AUD monthly wrap: November’s performance and highlights

A large part of the bullish bias for November was that traders had recently reached a record high level of net-short exposure, yet AUD/USD was refusing to break below 63c. We’re now seeing large speculators and managed funds increase short exposure and trim longs after it rallied as much as 5% in November. Given the Aussie stalled around trend resistance this week, we suspect a retracement could be in the cards ahead of the rally into the back of the month (assuming US equity markets enjoy their usual Santa’s rally from mid December).

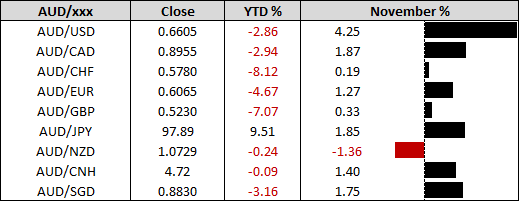

- AUD/USD was the strongest performer among the Aussie pairs we track in November

- A combination of hawkish RBA minutes and comments from members, alongside bets of Fed cuts in 2024 a risk-on tone for the month and played nicely with out long bias

- However, AUD was outperformed by NZD after the RBNZ’s statement hinted at further tightening, even though they held rates at 5.5% as expected

Monetary policy and economic data

- RBA governor Michelle Bullock made plenty of hawkish remarks following the release of the RBA’s hawkish minutes

- The RBA announced that they have hired BOE veteran Andrew Hauser to become the RBA’s deputy governor, making him the first appointee from outside the central bank

- His 30-years at BOE and as position as director for markets may prove useful for the RBA, particularly when it comes to fresh thinking and helping with comms

- While retail sales contracted -0.2% in October, it didn’t capture Black Friday sales and it is likely that consumers were waiting for the sales to arrive

- With inflation data coming in softer than expected, it seems unlikely that the RBA will hike on December 5th – even though the RBA are likely to maintain a hawkish bias

What to look out for in December

- Business Indicators (Quarterly estimates of private sector sales, wages, profits and inventories) – 4th December

- Household and business lending – 4th December

- RBA monetary policy meeting – 5th December

- Monthly household spending – 5th December

- Quarterly and annual GDP – 6th December

- Trade balance – 7th December

- Business turnover – 9th December

- Employee earnings – 13th December

- Labour force report - 14th December

RBA meeting: Bullock’s first two meetings as governor saw markets interpret the RBA’s statement as slightly dovish, only to see the minutes released later perceived as more hawkish. With Andrew Hauser joining the team for the December 5th decision, we’re looking out for any material changes to the tone of the statement to see if we head into 2024 with a hawkish bias.

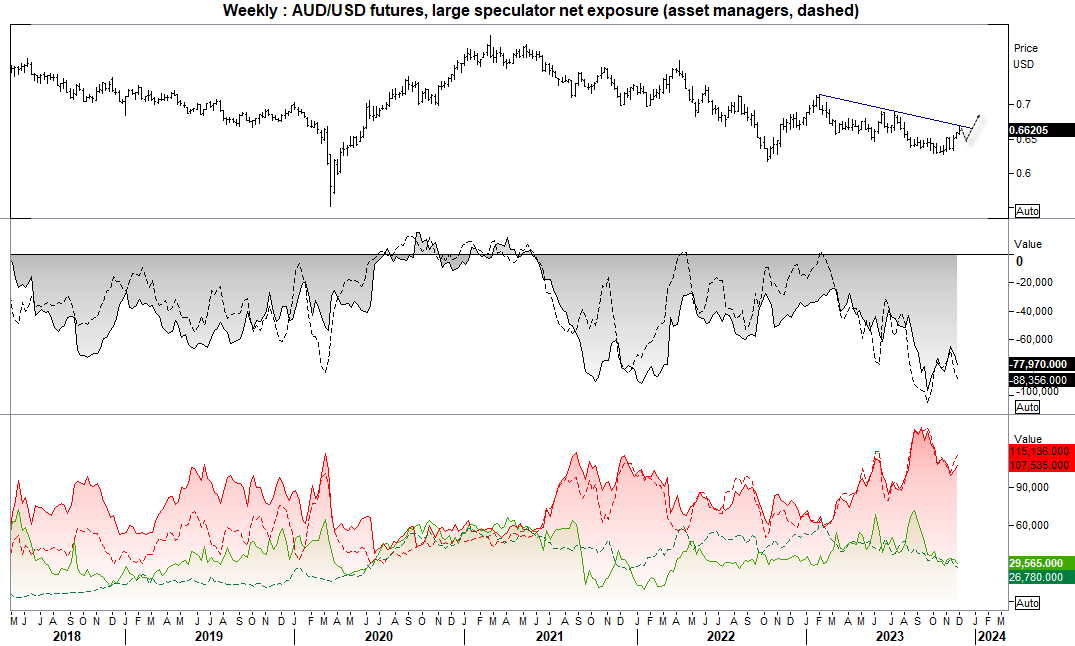

AUD/USD futures: Market positioning from the COT report

A large part of the bullish bias for November was that traders had recently reached a record high level of net-short exposure, yet AUD/USD was refusing to break below 63c. We’re now seeing large speculators and managed funds increase short exposure and trim longs after it rallied as much as 5% in November. Given the Aussie stalled around trend resistance this week, we suspect a retracement could be in the cards ahead of the rally into the back of the month (assuming US equity markets enjoy their usual Santa’s rally from mid December).

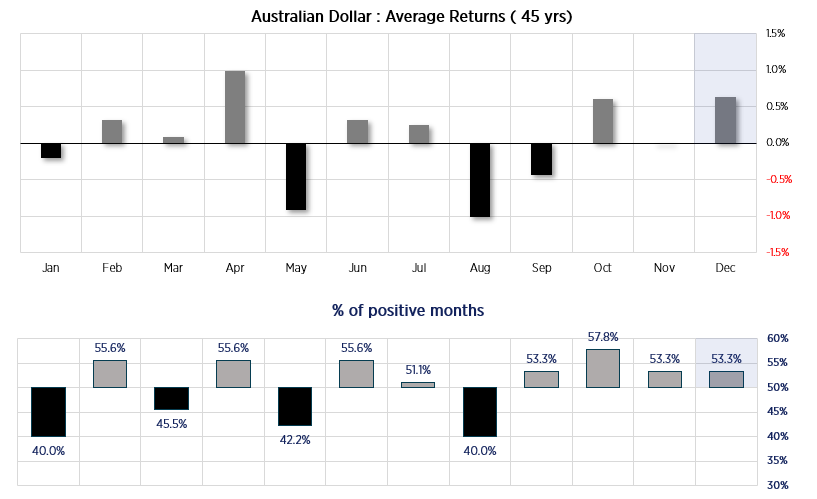

AUD/USD seasonality

December has average positive returns of 0.6% in December over the past 45 years, and has risen 53.3% of the time over this period. This is in line with gold’s bullish and the US dollar’s bearish seasonality patterns. Moreover, AUD has also posted gains the past 5 or 6 years in December, and has both a positive win rate and average positive returns over the past 30, 15, 10 and 5 years.

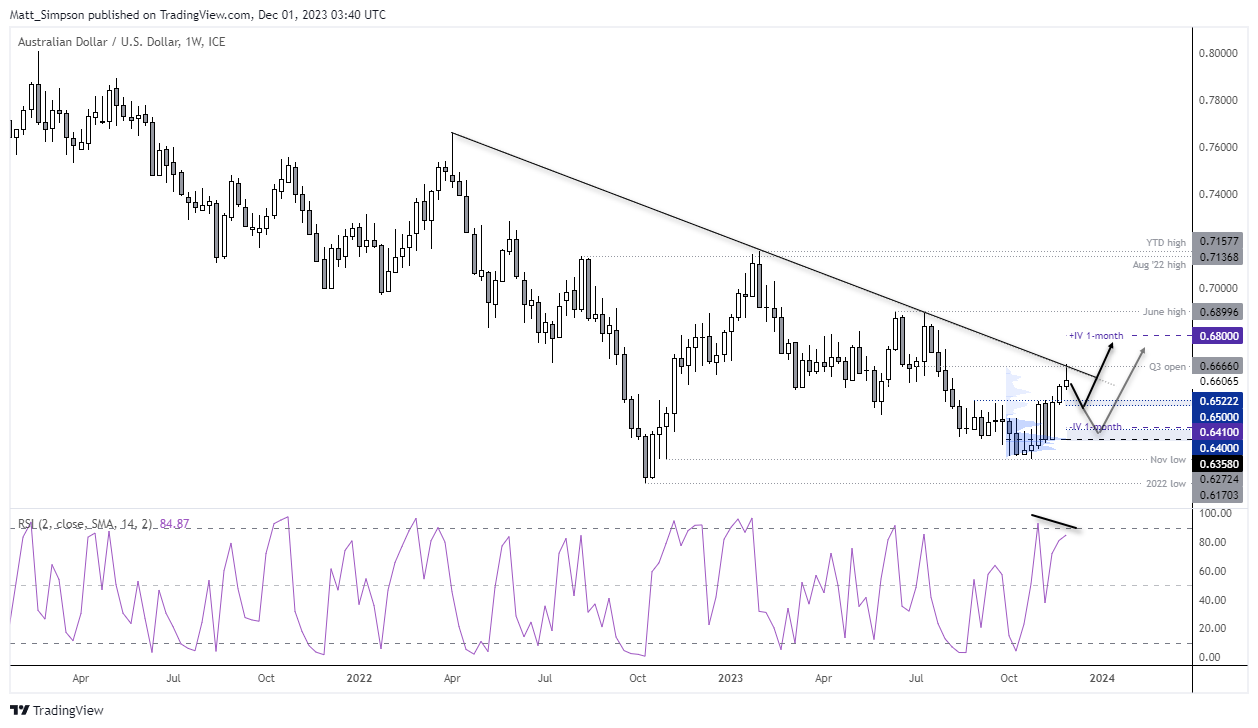

AUD/USD technical analysis (weekly chart):

The week is yet to fully close, but AUD/USD is on track to form a bearish hammer if it closes around current levels. The fact it has occurred near trend resistance and the Q3 open price alongside a bearish divergence on RSI (2) play into the bias of a retracement form current levels.

The volume profile for November shows that much of the buying activity occurred around 64c, so I suspect the closer AUD move towards the level the more it may be defended by bulls. Also note the potential support zone around 65c, so the plan is to seek evidence of a swing low on the daily timeframe around 64 – 65c in anticipation of pf a break above 0.6670 and trend continuation towards 0.6800 (which is near the 1-month upper implied volatility band).

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade