We find volatility on the low side so far in today’s Asian session, as debt ceiling talks resume in Washington and the world waits with bated breath. There’s a reasonable chance this could drag on, and the longer it does the more nervous investors are likely to become as we head towards a potential US default. But positive headlines for negotiations have generally been supportive of the US dollar and indices whilst weighing on safe-havens such as gold and the yen, so these are potential moves to look out for if we’re treated to an early agreement.

NZD/USD is consolidating above its 200-day EMA ahead of tomorrow’s RBNZ meeting, where the potential for a hawkish 25bp is on the cards thanks to the government’s inflationary budget. That also leaves room for AUD/USD to move towards 0.6700 having rebounded from just above 0.6600, assuming the US dollar allows.

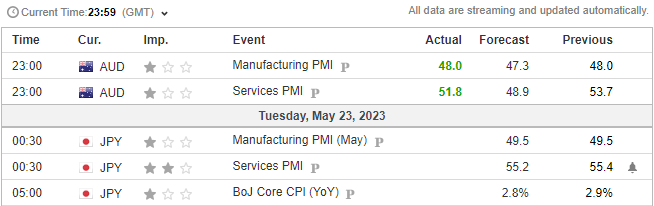

On the data front, Mixed PMIs for Australia saw little reaction form the Australian dollar which was released just as debt ceiling talks between Biden and McCarthy resumed in Washington. Flash manufacturing PMI contracted at a slower pace than expected at 48 (47.3 forecast, up from 48 prior) and services expanded at a slower pace than previously at 51.8 (53.7 prior) but above the forecasted contraction of 48.9.

Up shortly we have manufacturing and services PMIs for Japan, with the BOJ’s core CPI print later in the session. Attention will then shift to flash PMI data for Europe in the European session.

The RBNZ announce their monetary policy decision on Wednesday

The RBNZ (Reserve Bank of New Zealand) are expected to hike by another 25bp tomorrow, despite 1 and 2-year inflation expectations plummeting at their fastest pace since the pandemic. Whilst the RBNZ’s quarterly survey sparked hopes that they could potentially pause after a series of 50bp hikes, the government’s latest budget threw an inflationary spanner in the works. High levels of spending will likely be factored into the RBZ’s updated forecasts which are also set to be released tomorrow, and that leaves the potential for a hawkish 25bp hike.

Their OCR (overnight cash rate) currently sits at 5.25% following 11 consecutive hikes, and their February economic forecasts pencilled the terminal rate of around 5.5% by Q4. That leaves a decent chance of the terminal rate being upgraded to 6% for a couple of other hikes this year. Traders would also be wise to listen to Governor Orr's press subsequent press conference, given he has a tendency to not mince his words.

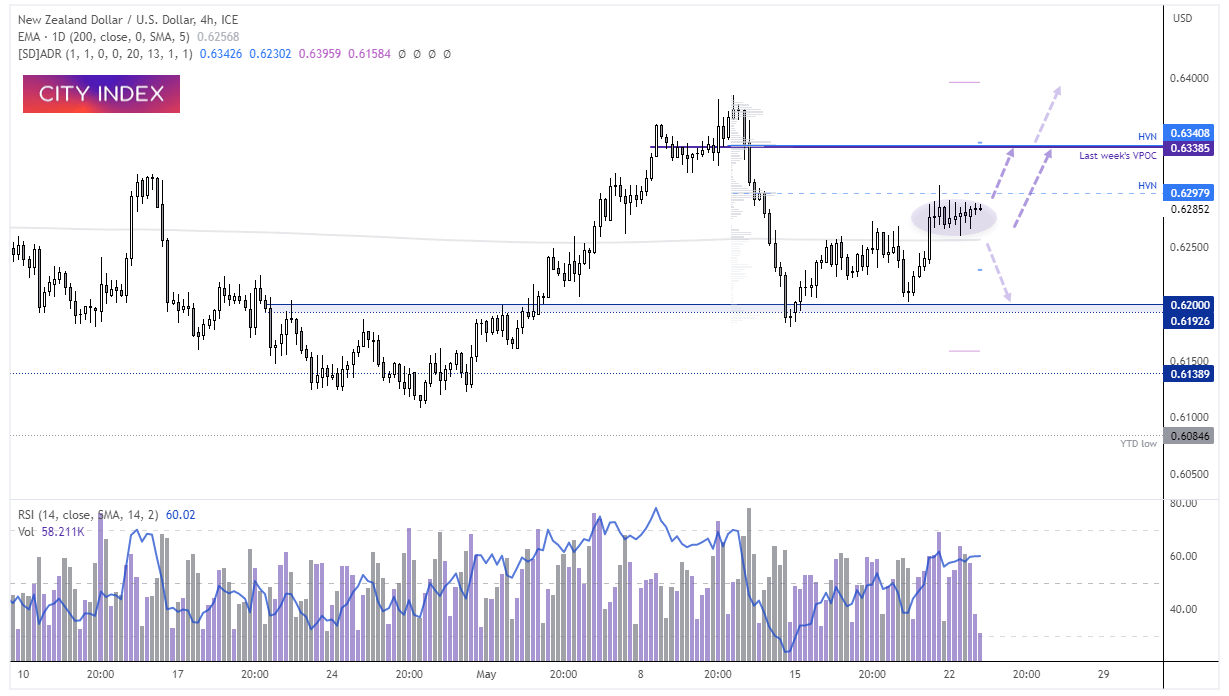

NZD/USD 4-hour chart

The 4-hour chart shows prices are recovering from last week’s selloff. Whilst the current move higher may simply be a correction against that move before losses resume, we see the potential for another pop higher leading into tomorrow’s RBNZ meeting.

Prices are consolidating above the 200-day EMA having formed a higher high and higher low. The consolidation retested a HVN (high volume node), and the bias is for NZD/USD to continue higher to retest last week’s VPOC (volume point of control) around 0.6340. Take note this is also near the monthly R1 pivot and upper range of the 20-day ADR (average daily range). The average weekly range upside target is between last week’s high and 0.6400.

Whether it could continue higher still could be down to how hawkish tomorrow’s meeting is. Yet if debt ceiling talks are to stall and weigh o the US dollar, perhaps it could happen sooner than later. Yet if talks go surprisingly well, the US dollar could surge and send NZD/USD sharply lower.

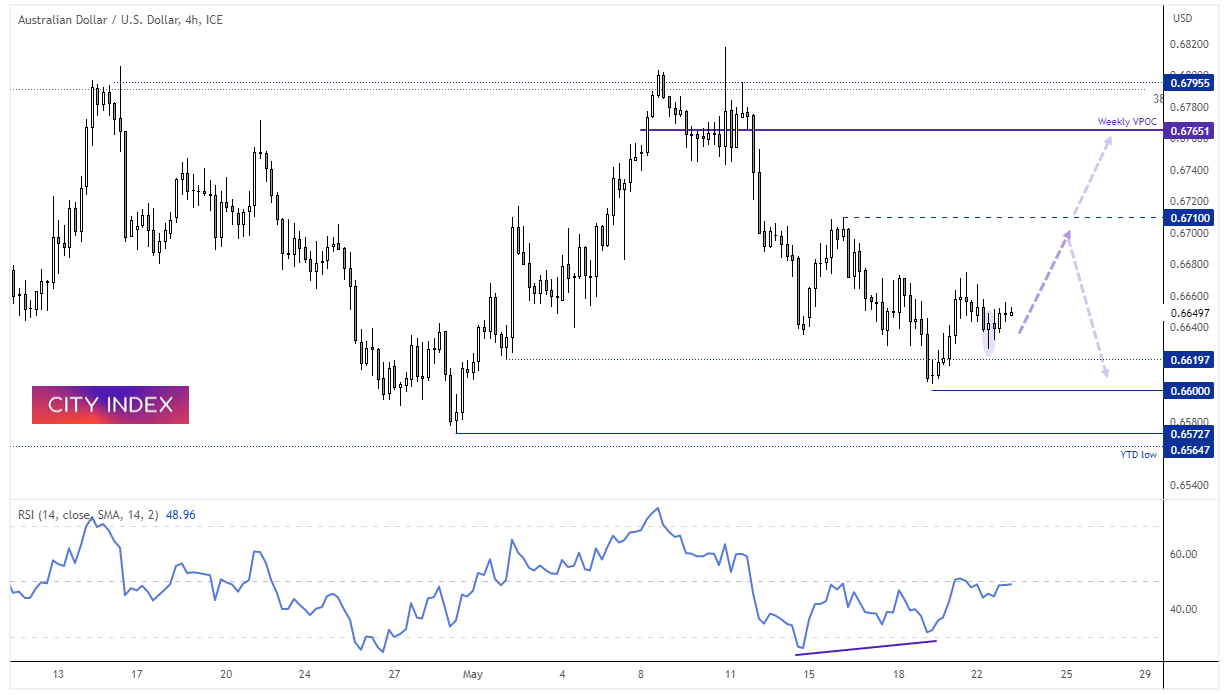

AUD/USD 4-hour chart:

We also see the potential for a pop higher on AUD/USD, assuming talks in Washington drag on. AUD/USD has spent the most part of the past three months confined within a ~200-pip range, and bearish momentum is waning as prices moved towards the lower bounds of the range. The decline also stalled just above 0.6600 before posting a recovery and subsequent pullback (with a potential higher low). A bullish RSI divergence also formed ahead of the rally, so we suspect a move higher towards the 0.6700 highs could be on the cards.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade