Key takeaways

- It’s a close call as to whether the RBA will hike or pause tomorrow

- Economists favour a pause, traders estimate it to be more of a 50/50

- Personally, I favour a 60/40 in favour of a hike

- Whatever happens, we can scrap any expectations of a dovish undertone

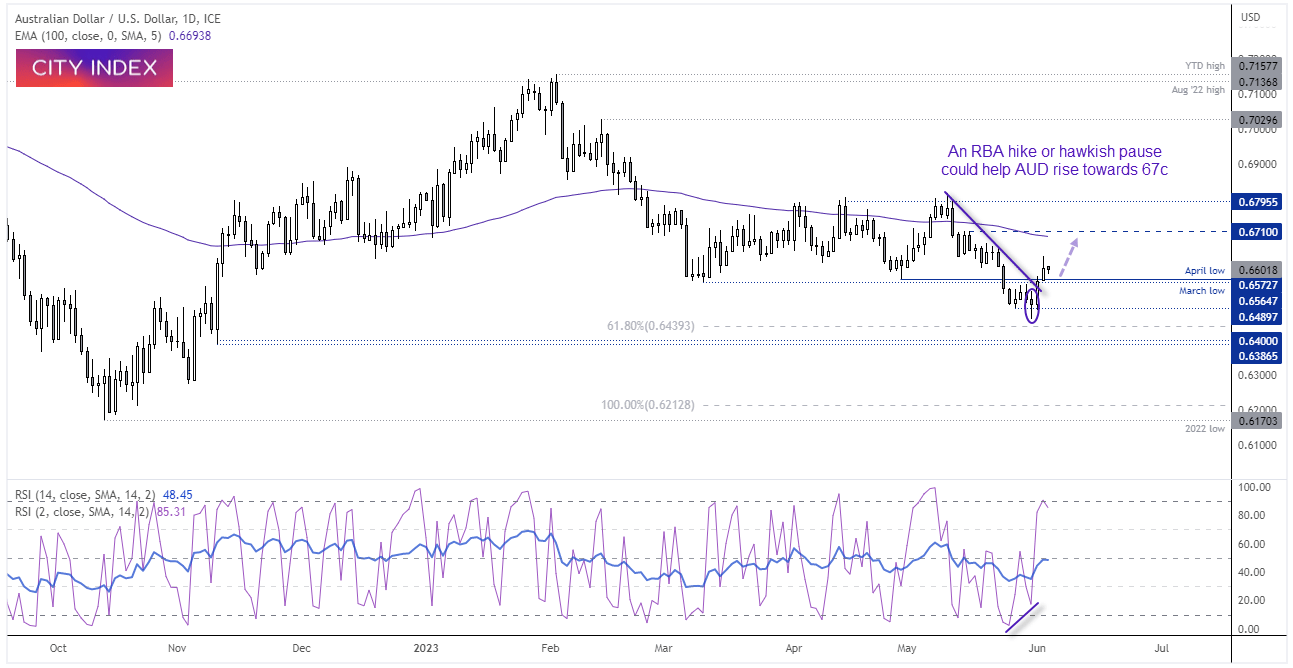

- Positive sentiment has helped AUD/USD rally from its YTD low set last week

- A hike or hawkish pause could further support AUD/USD

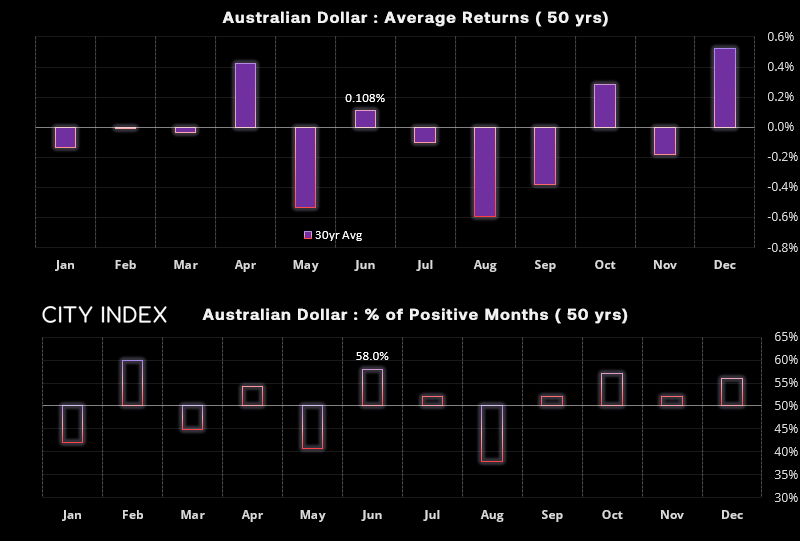

- Seasonality of the past 50 years slightly favours gains for the month of June

This time last week, markets had effectively priced out any expectation for the RBA to hike in June. But what a difference a week can make. One hot inflation report and minimum wage increase later, economists and investors are seriously contemplating the potential for the RBA to hike for a twelfth time this cycle. It has also seen some backs upwardly revise forecasts for a higher terminal rate, with Credit Suisse forecasting 75bp of hikes by September to take rates to 4.6%. Sure, they may be the outlier amongst the hawkish forecasters, but the fact it is happening at all means something.

With one measure of annual inflation now at 6.8% compared with 6.4% expected, it certainly leaves room for a hawkish pause at the very least (if not a hike tomorrow. Australia’s fair work commission announced an 8.6% minimum wage increase on Friday, which should boost pay for up to a quarter of Australia’s work force. Whilst this softens the blow for higher costs for lower-income earners, concerns have also arisen that it provides inflationary forces that will be unwelcomed by the RBA.

- According to a Bloomberg survey, a third of economists expect the RBA to hike rate by 25bp to 4.1% whilst traders see it more of a 50/50 change

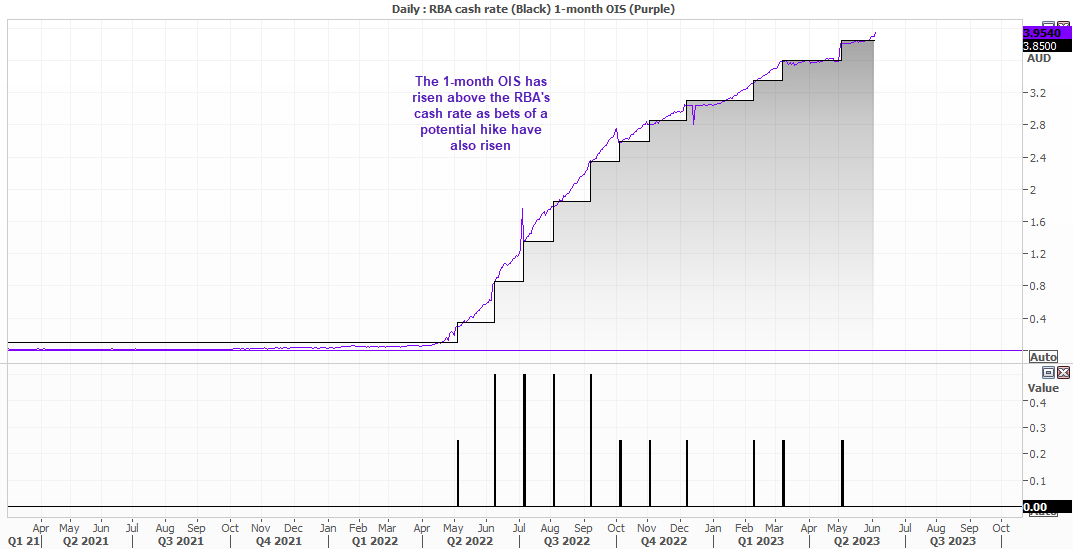

- The 1-month OIS (overnight index swap) is now above the cash rate and implies a 33% chance of a 25-bp hike

- The RBA cash rate futures implied a 37% chance of a hike (or 63% chance of a pause) by Friday’s close

Comments from RBA governor Philip Lowe have also leaned towards the hawkish side in recent weeks as he flagged upside risks to inflation and employment costs. The RBA also surprised with a 25bp hike in May despite the RBA’s cash rate futures implying a 100% probability of a hold. SO in a nutshell, this could be a close call as to whether they hike or not, and we can scrap any inkling of dovish commentary in their statement tomorrow. Governor Lowe and Deputy Governor Bullock also speak on Wednesday morning, which provides an opportunity for them to sway market expectations if their statement does not deliver a clear message.

June tends to be a bullish month for AUD/USD

On a side note, AUD/USD has averaged positive returns in the month of June over the past 50 years. They’re quite modest at 0.1%, although it has posted gains 58% of the time over this period. If the RBA deliver a hawkish hike and the Fed pause as expected, it could help AUD/USD climb further from its fresh YTD low printed last week. And with China having just delivered a strong services PMI report, it could keep the pressure on the RBA with improved global growth prospects and concerns of elevated services inflation.

AUD/USD daily chart:

On Friday we noted the potential for the AUD/USD to have printed a swing low on Wednesday, and so far it appears to be the case. A false break of 0.6489 support took the Aussie briefly to a fresh YTD low, only for prices to recover later in the session and form a Spinning top Doji on the daily chart, back above the prior swing low. Thursday’s bullish candle closed above trend resistance and hinted at a break above the April and May highs, with Friday’s risk-on tone helping it to break back within its prior range. We now see the potential for it to head for 0.6700, especially if the RBA delivered a hike or hawkish pause tomorrow.

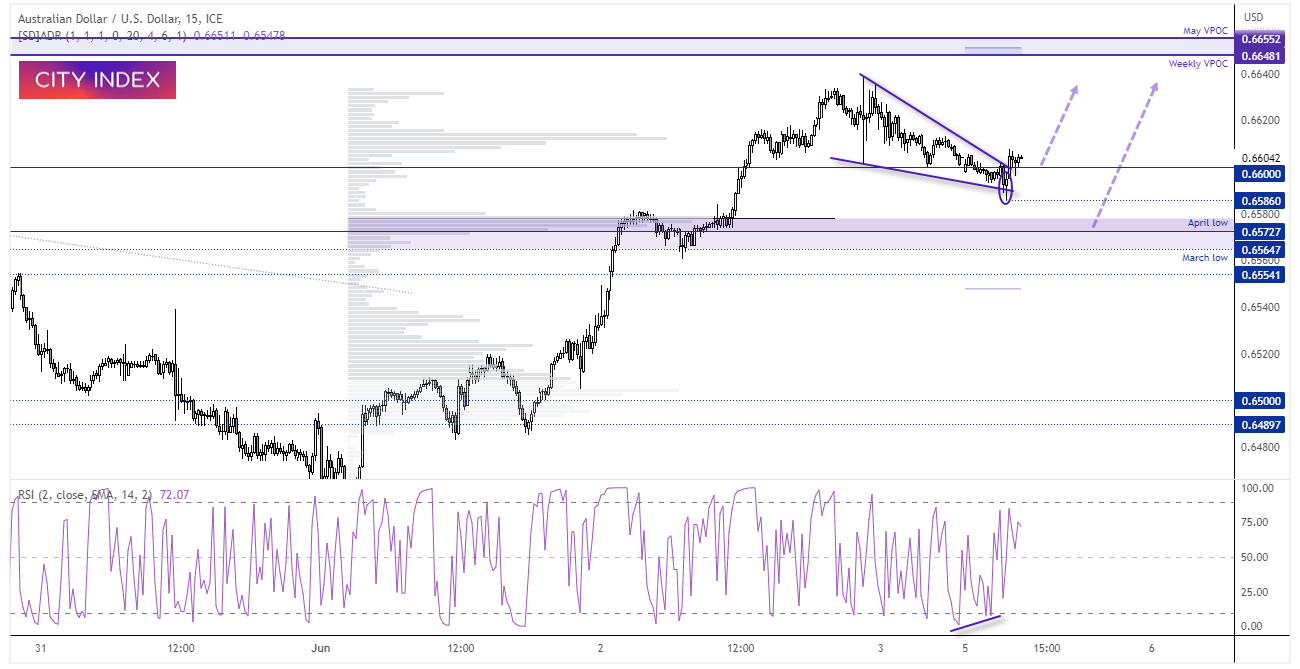

AUD/USD 1-hour chart:

A strong trend has developed on the AUD/USD 1-hour chart, although prices have pulled back from Friday’s highs thanks to a strong NFP report. Prices are meandering around 66c, although there’s also the potential for a falling wedge pattern which can sometimes produce a bullish reversal pattern, and projects an estimated target back near the highs. A bullish divergence is forming on the RSI(2) which also suggest a swing ow may have formed (or one has formed already).

In the event that prices recycle lower, we’d look for bulls to defend the 0.6560 – 0.6573 zone as this is where the March and April lows reside, and it also markets the heaviest number of trades during the bullish rally on this timeframe.

Of course, what could help if is the RBA either deliver a hike or a hawkish pause tomorrow. But given China has produced some strong services PMI data, perhaps we’ll see another attempt for it to rise ahead of the RBA meeting.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade