- DAX analysis: technical levels and factors to watch

- ECB could prepare markets for June cut

- US sticky inflation concerns make unwelcome return as focus turns to PPI

DAX analysis video and insights on US indices and FX majors

Although we have had some improvement in global data in recent weeks, including from the Eurozone, it is concerns about US inflation re-accelerating that has held back global equities following a strong rally in the past couple of months. The start of this quarter has been less than ideal for stocks, although energy names have done well as oil prices have remained elevated, while precious metals miners have also had some success as gold and silver prices surged, until ending lower on Wednesday. Today’s focus is on the ECB rate decision while stateside there will be more inflation data to look forward – this time, PPI.

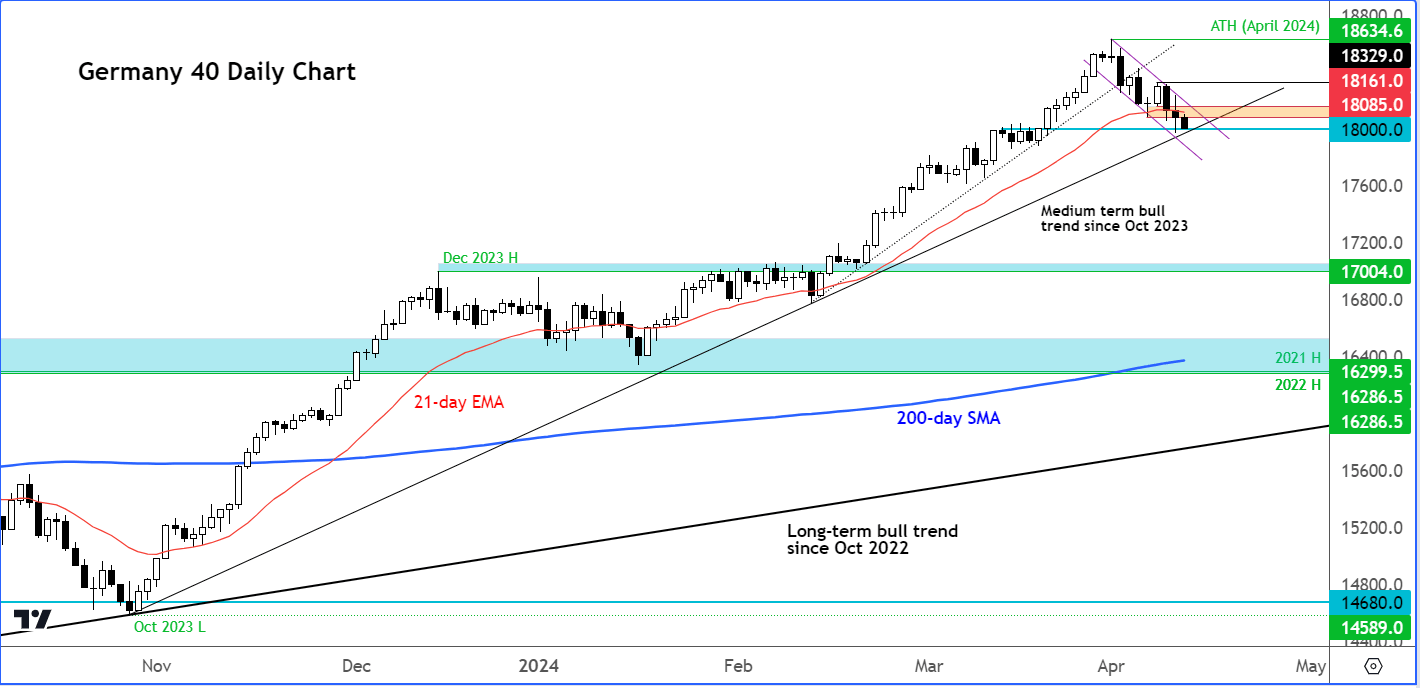

Before discussing the ECB rate decision and what to look out for, let’s have a look at the chart of the DAX first, as it tests a key pivotal area.

DAX analysis: technical levels and factors to watch

Source: TradingVIew.com

The DAX has reached a key technical area of support around 18,000. This level was the base of the breakout in March that led to a sharp rally to repeated record highs, before the index peaked – for now – at the start of April. From that peak of 18635, the index has given back 3.5% so far. In the process, a few short-term support levels have broken down. First it was the short term bullish trendline that had been in place since mid-February. This gave way on 2nd of April following a sharp drop which led to further technical selling in the ensuing days. More recently, the index has broken below the 21-day exponential moving average which is an objective indicator of the short-term trend.

So, there has been some short-term damage to the technical outlook on the DAX index. However, there is no question about the validity of the longer-term trend which remains bullish. If the German index wants to maintain its overall bullish bias intact, it will need to hold its own around current levels or slightly below the 18,000 mark, where we have a medium term trendline coming into play. This trend line has been in place since October 2023.

If the index holds at these levels, then I would expect a bounce of at least around 85 points towards the 18,085 to 18,161 area. This zone represents the first area of trouble where the index may find some resistance. Previously the index had found support here, with the 21-day exponential moving average also coming into play here.

However should we see a clean breakdown of 18K support on a daily closing basis, then this could trigger further follow up technical selling that could lead to a more significant correction in the days ahead.

DAX analysis: ECB could prepare markets for June cut

Unlike the US, we saw Eurozone CPI surprise to the downside last week with a headline print of 2.4% year-on-year in March compared to 2.6% in February, with core CPI weakening to 2.9% from 3.1% in February. Though Eurozone CPI is now close to the ECB’s 2% target, it is probable that the central bank will defer any interest rate adjustments until June, seeing how US inflation has accelerated again. Still, Christine Lagarde and her ECB colleagues could utilise this week’s meeting as an opportunity to lay the groundwork for a potential rate cut in June. The necessity for additional data on wage growth remains important, with further insights expected to be unveiled in May. The ECB wants to ensure that wages are coming down before starting the rate-cutting cycle. They don’t want to deliver a victory speech too soon, given how inflation in the US has started to accelerate, with the Fed’s rate cut expectations falling sharply this week.

Inflation concerns make unwelcome return

While Eurozone data have shown some signs of life – for example, German industrial production rising to a 13-month high – it has been Friday’s robust US jobs report and now a hot CPI report for March that is raising eyebrows among some market observers. Wednesday’s bigger-than-expected rise in US inflation gave rise to further weakness in the bond markets, lifting yields, and causing indices (and even gold) to reverse. The ECB could use today’s meeting to cement expectations for a June cut, which could provide some relief for stocks. However, if the central bank appears more cautious than expected, then expect to see some further weakness in key indices like the DAX.

Eurozone data remains weak despite some improvement

In recent weeks we have seen mild improvement in German data, and this partly explains why German bond yields have edged higher. German industrial production rising by 2.1% month-on-month marked the second consecutive monthly increase. Additionally, the Eurozone Sentix Investor confidence index came in better than expected earlier this week, improving to -5.9 compared to -10.5 last. However, Italian retail sales and industrial production both disappointed with gains of 0.1% respectively. So, we are not seeing consistency in data, which should discourage the ECB’s hawks from calling for more patience when it comes to expectations of rate cuts around the middle of the year.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade