- DAX analysis: What’s behind the slight risk appetite improvement?

- Focus turns to US employment before attention turns to inflation data

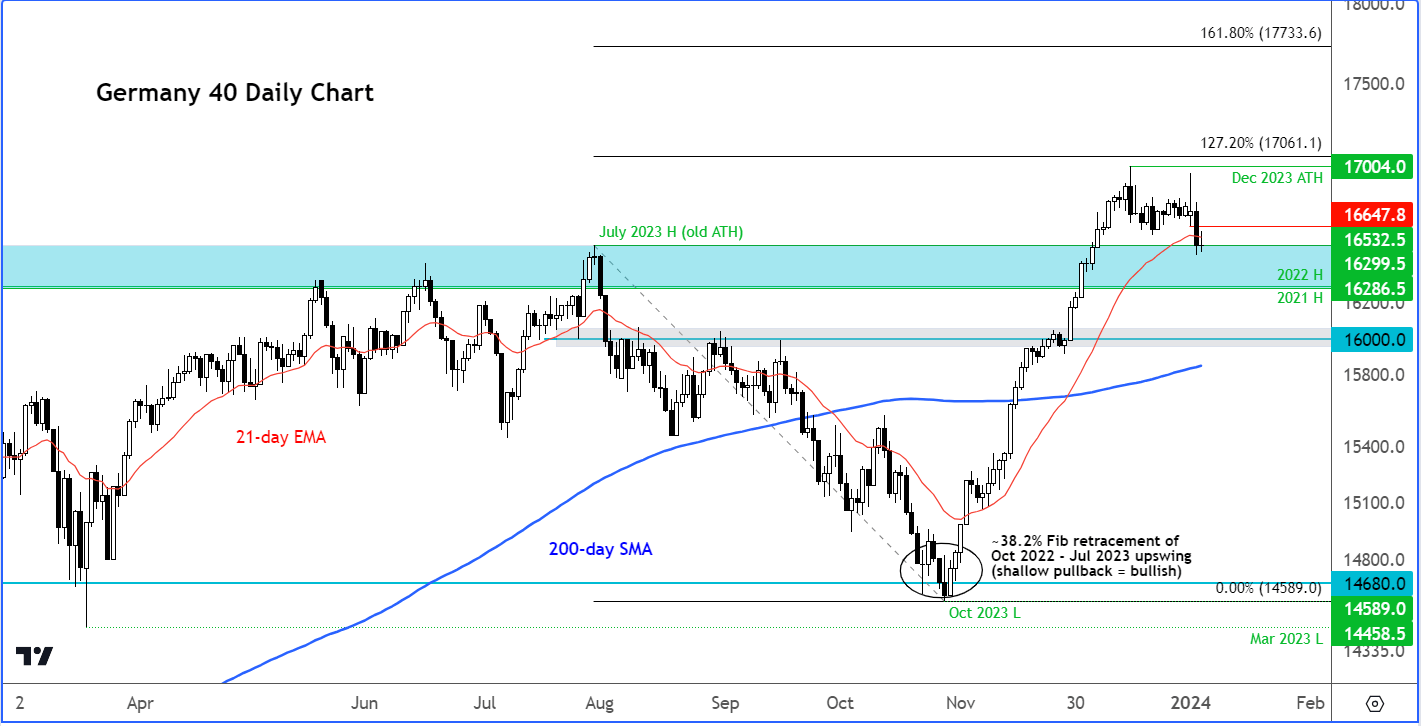

- DAX technical analysis: 16285-16530 key support area being tested

Risk appetite improved a little in early European trade, as the major EU indices and US futures bounced back a little. However, by mid-day, those gains had evaporated, although the downside was limited as traders were unwilling to commit in either direction ahead of key US employment data. The DAX and other major indices will be looking to post their first gains for 2024.

DAX analysis: What’s behind the slight risk appetite improvement?

Today’s earlier bounce may be a sign that the sluggish start to the year for European and global indices could soon be over. We have had some better-than-expected Chinese and European data, while the dollar eased back, providing relief for all sorts of risk assets. Energy stocks were supported by crude oil’s recovery while firmer Chinese data helped to lift mining stocks.

Among the positive economic developments, Eurozone final PMIs were unexpectedly revised higher which came in a day after we had better-than-expected German and Spanish employment data. The Eurozone Final Services PMI improved to 48.8 from 48.1, while the UK PMI was even brighter at 53.4 vs. 52.7 reported initially. In addition, China's stronger-than-expected Caixin manufacturing (50.8) and services (52.9) PMIs have alleviated worries about the health of the world's second-largest economy, contributing to the outperformance of currencies like the Australian dollar, a top exporter of iron ore and a major copper producer.

The weaker start to the year for risk assets contrasts with a strong finish to last year, fuelled by high expectations for a significant dovish shift by the Federal Reserve. However, investors this week have expressed doubt about whether the anticipated rate cuts will align with the market's lofty expectations. Market expectations of up to 160 basis points in cuts this year, double the Fed's projection, have led some investors to reconsider their positions, reversing trades, or taking profits on long risk positions.

Focus turns to US employment before attention shifts to inflation data

Investors are awaiting the release of crucial employment data that could potentially influence the market direction meaningfully. Commencing with the ADP private payrolls report and weekly jobless claims data scheduled for release later today, these updates will provide further insights into the labour market ahead of the official non-farm payrolls report on Friday. Given the current focus on when the Fed might initiate rate cuts in 2024, the December jobs report holds considerable weight in shaping those expectations.

The preceding jobs report for the month of November was stronger, with both headline job growth exceeding expectations at nearly 200,000 and average hourly earnings registering a 0.4% month-on-month increase. If employment maintains its robust performance, the Fed may find itself compelled to postpone rate cuts to mitigate the risk of accelerating inflation. Consequently, the market is keenly observing for signs of a soft landing.

DAX technical analysis

Source: TradingView.com

The DAX is still looking quite bullish. Though it has started the year weaker, there may still be lots of momentum behind the move from last year when it sharply outperformed some of its peers, most notably the UK’s FTSE 100, boosted by expectations that the ECB is going to cut interest rates. It broke several resistance levels include the area shaded in blue on my chart, where the highs of 2021, 2022 and the July 2023 peak all converge. It now needs to hold above this 16285-16530 area in order to maintain its short-term bullish bias.

If it holds support here and shows a bullish candle, then that could be a sign that the market wants to push to a new high. In this case, we should expect to see follow-up technical selling to take us above the December high of 17004. Interim resistance at 16650 should not be forgotten.

However, if support doesn’t hold in that 16285-16530 area, then this could pave the way for a deeper correction, with the next level of potential support not seen until around the 16000 area.

Video: DAX analysis and insights into FTSE, Gold, Silver and EUR/USD

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade