European equity indices again outperformed in the first half of today’s session, with the likes of the German DAX being up around 1.5% by midday in London. US future were up modestly at the time of writing. As we transition to the US session, will those earlier gains evaporate for Europe, as the focus turns back to central bank policy tightening and a slumping US technology sector?

In Europe, sentiment has been boosted because of warmer-than-expected weather at the start of the winter season, which has reduced fears about gas shortages. What’s more, data from Eurozone has improved, albeit from a very low base. Today, for example, the latest services PMI data from Spain and Italy beat expectations, while the Eurozone final PMI was revised up a touch – though still remained just below the boom/bust level of 50.0. What’s more, German import prices slumped 4.5% month-over-month, in a further sign that inflation may have peaked.

However, recession fears have not gone away completely. Just look at oil prices. They fell more than 3.5% to extend their drop from the previous session. We had weak PMI data from China over the weekend and yesterday Caixin PMI was also weak. With activity contracting, this feeds back into the weak global growth narrative. China’s reopening has been hampered by rising covid cases and measures countries are putting against Chinese travellers.

In the afternoon, the focus will turn to US data, with ISM manufacturing PMU, JOLTS Job Openings and FOMC meeting minutes all to come. So, we will have this year’s first set of important macro data later, with the minutes of the FOMC’s December meeting likely to be the most important. At that meeting, the FOMC reduced the pace of tightening to 50 basis points but appeared more hawkish than expected, in that policymakers projected a higher terminal interest rate and indicated that monetary policy will remain contractionary for longer. The minutes should reveal more details, which should set the tone for next few days at least.

Overall, much of the issues we faced in 2022 are going to be with us well into 2023, including high levels of inflation and rising interest rates. A recession seems unavoidable. Traders know that after a big rebound starting in October for US and global indices, much of the positivity about the Fed pivoting to a less hawkish stance has now been priced in. So, the risks remain tilted towards the downside.

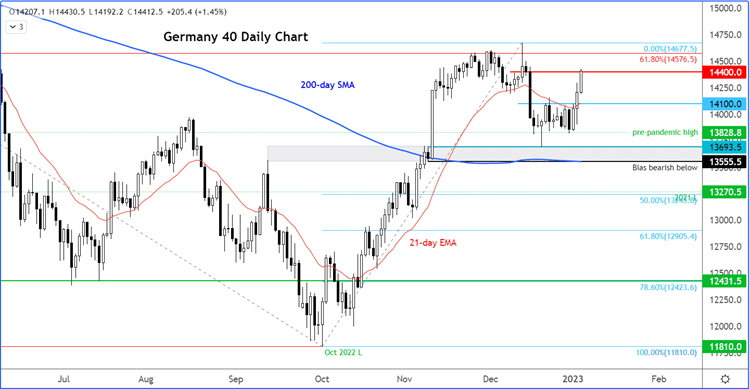

Still, the DAX’s strong recovery cannot be ignored. The bears will need to see some confirmation after it broke key resistance at around 14100, before surging to the next resistance around 14400 today. Perhaps a potential move back below 14100 could excite the bears. On the other hand, if the index closes today’s session around current levels then the bulls will remain confident of a larger recovery and will thus be in the mood to keep buying short-term dips.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade