With the 1st of April last Friday, Canada waited until the next week (today) to release its March jobs data. The headline print was an additional 72,500 jobs added to the Canadian economy vs an estimate of +80,000. However, what makes this number strong is that the amount of full-time jobs was +92,700 vs a loss of 29,300 part-time jobs. Average hourly earnings up ticked to 3.4% YoY in March vs 3.3% YoY in February. In addition, the Unemployment Rate dropped to 5.3% vs a reading of 5.5% prior. Clearly the jobs data is on the right path, and this will play a big part in the Bank of Canada’s interest rate decision next week. The question is not “if” the BOC will hike, but rather by “how much” will it hike: 25bps or 50bps?

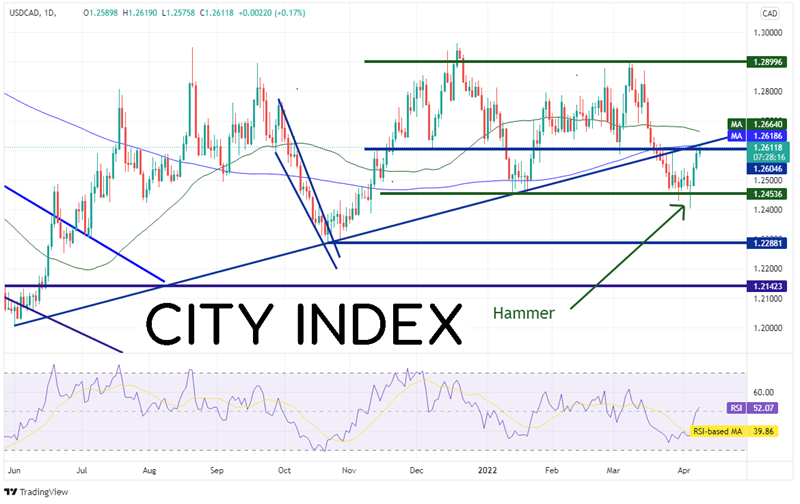

USD/CAD has been trading in a range between 1.2450 and 1.2900 (green lines) since mid-November 2021. In mid-December, price tried to break through the top of the sideways channel and as recent as last week, the pair tried to break through the bottom of the channel, failing both times. USD/CAD formed a hammer on April 5th, and price has been moving higher since. The pair is currently trading near horizontal resistance, an upward sloping trendline dating to June 1st, 2021, and the 200 Day Moving Average, near 1.2620.

Source: Tradingview, Stone X

Trade USD/CAD now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

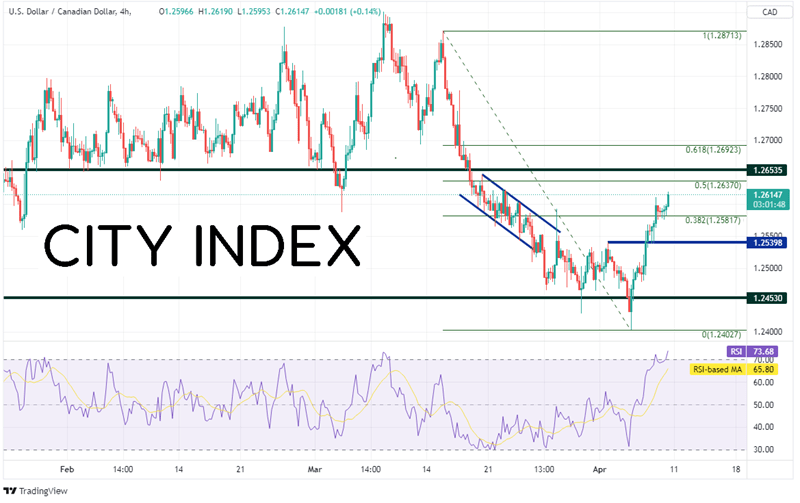

On a 240-minute timeframe, USD/CAD has broken above the 38.2% Fibonacci retracement from the highs of March 15th to the lows of April 5th, near 1.2581. First resistance above the 200 Day Moving Average (see daily) is at the 50% retracement from the same timeframe near 1.2637. 1.2653 has also been an important support level in the past, which now acts as resistance. Above there, resistance is at the 50-Day Moving Average (see daily) at 1.2664. However, notice that the RSI on the 240-minute timeframe is in overbought territory. Support is at today’s low of 1.2575 and then horizontal support at 1.2540. Below there, there is room for price to fall to the lows from April 5th at 1.2403.

Source: Tradingview, Stone X

The Canadian Employment change for March was roughly in line with expectations today, however the number of full-time jobs over part-time jobs makes the headline print stronger. The Bank of Canada will take this information into account when it meets next week. But will it be enough for the central bank to hike 50bps?

Learn more about forex trading opportunities.