- EUR/USD analysis: Boost from Eurozone PMI offset by drop in German retail sales

- Focus turns to US non-farm payrolls report – 170K net job gains expected

- EUR/USD technical analysis point to short-term weakness, although long-term bull trend still intact

EUR/USD analysis: Video update

Welcome to another edition of Forex Friday, a weekly report in which we highlight selected currency themes. In this week's edition, we will discuss the US dollar ahead of the NFP data and look at the EUR/USD pair in light of fresh data disappointment from Germany.

The EUR/USD was trading lower ahead of the publication of the US monthly non-farm jobs report, extending its weekly decline after rising for two consecutive months at the back end of last year. European indices and US futures were again pointing lower. The dollar has found support on the back of stronger US data on Thursday with jobless claims and ADP private payrolls both beating expectations. On Friday morning, the greenback gained further ground against the euro on the back of softer European data. Attention now turns to the upcoming release of NFP and later the ISM services PMI.

EUR/USD analysis: Boost from Eurozone PMI offset by drop in German retail sales

On Friday morning we saw a sharper than expected 2.5% drop in German retail sales and weaker Eurozone CPI print of 2.9% vs. 3.0% expected, which hurt the euro and underpinned the dollar. The drop in German retail sales was significantly worse than the 0.1% decline analysts had expected. It underscores the struggles households are continuing to face, with inflation still quite high and interest rates at record levels.

The EUR/USD bulls are clearly disappointed with the pair now hovering near the 1.09 handle. Today’s weaker data comes after the Eurozone final PMIs saw an unexpected upward revision on Thursday, following positive outcomes in German and Spanish employment data the day before. Those development provided some support for the euro on Thursday. Additionally, China reported stronger-than-anticipated Caixin manufacturing (50.8) and services (52.9) PMIs, alleviating concerns about the well-being of the world's second-largest economy.

Focus turns to US non-farm payrolls report

Thursday’s stronger ADP and jobless claims data support the view of a later than earlier cut, which is why the dollar is refusing to budge, despite its bearish trend over the past couple of months. The ADP non-farm payrolls report printed 164K versus 120K expected, and weekly jobless claims data showed claims for unemployment benefits rose by 202K applications last week, which was well below 217K expected and 220K from the previous week. A day earlier, we saw the employment component of the ISM manufacturing PMI beat expectations – although at 48.1 it still remained below the expansion level of 50.0, it was nonetheless much better than 45.8 print of the previous month.

As far as the non-farm jobs report is concerned, it displayed notable strength in the previous released, which easily exceeded expectations with almost 200,000 jobs added and a 0.4% month-on-month increase in average hourly earnings. Should employment continue to exhibit robustness, the Fed might find it necessary to postpone rate cuts to prevent a resurgence of inflation. Dollar bears, gold enthusiasts, and stock market bulls will be looking for a weaker print than the 170K expected figure in today’s release. Average hourly earnings are expected to come in at 0.3% month-on-month.

Here's our full NFP Preview article written by my colleague Matt Weller

Later in the day we will have the latest ISM services PMI data to look forward to. This is expected to come in roughly unchanged from the previous months 52.7 print.

Probably of rate cuts fall ahead of US data

Once today’s US data releases are out of the way, attention will slowly turn to inflation with CPI on tap Thursday of next week. The market has factored in a 66% probability of a rate cut in March. This was closer to 100% at the end of December, despite the Fed indicating that the initial rate cut might occur later in the year. In December, the FOMC hinted at three rate cuts in 2024, leading to fresh record highs in some US stock indices, a sharp decline in bond yields, and a weakened dollar. Despite efforts by several Fed officials to tame market expectations of aggressive rate cuts, these attempts proved somewhat ineffective, even as certain sectors of the US economy surprisingly maintained resilience in the face of challenging conditions. But this week, it looks like investors have been making a more sober assessment of the situation. The forthcoming CPI data next week will likely have implications for expectations regarding rate cuts. Will inflation fall for the third consecutive month from December's 3.1% year-on-year figure?

EUR/USD technical analysis

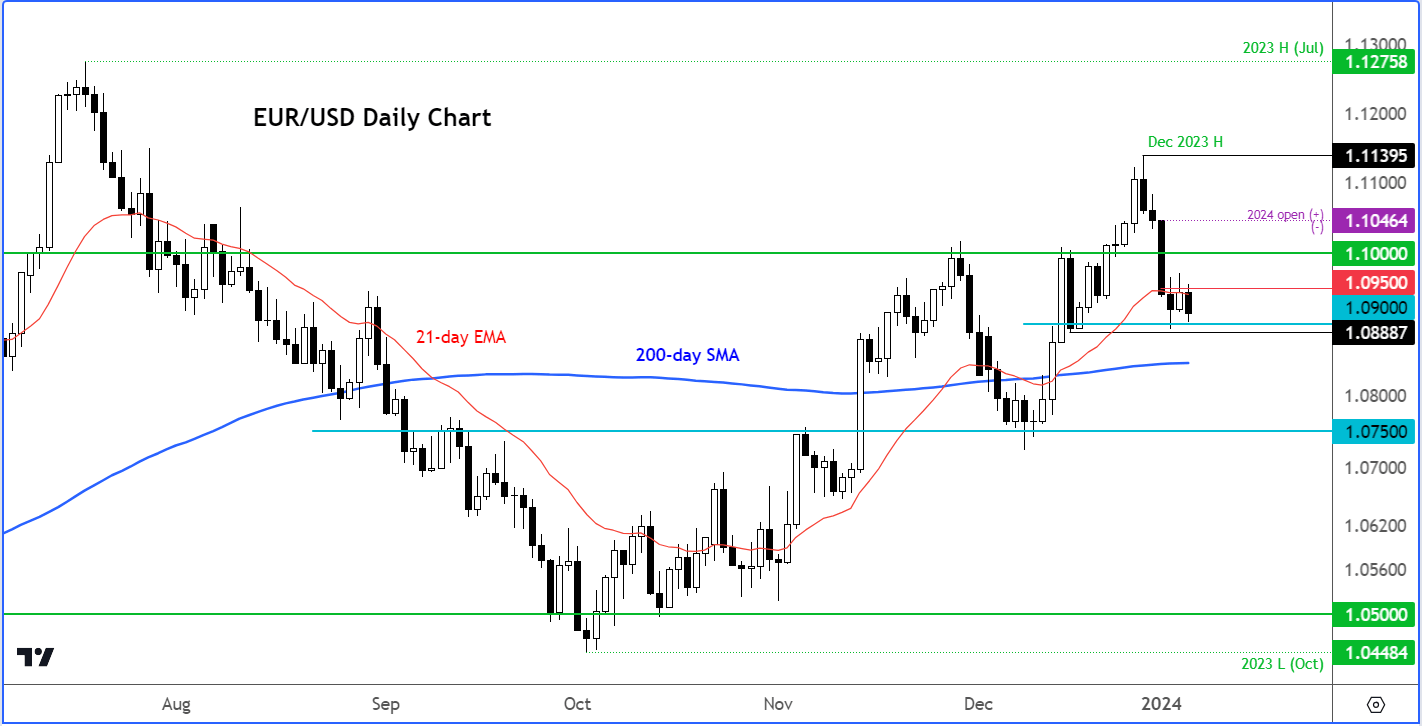

Source: TradingView.com

The EUR/USD's overall technical stance remains bullish on longer-term time frames, as it maintains its position above the 200-day average. However, in the short term, bearish price action persists, especially since it fell short of achieving a new high for 2023 in December. Consequently, a cautious approach for bullish investors is advisable. It is important to wait for a clear bullish signal instead of blindly entering bids at potential support levels, a strategy typically favoured in more robust and established bullish trends.

The next short-term potential support is seen around 1.09 handle, after 1.0950, aligned with the 21-day exponential moving average, broke down. The 200-day simple average stands at 1.0845. Resistance comes in around 1.0950 followed by 1.1000.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade