DAX limited by hawkish central bankers & ahead of inflation data

- DAX struggles after a hawkish panel of central bankers

- German inflation expected to rise to 6.3%

- DAX trades between 50 & 100 sma

The DAX is pointing to a flat open after two straight days of gains as investors continue digesting takeaways from yesterday's panel of the world's top central bankers and they look ahead to German inflation data.

One of the key messages of yesterday's panel, which included ECB president Christine Lagarde, Fed Chair Jerome Powell, BoE’s Andrew Bailey, and BoJ’s Kazuo Ueda, was the persistence of inflation. All pointed to the strength of underlying prices so far and how policy is being adapted.

A hawkish message from Christine Lagarde, who reiterated that a rate hike is likely in July, could keep the lid on gains in the DAX. However, she refrained from commenting on the direction of policy in September. Her comments come after data showed that credit conditions continued to tighten in the region in May.

Similarly, Fed Chair Powell was a touch more hawkish, hinting that there could be consecutive rate hikes in the coming meetings.

Attention now shifts to German inflation data, which is expected to tick higher to 6.3%YoY in June, up from 6.1% in May. Hot inflation data would support Lagarde’s hawkish comments.

The ECB’s economic bulletin is also set to be released and could shed more light on the health of the eurozone economy as the central bank tightens monetary policy.

DAX outlook – technical analysis

The DAX rebounded from the 100 sma and is testing the 50 sma resistance at 15977. A rise above here and 16030, the rising trendline resistance, is needed to extend gains towards 16430 and fresh all-time highs.

Should sellers defend the 50 sma, a move back towards the 100 sma at 15700 could be on the cards. Sellers need to break below this support and 15625, the May low, to create a lower low, being 15250, into play.

USD/JPY rises on USD demand after a hawkish Fed Powell

- Fed -BoJ divergence under the spotlight

- US GDP data expected to confirm 1.4% QoQ

- USD/JPY grinds higher to a fresh 2023 high

USD/JPY is rising towards a fresh 2023 high amid solid demand for the dollar after Federal chair Jerome Powell reaffirmed that more interest rates were likely and after BoJ’s Kazuo Ueda reiterated the central bank’s dovish stance.

Powell speaking at the ECB conference in Sintra, Portugal, noted a few more interest rate hikes were likely this year, with one possibly at the July meeting. He added in a more hawkish twist that the central bank could raise interest rates at consecutive meetings. Powell doesn't see inflation returning to the Fed’s 2% target until 2025, instead saying that rates will stay higher for longer.

Investors will look ahead to the release of core PCE data tomorrow, the Fed’s preferred gauge for inflation, for further clues over how sticky inflation is.

Meanwhile, US GDP figures for Q1 will be released and are expected to confirm the earlier readings of 1.4% QoQ annualized.

Meanwhile, the BoJ’s governor Ueda remained an outlier on the otherwise hawkish central bank panel. Ueda said there was still some distance to go to achieve 2% inflation sustainably.

The yen is driving towards that level of 145, where the Ministry of Finance and the BoJ intervened in the currency market last autumn.

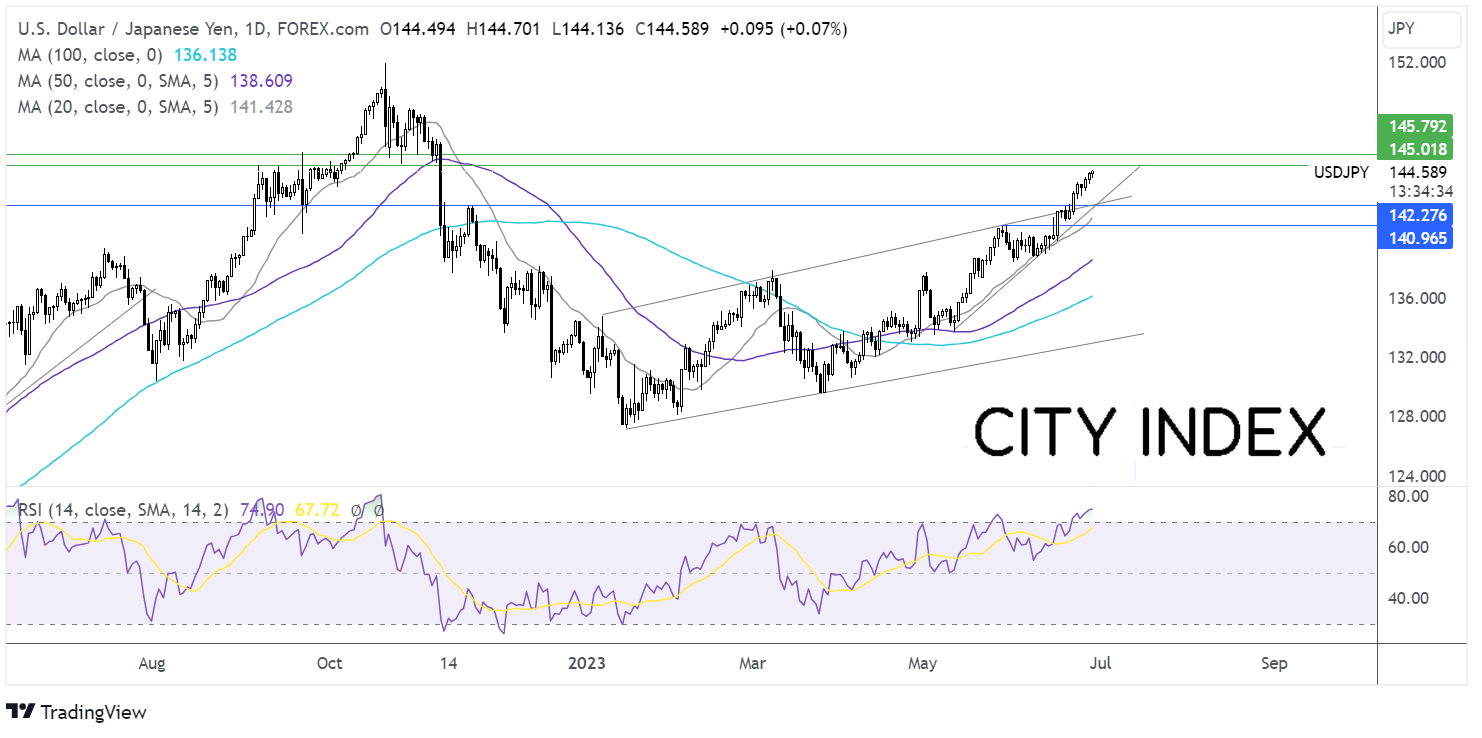

USD/JPY outlook – technical analysis

After breaking out above the rising trendline dating back to the start of the year, USD/JPY continues to scale higher. The RSI is deep in overbought territory, warranting caution for the bulls.

Buyers now target 1450.00, the psychological level which held firm in September 2022 for around a month, ahead of 145.90, the September’22 high.

On the downside, support can be seen at 142.40 and November ’22 high. A break below here could open the door to 141.50, the 6-week rising trendline.