Moves higher lack momentum

The DAX has seen choppy trading this week as investors jump from one Russia, Ukraine headline to the next. Risk sentiment has been on a roller coaster ride as the world watches to see what Putin does next.

The DAX has been particularly vulnerable to the geopolitical instability falling to an eight-month low earlier this week. Whilst Germany is usually the first place that investors put their money to work in the eurozone, it stands to reason that it would be the first place for money to be pulled out of as well.

Then there is also the question of energy. Europe is overly reliant on energy from Russia. Should the West put sanctions on Russia, these would inevitably mean higher energy prices for Europe, including Germany. Even if the sanction weren’t placed on oil, there is a good chance that Russia would restrict energy supply to Europe in retaliation. This could not only impact growth in German, as well a wider Europe, but could also lift inflation further.

And then there is the question of palladium. Russia is a key producer of palladium, which is used in catalytic converters and raises concerns for the German automobile industry.

Where next for the Dax?

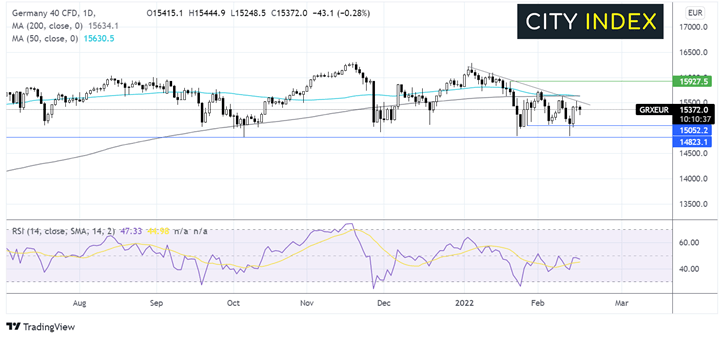

The DAX rose to an all time high of 16300 at the end of last year, a level which was refreshed again at the start of 2022. However, since then the price has been trending lower

The price trades below a falling trend line dating back to early-January and trades below its 50 & 200 sma suggesting that the overall bias is bearish, even if it has been rather choppy. Whilst there have been several attempts at a push higher, buyers don’t have the same momentum from the previous push, resulting in a series of lower highs.

That said, on the downside there are a couple of important levels which are offering support. Firstly 15,000, with any breakthrough here opening the door to 14800, a major strong support that has been in place since May last year. A break below here could spark a large move lower.

It would take a close above 15600 the 50 and 200 sma for the bulls to pick up momentum towards 16000 and 16300. However, given the fundamental picture this could be a challenging move.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.