The AUD/USD has stabilized recently having tumbled to fresh lows, brushing aside Chinese economic concerns and growing expectations the RBA tightening cycle is over as traders move to the sidelines ahead of Jerome Powell’s speech on Friday.

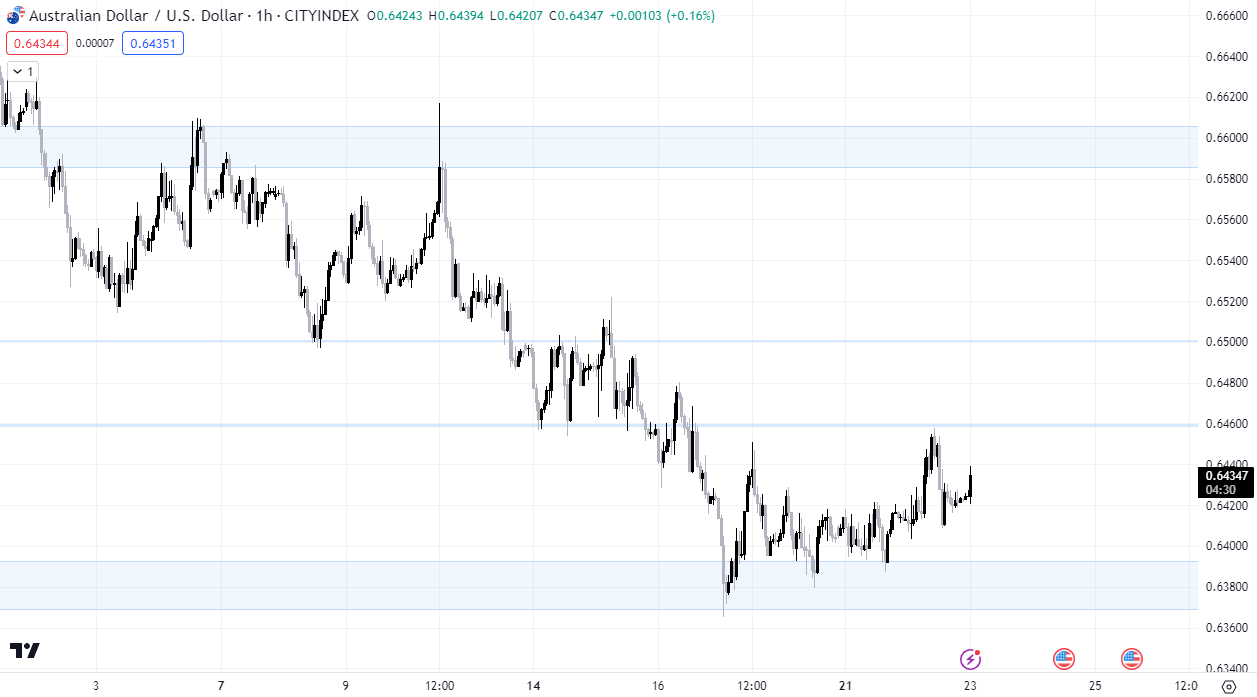

As things stand, the pair currently sits near the bottom of the range it’s been trading in during August, finding support on probes below .6400 while being capped on attempts to push towards .6600. The question now is which direction does the AUD/USD break next? Downside or topside.

Extreme pessimism is priced into the AUD

Assessing sentiment alone, it’s surprising the Aussie isn’t through 60 cents on its way to the pandemic lows. Everyone seems bearish – I even saw a media article recently suggesting the ‘battler’ could spiral to 40 cents. While anything is possible, including that bold call, experience tells me when you see headlines like that, we’re close to peak pessimism near-term.

One thing many Aussie dollar bears are also overlooking is increasing market intervention from Chinese policymakers, as witnessed in the continued defense of Chinese yuan over the past week. Sudden bursts of buying have also been witnessed in mainland equities, along with in Hong Kong. Iron ore and metallurgical coal futures are also ripping higher, suggesting something larger may be brewing when it comes to large-scale industrial sector stimulus measures. That’s all AUD supportive.

USD bulls are plentiful

In contrast, the USD side of the AUD/USD equation is congested with bulls who have been flocking to the buck, not only because of its safe haven attributes but also a growing belief the Fed may be forced to continue hiking rates to prevent a reacceleration in inflationary pressures, in part to counteract ballooning fiscal deficits. US bond yields have soared, widening the USD’s yield advantage over other currencies, soaking up capital like a sponge.

But bonds have moved a long way fast, likely reflecting stop-loss selling by weak hands and a growing belief Jerome Powell may use his Jackson Hole speech to discuss how structural changes in the US and global economy may mean the neutral rate for US interest rates is higher than the past, implying the next easing cycle may be shallower than those seen previously.

But that speculation has been circulating for a while, suggesting it’s already in the price. So too is the recognition we’re unlikely to get a repeat of the eight-minute wrecking ball Powell delivered to markets last year, but rather a continuation of recent messaging that it’s too early to declare victory on inflation. He’ll most likely say future policy decisions will be data dependent, keeping speculation of at least one more rate hike alive.

Fuel for a near-term reversal risk?

Pulling it together, sentiment appears almost universally bearish towards the Aussie and similarly bullish on the greenback. The latter looks priced for perfection, the former something akin to Armageddon. You don’t have to be Einstein to understand that even a slither of new information to the contrary could spark a savage near-term reversal.

An attempted AUD/USD rebound stopped dead at .6460 overnight, running into sellers at previous support. Should that level go, it may open the door to a move towards the top of the August range that straddles either side of .6600. Conversely, should the bearish trend resume, a break of the year-to-date lows set last week opens the door for a possible move back below .6200.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade