- Dollar analysis: All eyes on NFP

- How much of hawkish repricing is completed?

- Key levels to watch on Dollar Index

- Next week’s data highlights: FOMC minutes, US CPI, UK GDP and UoM sentiment survey

Welcome to another edition of Forex Friday, a weekly report in which we highlight selected currency themes. In this week’s report, we will focus the US dollar and look ahead to key events coming up.

It is all about the nonfarm payrolls report and the dollar today. The NFP data will be responsible for the short-term direction of the US dollar and bond yields, before the focus turns to the FOMC meeting minutes and inflation data next week.

Dollar analysis: All eyes on NFP

Insofar as the jobs report is concerned, it is expected to show 171K net new jobs were created in September and that average hourly earnings rose 0.3% m/m. Interestingly, Joe Biden is set to deliver a speech on the jobs market after the data is released. Does he know something we don’t? It is possible he will have seen the report ahead of its publications and thought it was strong enough to warrant delivering a speech on it. You can also argue that he can put a positive spin on it even if it is a weak report – i.e., that the Fed is winning its fight against inflation by slowing down the economy and jobs growth.

How much of hawkish repricing is completed?

Once the jobs report is out of the way, investors and traders will be wondering whether the dollar already has or about to top out. We have seen the greenback pull back over the last few days, consolidating its sharp gains following the Fed’s hawkish pause last month, which sent the reserve currency surging higher alongside bond yields. At that meeting, the FOMC trimmed their interest rate cut projections in 2024 from 4 to just 2 and left open the possibility of one more rate increase before the end of 2023. As a result, the market was forced to revise higher its prior dovish expectations. At the same time other central banks also signalled that they had reached peak interest rates. So, it was a combination of a hawkish Fed and not-so-hawkish foreign central banks that drove the dollar higher against the favour of the likes of the pound and euro, while the yen just kept dropping because of inaction by the BoJ.

The key question now is this: Is the market done with its repricing? If so, does that necessarily mean the dollar will now plunge back down, or simply consolidate nears its recent highs?

A lot will obviously depend on incoming data, but my feeling is that at best, the dollar’s bullish trend will slow down markedly moving forward. Even if we don’t see a complete reversal, major currency pairs like the EUR/USD, GBP/USD, etc., should be able to show some signs of life, rather than just keep dropping. So, if I were to put a percentage on it, I would say that around 90% of the hawkish repricing is done already. But that is just my guestimate and can change dramatically if incoming US data proves to be far too resilient than I and many other analysts expect.

Before we turn our attention to next week’s key macro events, including the FOMC meeting minutes and inflation data, let’s a have a quick look at gold in the video below, which is testing some key long-term support levels, and also take a look at the chart of the dollar index ahead of today’s jobs report.

Gold tests key support ahead of jobs report

Dollar analysis: Key levels to watch on Dollar Index

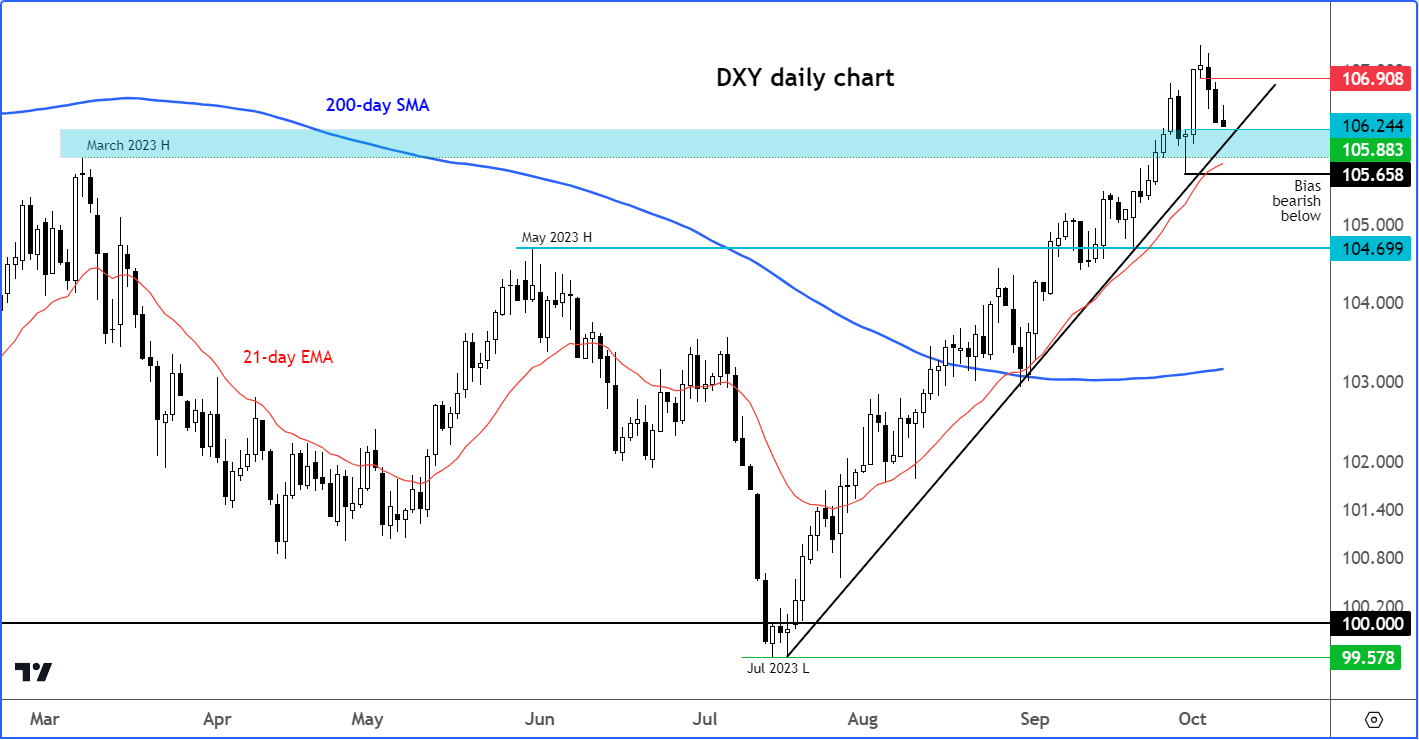

Source: TradingView.com

The initial retest of the broken high from Match that was made at 105.88 on the Dollar Index held on Friday, leading to fresh gains at the start of this week. The DXY has since struggled, as the like of the EUR/USD rebounded, rising back above the 1.05 handle. The key test for dollar bulls is to defend the shaded area on the chart, between that 1.0588 level and 106.24. The latter is last Friday’s high, when the DXY created a hammer/doji candle on the daily chart. We also have a bullish trend line cutting through this 105.88-106.24 range. The line in the sand for me is at 105.65, last Friday’s low. A move below that will create a lower low, and thus a key reversal signal.

Next week’s key data highlights

There will be bank holidays in US, Canada and Japan on Monday, meaning volatility is likely to be very limited. Things should be pick up later in the week with the release of some key market moving data. These include the following:

1) FOMC meetings minutes

Wednesday, October 11

19:00 BST

The Fed’s hawkish pause last month sent the dollar surging higher alongside bond yields. At that meeting, the FOMC trimmed their interest rate cut projections in 2024 from 4 to just 2 and left open the possibility of one more rate increase before the end of 2023. As a result, the market was forced to revise higher its prior dovish expectations. The minutes of that meeting will reveal more insights into the Fed’s thinking and thereby help to fine-tune market’s expectations.

2) UK GDP

Thursday, October 12

07:00 BST

Things can only get better, right? The UK economy is on its knees, and this is reflected in the pound weakening across the board. On Thursday, we will get the latest monthly GDP estimate, along with several other UK economic pointers. Last time, the monthly GDP estimate for August showed a much larger drop of 0.5% than expected, which wiped out the gains from July. Let’s see how the warm weather impacted growth in September. GBP bulls will need to see a sharp rebound.

3) US CPI

Thursday, October 12

13:30 BST

The market appears convinced that the Fed’s tightening cycle is over, but equally they are not expecting any rate cuts any time soon. This is because macro indicators in the US have remained relatively upbeat compared to the rest of the world. The dollar bulls will be looking for further evidence in incoming data, such as Thursday’s CPI print, to support the Fed’s view in keep rates high for long. Last month, CPI surprised to the upside, rising to 3.7% from 3.2%, ending a 14-month run of falling price pressures. But if there’s renewed weakness observed in CPI then this could provide relief for major FX pairs and gold.

4) UoM Consumer Sentiment

Friday, October 15

15:00 BST

Since the middle of last year, consumer sentiment has generally been improving despite borrowing costs continuing to rise and price pressures remaining elevated. In more recent weeks, concerns over interest rates remaining high for longer in the US has caused lots of volatility in across financial markets. We have seen a sharp sell-off in stocks while bond yields have hit levels last seen before the global financial crisis. If these concerns filter through to the consumer, then spending is likely to fall on no-essential items, potentially causing the economy to come to a standstill. The UoM survey will give us an advanced indication on the front.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade