Having been driven by rate differentials for much of the past three years, AUD/JPY is evolving into an effective way to express a view towards China’s outlook that does not involve the US dollar. Sitting in a strong uptrend, and with sentiment towards China pessimistic, the path of least resistance appears to be higher, especially should we see even a modest improvement in activity in the world’s second-largest economy in the months ahead.

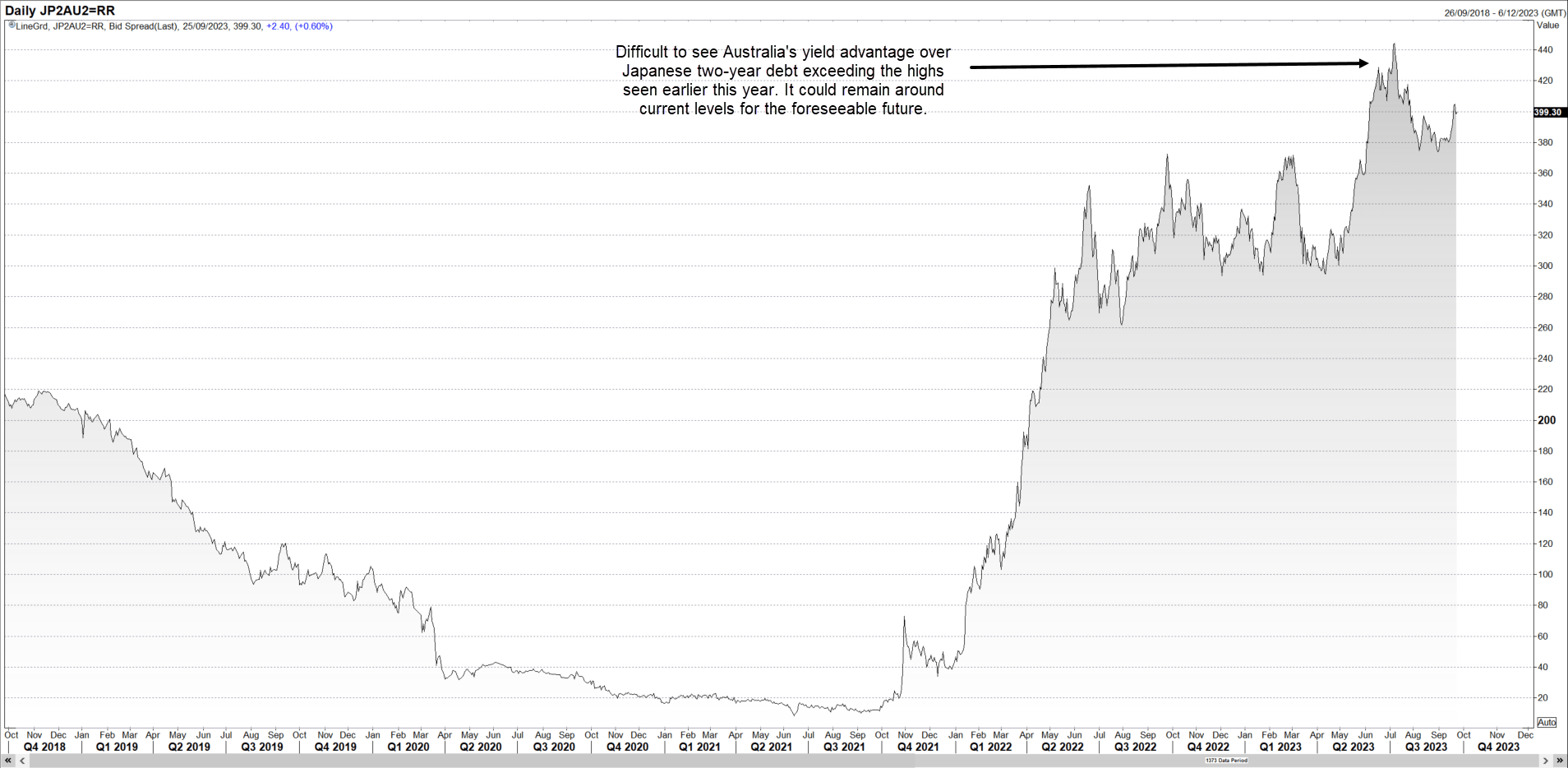

Australia’s yield advantage over Japan has likely peaked

AUD/JPY has been in an uptrend since bottoming in 2020 at the height of the pandemic panic, coinciding with Australia’s yield advantage over Japanese debt for a two-year tenor blowing out from less than 20 basis points to around 450 basis points earlier this year, as shown in the chart below.

Source: Refinitiv

While it’s been a dramatic move, it’s difficult to see yield differentials deviating too far from present levels given the Reserve Bank of Australia (RBA) and Bank of Japan (BOJ) look set to remain sidelined on the monetary policy outlook for foreseeable future.

The BOJ left little doubt last week that speculation over an abrupt end to yield curve control and negative interest rates as soon as early next year was very premature, reinforcing the view it will continue to persist with ultra-easy policy settings.

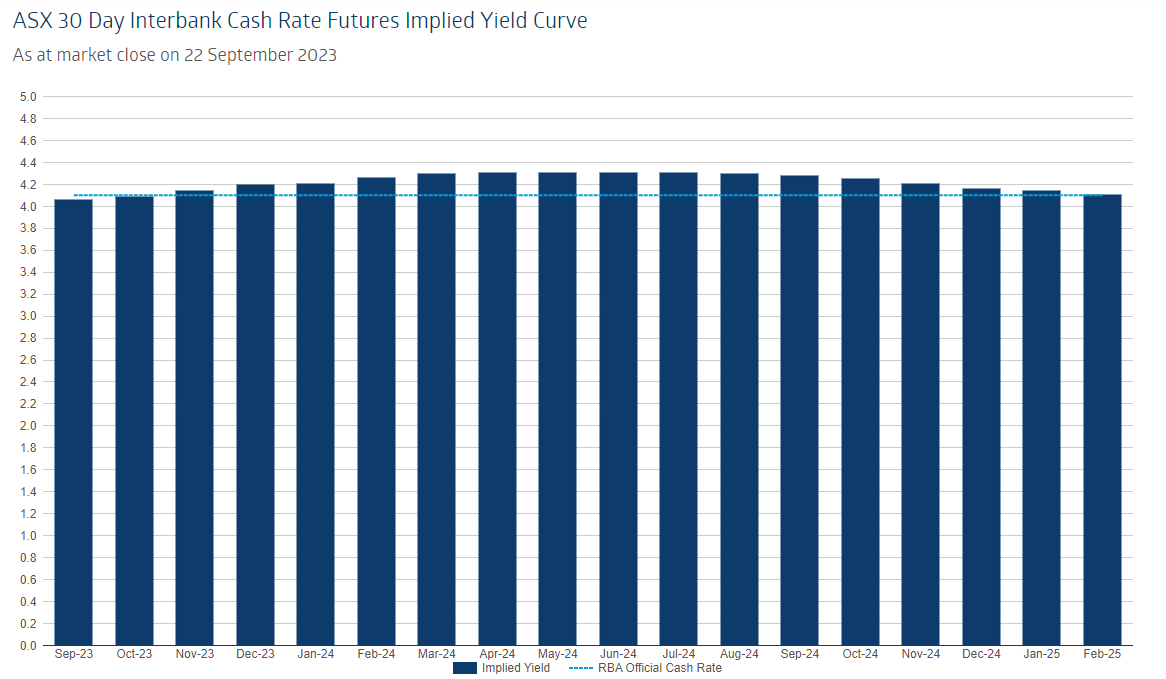

While cash rate futures and Australian overnight index swaps are flirting with the idea of another 25 basis point rate hike from the RBA next year, there appears to be no near-term risk of any shifts as new Governor Michele Bullock settles in. The RBA’s smaller tightening cycle relative to other central banks also points to the next easing cycle being potentially shallower than those of the past.

As show in the chart below from the Australian Securities Exchange (ASX), the RBA cash rate expected to sit at 4.1% by early 2025, the same level it is today.

Source: ASX

China sentiment new driver of AUD/JPY?

It points to an outlook where something other than monetary policy may prove to be the main driver on movements in AUD/JPY. As a well-known proxy for expressing an investment towards China, that could well be it moving forward.

As pointed out by my college Matt Simpson, the latest Commitment of Traders report from the US CFTC revealed short interest in the Australian dollar against the US dollar has risen to record levels, underlining just how much pessimism is baked into AUD/USD thanks primarily to China’s spluttering economic performance. But with stretched bearish positioning and no real progress on the downside recently, there’s a clear risk we may see some form of reversal should sentiment towards China improve even modestly.

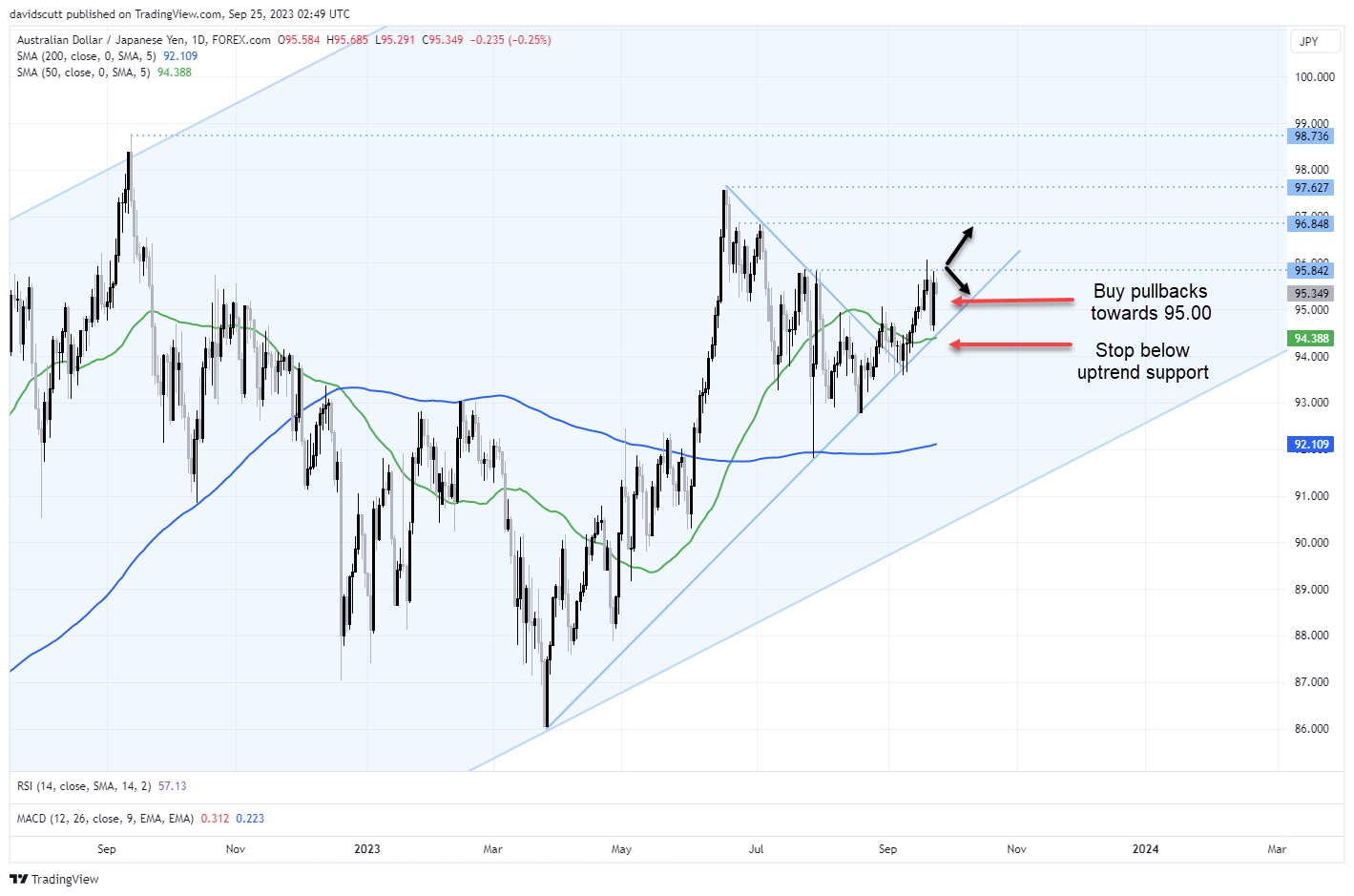

But not everyone wants to express a view on China that involves the US dollar, hence why AUD/JPY may be more appealing to some traders. Looking at the daily chart, the pair sits in an uptrend within a larger uptrend. As a trade idea to play a modest improvement in sentiment towards China, pullbacks towards 95.00 provide a decent entry level given how solid support has been, allowing for a tight stop to be placed under to protect against a potential trend reversal. The first upside target would be around 95.85, a level the pair has tried unsuccessfully to break on several occasions over recent month. Given the prevailing trend, a topside break may open the door to a move towards 96.85, 97.60 and then again to 98.75, the high set in September 2022 when China reopening optimism was getting into full swing.

As for the threat posed by intervention in FX markets by the Bank of Japan to support the JPY, I expect the bar is extremely high in the absence of a sharp move higher in USD/JPY.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade