A multinational and dual-listed company, BHP is headquartered in Melbourne and is the second-largest listed company on the ASX behind CBA. BHP will report its half-year numbers on Tuesday the 15th of February at 8.30 am Sydney time.

Expectations for BHP are running high after BHP’s quarterly production report dropped in mid-January. While the report showed copper and nickel production was lower, iron ore from its flagship Pilbara iron ore mine finished the December half close to record levels. Iron ore accounts for ~60% of BHPs earnings.

Providing some offset to the strong production numbers, the iron ore price has been volatile, falling from around $US230p/t in May to ~$US80 in November, before rebounding back to $US140 p/t.

Keeping in mind the companies cost of iron ore production is a miserly $US14 p/t and the company's forecast of the iron ore price for this period is $US113 p/t.

The market consensus is for BHP to report earnings of $US 9,800m for 1H2022, with an interim dividend payout of $US 175c per share.

Due to the proposed merger of BHP’s Petroleum business with Woodside (expected to be completed in the June 2022 quarter, subject to approval by Woodside shareholders), the 1H2022 results are being prepared on the assumption that the Petroleum Business is a discontinued operation.

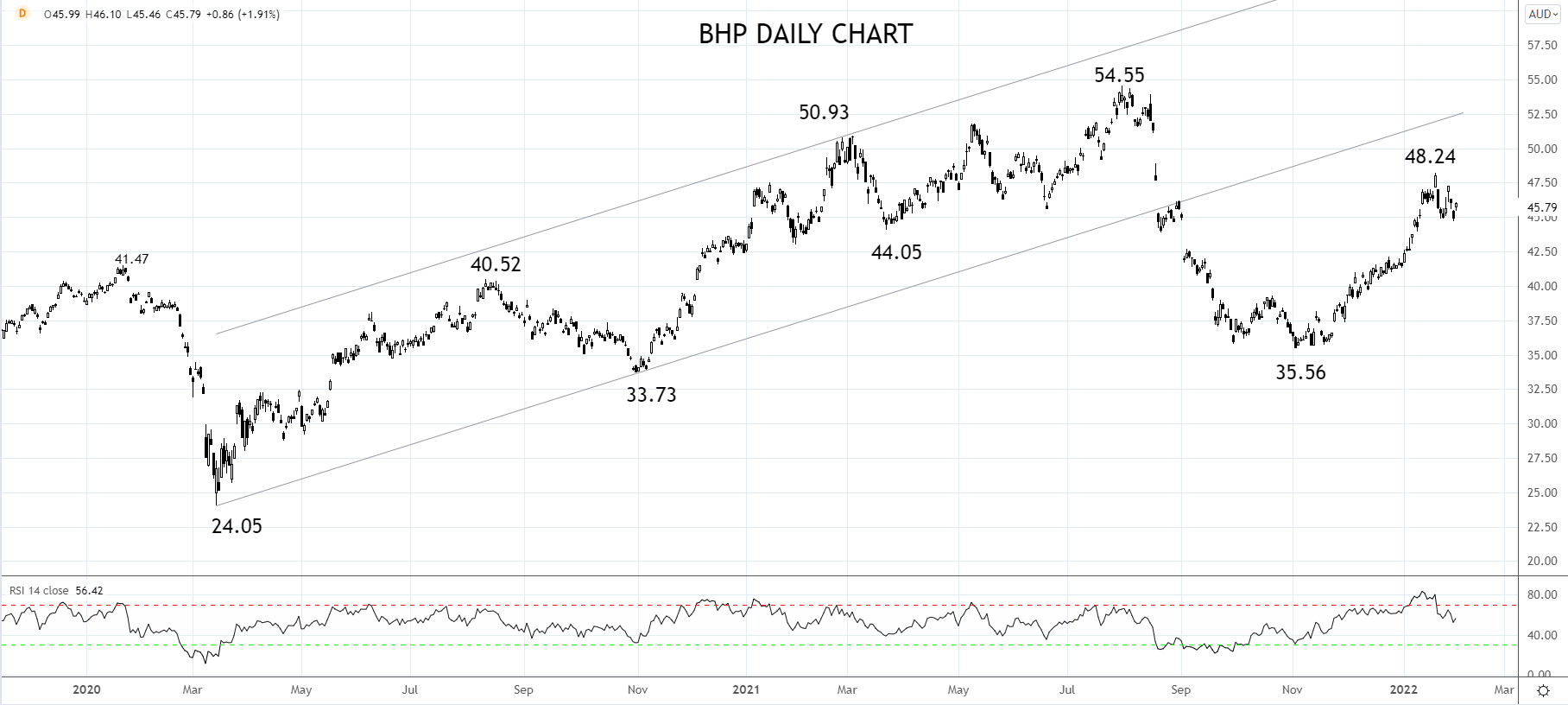

BHP Share Price Chart

The share price of BHP has tracked the iron ore price over the past six months, falling ~35% from its July high of $54.44 to $35.56 in November.

However, following the easing in Chinese monetary policy in early December, the price of iron ore has rallied, and by extension, so to the share price of BHP. This trend is expected to continue.

As a result, the preference is to buy BHP on dips back towards $44.00, looking for the price to retest the psychological $50.00 level in the coming months.

Source Tradingview. The figures stated areas of the 2nd of February 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade