Australians are none the wiser as to what’s happening in the domestic labour market with another volatile jobs report creating more questions than answers. AUD/USD is largely unmoved, leaving offshore factors to remain in the driving seat.

Australian unemployment up, hiring down

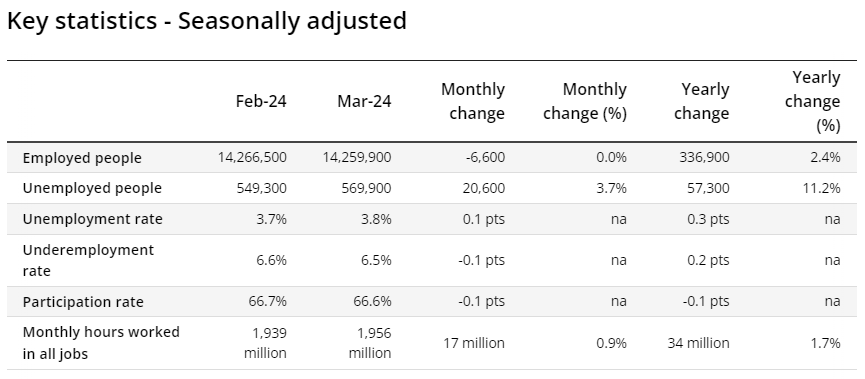

Australia’s unemployment rate ticked higher in March, lifting a tenth of a percent to 3.8%, below the 3.9% level expected. Employment fell by 6,600, although the full-time workforce grew by 27,900. Markets were looking for employment to increase by 10,000.

Keeping a lid on unemployment, labour force participation – which measures the percentage of the civilian working age population either employed or looking for work – declined a tenth of a percent to 66.6%. Markets were looking for it to remain steady at 66.7%,

Underemployment and underultilsation – broader measures of excess capacity in the labour market – stood at 6.5% and 10.3% respectively.

Underemployment measures the percentage of the employed workforce who would like to work more hours but can’t, be it involuntarily or voluntarily. Combined with unemployment, that provides the underutilisation rate which is tracked closely given it has a decent inverse relationship with wage pressures.

Source: ABS

Jobs report difficult to interpret, including for RBA

Australian markets took one look at the messy detail and thought ‘too hard basket’, largely ignoring the detail. Not only were the movements relatively minor but the seasonally adjusted data series has become incredibly volatile recently, making interpretation difficult from month to month.

Rather than the jobs report, AUD/USD and ASX 200 look set to track risk sentiment and Chinese markets over the remainder of the week, the latter especially so given what we’ve seen in recent days where swings in Chinese equities have been mirrored by Australia markets.

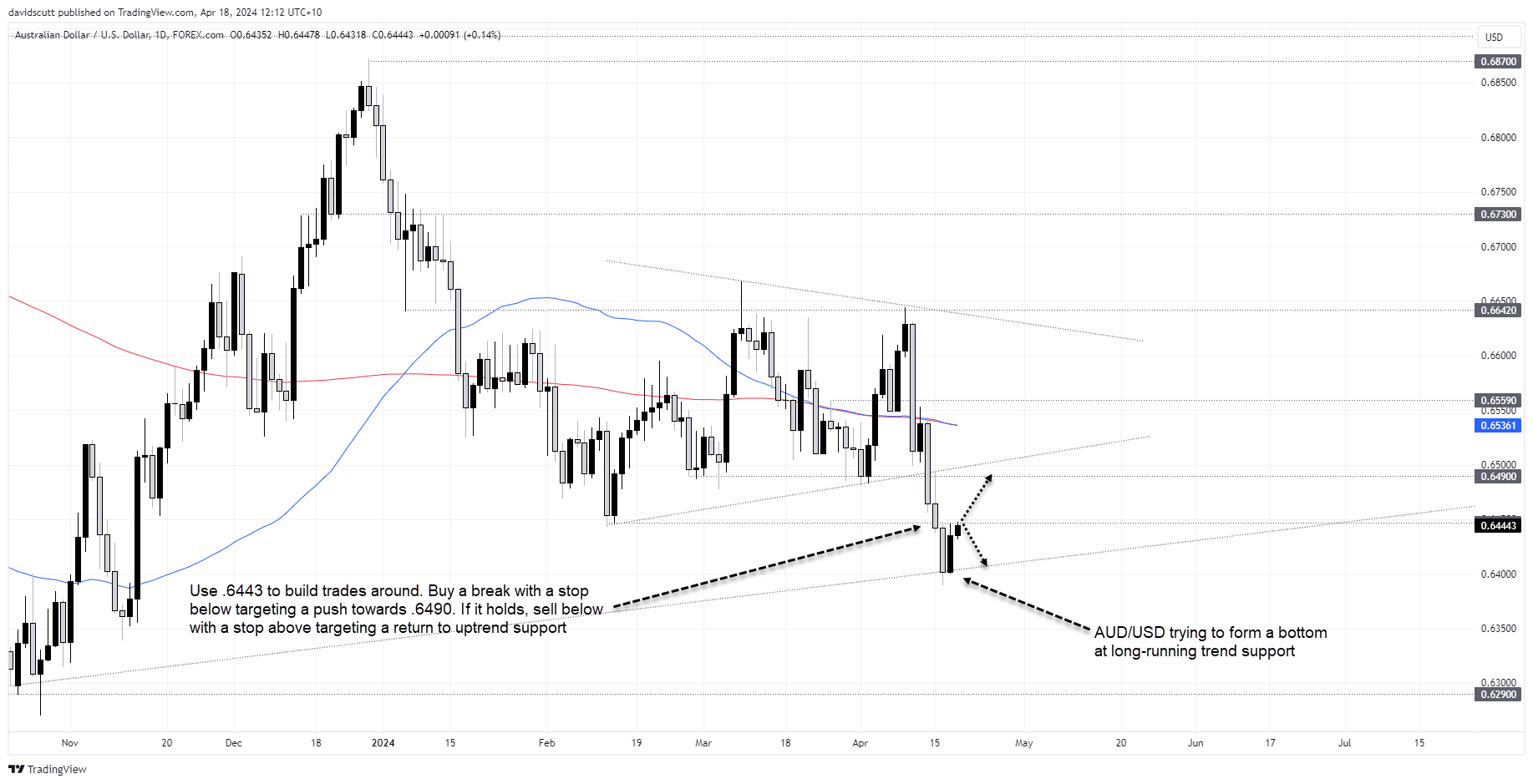

AUD/USD attracting bids at key support

AUD/USD has been very respectful of existing levels this week, bouncing twice off long-running trend support dating back to the start of the pandemic before stalling twice at .6443, former horizontal support that was also the prior 2024 low. Those are the two key levels for traders to watch near-term.

A break of .6443 opens the door to a push towards .6490, allowing for traders to buy the break with a stop below the level for protection.

Should .6443 hold, the trade can be flipped around, with shorts initiated below the level with a stop above for protection. The initial target would be the uptrend located just above .6400. Below, bids may be found below .6350 before more meaningful support is found from .6290.

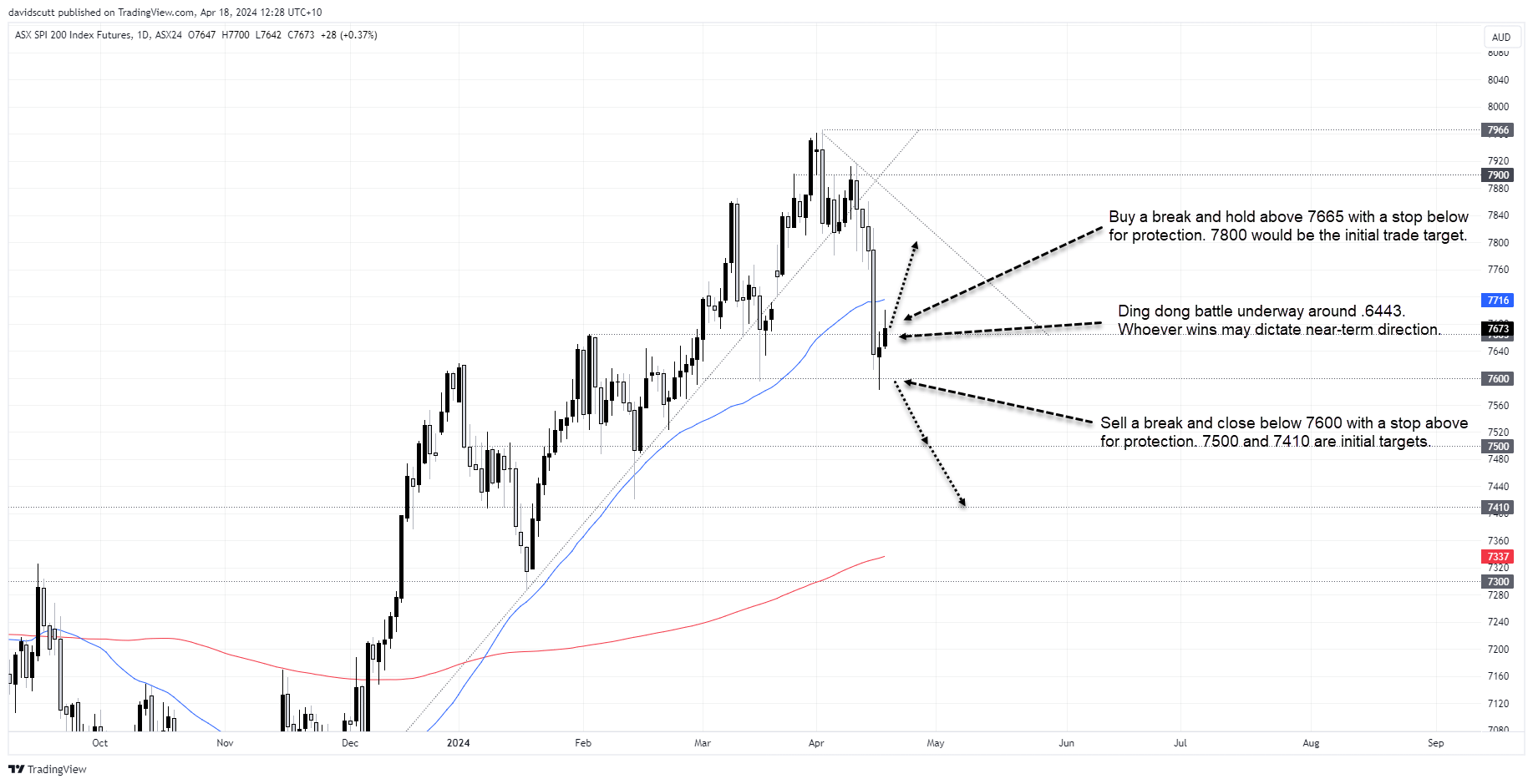

Bears and bulls battling for ASX 200 supremacy

As for ASX 200 futures, a ding-dong battle between bulls and bears is underway around 7665 after the break of long-running uptrend support last week. The dip below was 7600 was hoovered up fast, as has been the case previously when the market ventured below this level. However, having burst higher early in Thursday’s session, futures have been knocked back lower, indicating plenty of traders are willing to sell rallies too, not just buy dips.

I get the sense that whoever wins the battle here may dictate trajectory looking ahead. Buy a close above .7665 and sell a break and close below 7600, whichever arrives first. Just make sure you place stop loss orders on the opposite side to entry for protection against reversal.

On the topside, 7800 is one target, the former record high another. On the downside, 7500 and 7410 are two potential targets for shorts.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade