- Dollar analysis: Middle East situation has compelled investors to shift away from riskier commodity currencies

- EUR/USD outlook in focus ahead of busy week

- Key macro events to watch next week: Global PMIs, ECB and US GDP

It has been a tumultuous and eventful week for the global financial markets. The ongoing situation in the Middle East has triggered a surge of volatility in the oil and stock markets, compelling investors to re-evaluate their strategies and shift their focus from riskier assets to “safer” investments. We have seen gold rise while stock indices across the globe have fallen. Meanwhile, the 10-year Treasury yields have risen further, reflecting the market's expectation of a prolonged period of elevated interest rates from the Federal Reserve, aimed at managing the persisting inflationary pressures.

In light of these developments, Chair Jerome Powell hinted on Thursday that the Federal Reserve is inclined to maintain the status quo during its next meeting, emphasizing the need to carefully monitor the trajectory of economic growth data. The uncertainty surrounding the markets has prompted both investors and analysts to closely watch how these geopolitical and economic factors will continue to shape the landscape in the coming weeks.

While the dollar has managed to do very well against the commodity dollar, it has fallen against the euro, gold and silver. If recent FX correlations are anything to go by, then the likes of the euro may also weaken again should we see further stock market downturn.

It is worth watching the Australian and New Zealand dollars and Chinese yuan next week. Despite being somewhat undervalued from a macro perspective, the Aussie faces a significant downturn risk as a high-beta currency during an equity sell-off. Further stock market declines could potentially drag down cross rates like AUD/JPY and NZD/JPY.

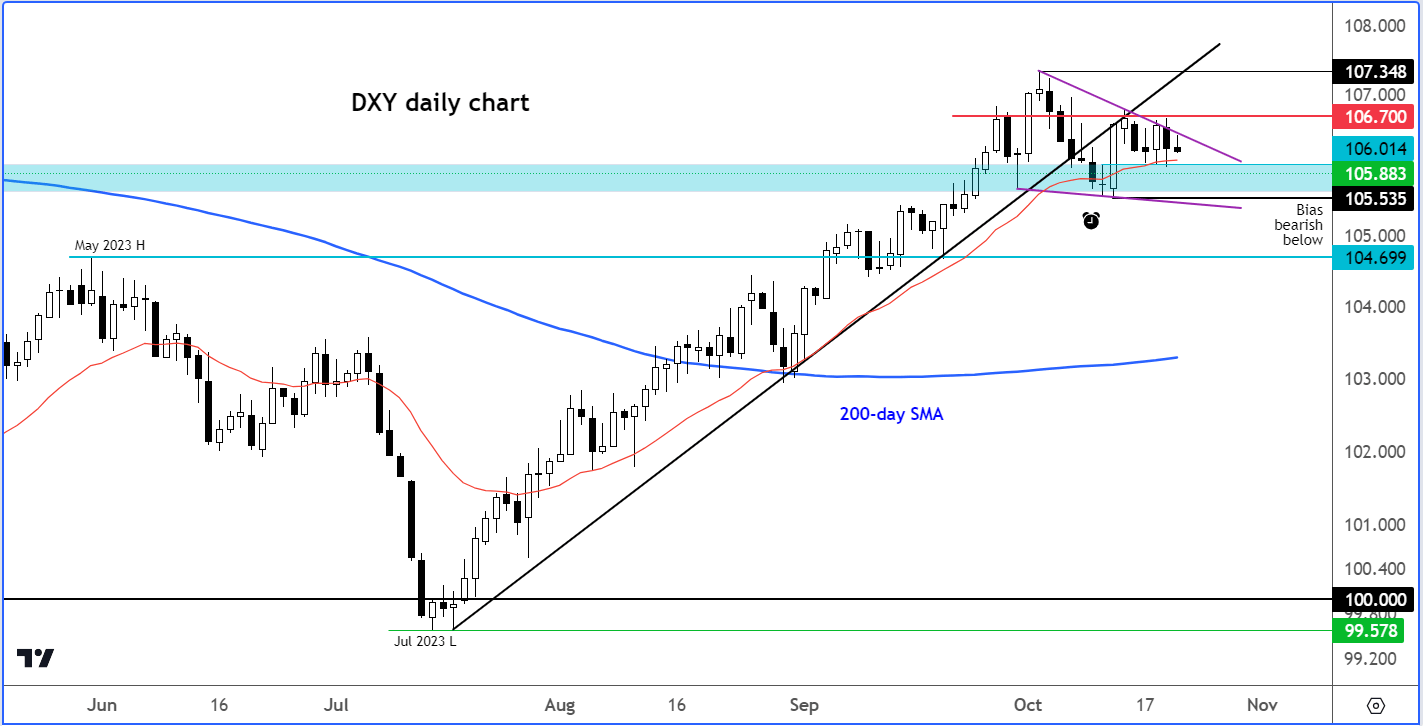

Dollar index technical analysis: key levels to watch

After breaking its bullish trend line in the first week of October, the Dollar has huffed and puffed, but it hasn’t gone anywhere fast, despite a still-supportive macro environment.

The consolidation means the bullish trend has weakened, but it is far too early to say the greenback has topped.

It is possible we may see the formation of a bullish continuation pattern around current levels like a flag or falling wedge formation, before the trend resumes at some later point in time.

The US macro calendar is quiet today but do keep an eye on the bond yields which continue to creep higher and higher. Further potential strength in yields could provide the dollar index renewed strength.

A break above 106.70 resistance is needed now to re-ignite the dollar rally. Meanwhile, support is seen in the range between 105.80ish to 106.00 (blue shaded region on the chart). However, if the DXY doesn’t find support here and goes on to break 105.53, then this would be a bearish development as we will then have a confirmed lower low in place.

Dollar analysis: EUR/USD outlook in focus ahead of busy week

In spite of the continued instability in the stock market, with recovery attempts failing to inspire confidence among investors, and the upward trajectory of US 10-year bond yields towards that critical 5% level, the EUR/USD has remained relatively stable over the past few weeks. Investors may be wondering how much of the Fed’s hawkish stance is priced in for the dollar, but that doesn’t explain why the dollar has risen further against most other currencies and why the euro is holding its own so well against most major currencies. It could be that investors are just simply waiting for the outcome of next week’s significant macro events before committing. These include global PMIs, the ECB's policy decision, and US GDP, among other significant data.

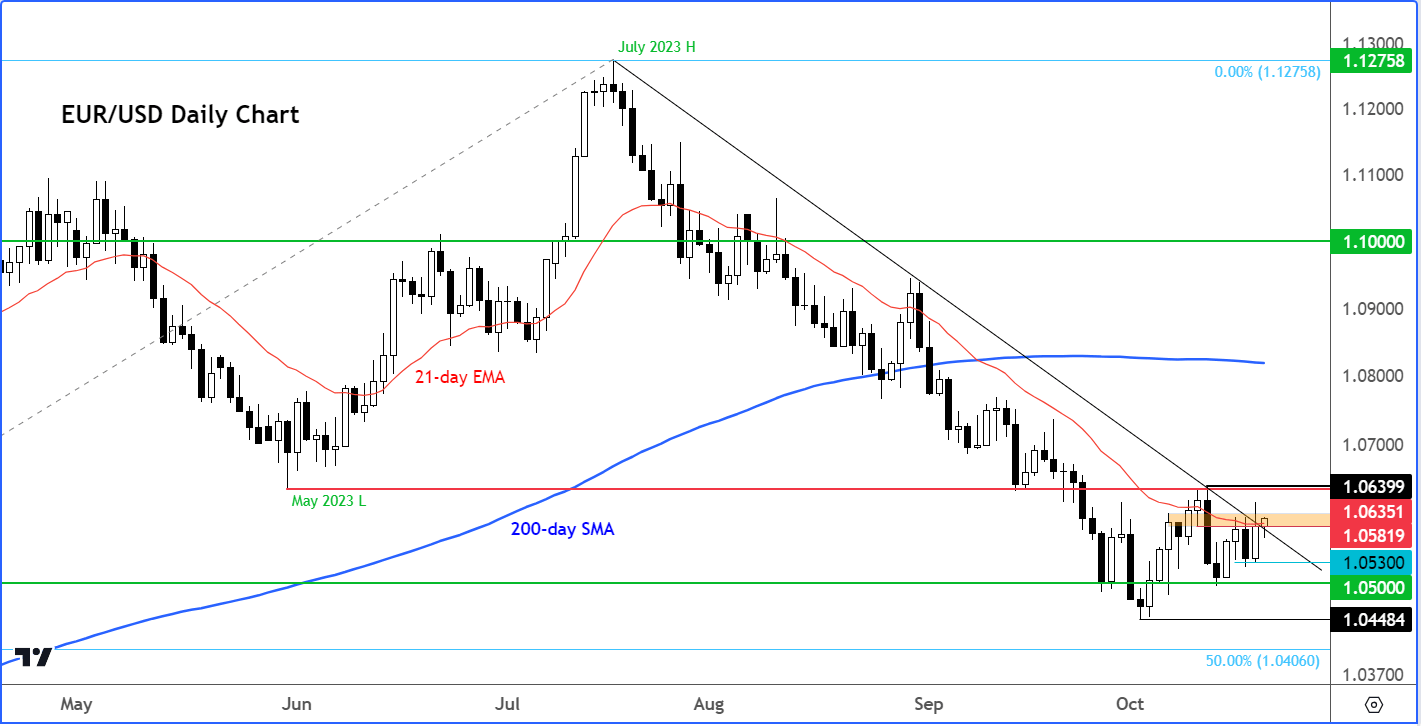

Before looking at those macro events in greater detail, let’s have a quick look at the chart of the EUR/USD first.

EUR/USD key levels to watch

Looking at the technical analysis of the EUR/USD, the currency pair was trying to break its well-established bearish trend line and a key short-term resistance area around 1.0580. A successful break above this level could pave the way for a further upward movement towards a more substantial resistance level at 1.0635, above which one will have to consider the possibility that rates may have formed a bottom.

As before, key support comes in around the 1.05 handle, but there are several other shorter-term levels to watch before that, including 1.0530.

EUR/USD outlook: key macro events to watch next week

Turning our attention to the key macro events for the upcoming week that will be relevant to the EUR/USD pair, we have several crucial economic data releases. Of particular significance are the Global PMIs scheduled for Tuesday, October 24, the ECB policy decision on Thursday, October 26, and the US Advance GDP estimate also on the same day. These events will likely shape the market sentiment and impact the EUR/USD trajectory, with market participants closely monitoring the economic indicators for insights into the potential direction of the currency pair.

Global PMIs

Tuesday, October 24

All day

The PMI data has been consistently very poor throughout much of this year, correctly highlighting a challenging macro backdrop with stagflation and high interest rates holding back the developed economies, most notably the Eurozone. Add the raised geopolitical risks to the equation, sentiment in the services sector is likely to have remained downbeat in October. The PMI is a leading indicator of economic health as purchasing managers possibly hold the most current and relevant insight into the company's view of the economy. Unless we see a surprise improvement in the PMI readings for the Eurozone, expect the pressure to remain on the EUR/USD.

ECB policy decision

Thursday, October 26

Following the ECB’s September meeting, the central bank made it clear that they won’t be hiking rates in October, as the central bank will want to get fresh information on Bank Lending Survey, Q3 GDP and a new round of staff projections. But soft data and the flare up in Middle East tensions have made it even easier for the ECB to pause its hiking. So, the focus will be on clues about the ECB’s December meeting, and beyond. All told, we don’t expect to see any support coming for the euro from this meeting.

US Advance GDP estimate

Thursday, October 26

We will have lots of important data from the US next week, including PMIs from the manufacturing and services sectors (Tuesday), GDP (Thursday) and Core PCE Price Index (Friday). Among these, GDP is likely to garner most of the attention as investors assess the likelihood for one more rate increase from the Fed. If GDP and most other US macro pointers in the week come in higher, then at the very least it would boost the “higher for longer” narrative, while data disappointment could finally send US dollar and yields lower.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade