s hotter-than-forecast inflation.

Meanwhile, the euro has been capitalising on the weaker GBP despite a relatively quiet economic calendar this week.

Eurozone consumer confidence data will be released later and is expected to improve modestly to -17 from -17.4. ECB speakers will also be in focus as divisions start to appear over whether the central bank should be considering a rate hike in September.

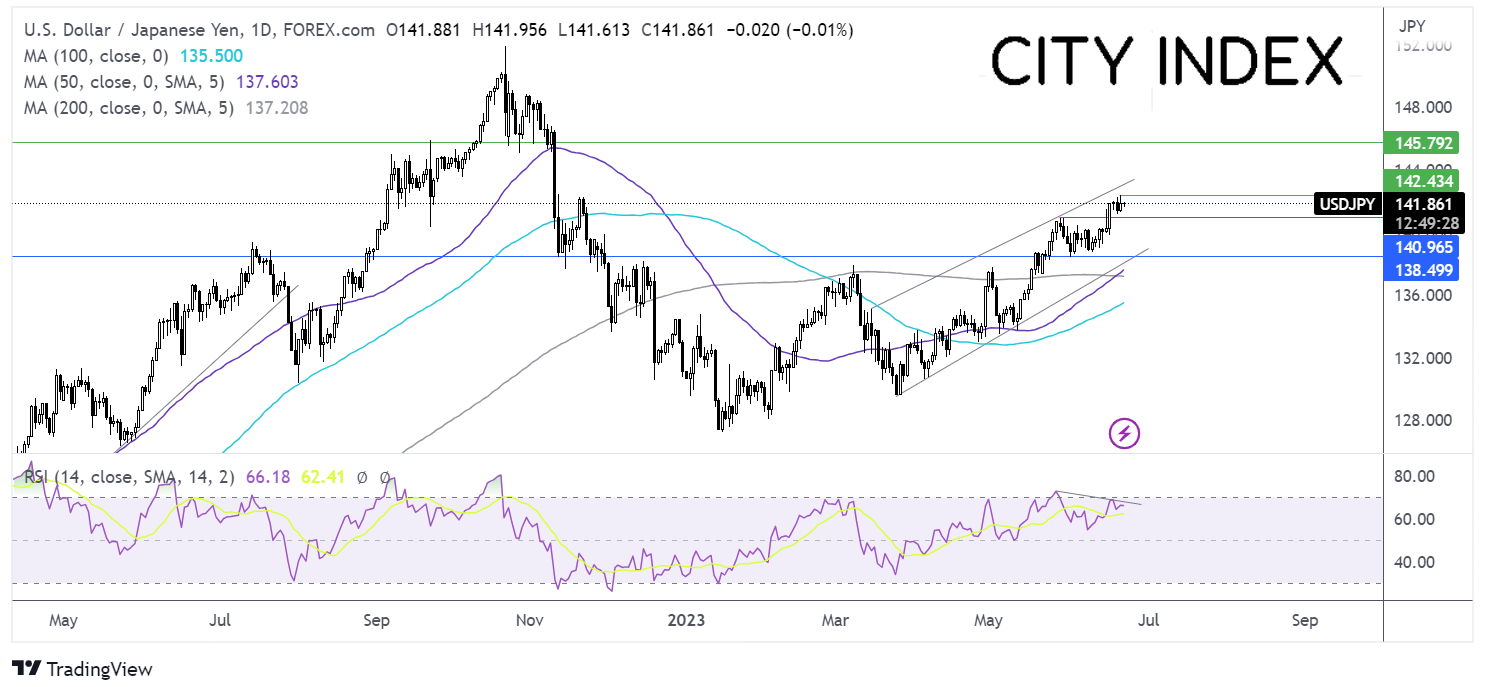

EUR/GBP outlook – technical analysis

EUR/GBP has rebounded off 0.8, the 2023 low, rising back above the falling trendline dating back to late April, and the 20 sma. This, in addition to a rise above 0.86, keeps buyers hopeful of further upside.

Buyers will look for a rise above 0.8635, the June high, to bring 0.8670, a support level that held across mid-May, into focus. A rise above here negates the near-term downtrend.

Immediate support can be seen at 0.86, the 20 sma, and 0.8575, the rising trendline support. Failure to hold above the 20 sma and rising trendline support brings 0.85 the 2023 low back into play.

USD/JPY is supported by BoJ-Fed divergence

- Fed Chair Powell indicated that more hikes are coming

- BoJ policymakers have been supporting thre ultra-loose policy

- USD/JPY trades in rising channel towards 142.00

While Federal Reserve Chair Jerome Powell leaned into a hawkish bias yesterday as he testified before Congress, the BoJ policymakers have been vocal in supporting the central bank’s ultra-loose monetary policy stance.

BoJ board member Asahi Noguchi said that the BoJ must maintain its ultra-loose monetary policy stance to ensure that wages continue to rise, driving up inflation. His remarks echoed those of colleague Seiji Adachi on Wednesday.

In contrast, on the first day of his testimony before Congress, Federal Reserve Chair Powell leaned towards a hawkish bias saying that growth was still strong and inflation too high and that more hikes were needed. In his semi-annual testimony, he stayed on message saying that if the economy continues in its current direction, two more rate increases would be a good guess.

However, his hawkish comments aren't supported by all, with his stance being contradicted by some other fFd members who have called for an extended pause in the central bank's rate hiking cycle.

Powell is due to speak again to the Senate Banking Committee later today. US jobless claims will also be in focus.

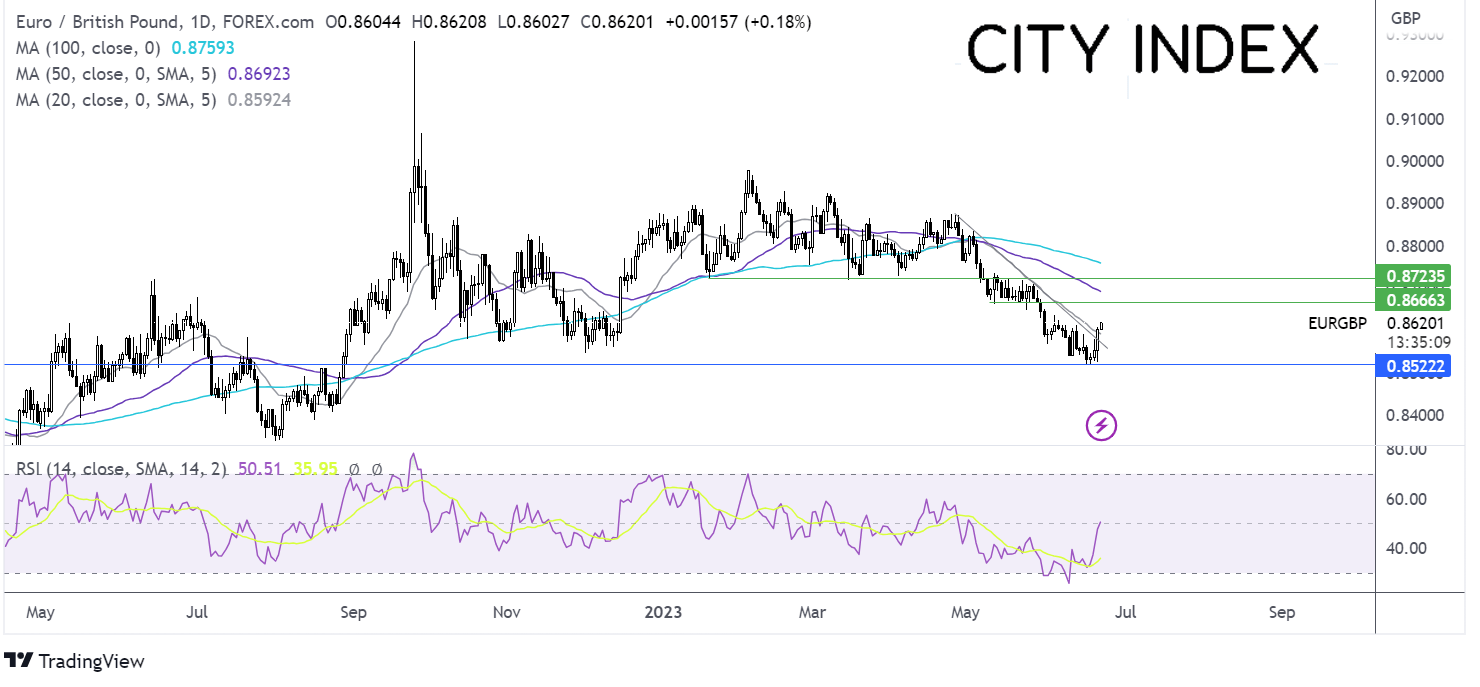

USD/JPY outlook – technical analysis

USD/JPY trades within a rising channel since the start of the year. A crossover has also formed between the 100 and 200 sma, in a bullish signal.

Buyers will look to rise above 142.35, the 2023 high to extend gains towards 143.10 the rising trendline resistance. Above here, 145.90, the September 2022 high, comes into play.

On the downside, sellers could be encouraged by the RSI bearish divergence. support can be seen at 141.25, the weekly low, and 140.90 the May high. Below here, 140.00, the psychological level comes into play. A break down 138.50 changes the bias to bearish, creating a lower low.