Summary of RBA’s June statement

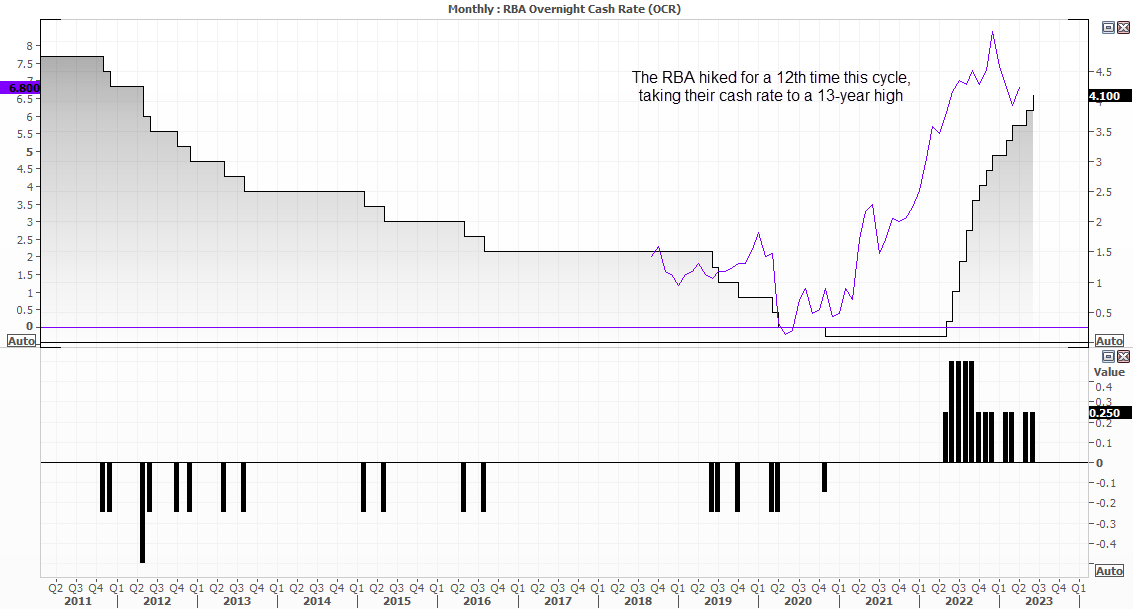

- The board increased the cash rate by 25bp

- Inflation in Australia has passed its peak

- CPI is still too high at 7%

- Growth has slowed

- Labour market has eased but remains very tight

- Job vacancies and advertisements are still at very high levels

- Wages growth is still consistent with the inflation target, provided that productivity growth picks up

- The path to achieving a soft landing remains a narrow one

- Higher interest rates and cost-of-living pressures is leading to a substantial slowing in household spending

- Some further tightening of monetary policy may be required

The RBA decided to pull the trigger once more, and hiked their cash rate by another 25bp to a 13-year high of 4.1%. Once again, cash rate futures and the majority of economists seemed to underestimate the potential for a hike, although were arguable caught less off guard than they were in May.

If Mays decision to hike was ‘finely balanced’, then today’s hike should have been a no-brainer given their monthly inflation gauge ripped higher and around a quarter of Australia’s workforce is about to receive a bumper pay rise. And with inflation now back at 6.8% y/y, we’re sure some ‘further tightening’ will indeed be required, as mentioned in today’s statement.

I doubt this will force the BOC to hike this week, although their economic data is also heating up to potentially justify one further down the track. But with the Fed in pause mode and possible at or near their terminal rate, AUD/USD could appear oversold to many. And we’ve already seen buyers pile in to the Australian dollar and push AUD/USD a 3-week high and send AUD/JPY briefly to a fresh YTD high.

The hike has seen the ASX 200 unwind all of yesterday’s gains to fall back below 7200, as equity investors come around to the reality that the peak rate may not be as close as originally hoped (and cuts are even further back into the future).

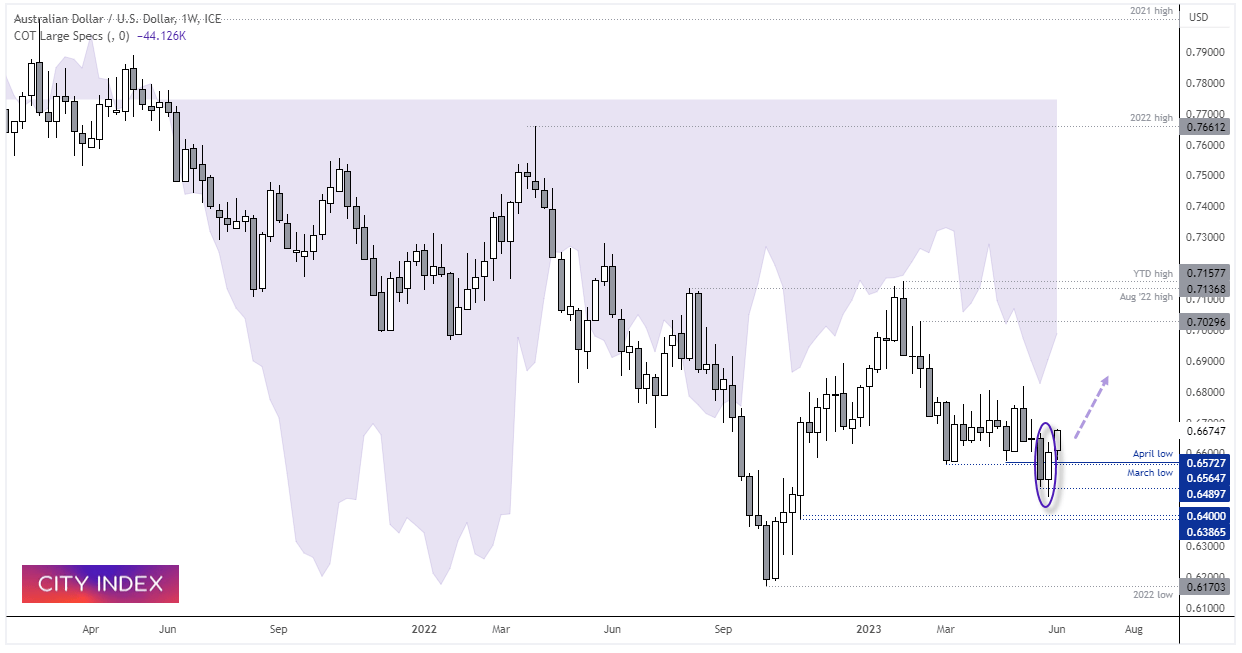

AUD/USD weekly chart:

If we compare price action on the weekly chart to positioning of large speculators since they reverted to net-short exposure, it could be argued that prices are lower than they should be. And that could be due to expectations that the RBA were done with hiking and could begin cutting rates sooner than some other central banks. But the RBA seem to have run with a ‘last in, last out’ approach to their monetary policy which leaves them susceptible to hiking later relative to the early birds who hiked sooner.

As for price action, the decline from the YTD high has come in third waves. Whilst it is too soon to confirm if a corrective low has been seen, a two-bar bullish reversal pattern formed (a bullish piercing line) to suggest a swing low may have formed over the near term.

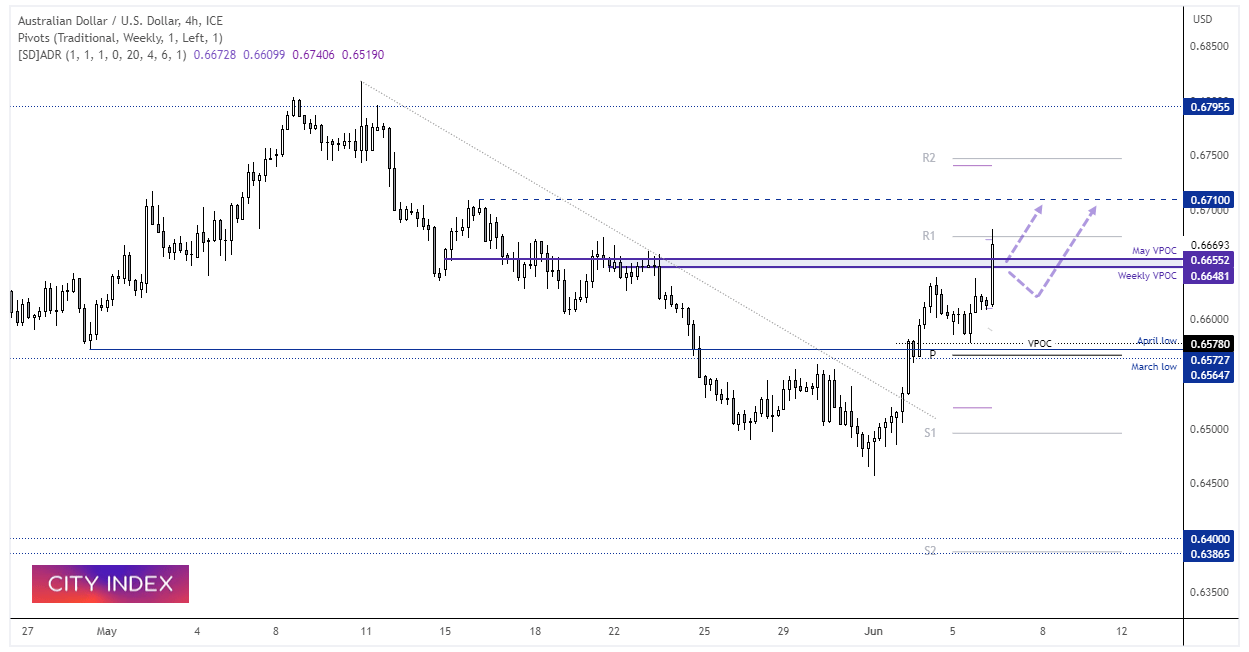

AUD/USD daily

AUD/USD spiked higher following the rate increase, rising almost immediately to the upper target outlined in this morning reports around the daily R1 pivot and upper average daily range band. Given prices have failed to push higher, I suspect a pullback cold be due.

The VPOC cluster around 0.6550 is the first area I would look for potential support, as it could allow bulls a cheeky swing trade as we head towards / beyond the European open (as those traders are yet to react to the RBA’s decision). But with price action around London’s open being notoriously fickle, we’d also consider bullish setups within today’s daily range should it produce a deeper pullback.

But overall, a strong bullish trend is now developing on the daily chart, and it could favour dips given the RBA’s hawkish hike.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade