Asian Futures:

- Australia's ASX 200 futures are up 46 points (0.63%), the cash market is currently estimated to open at 7,357.70

- Japan's Nikkei 225 futures are up 240 points (0.84%), the cash market is currently estimated to open at 28,790.93

- Hong Kong's Hang Seng futures are down 0 points (0%), the cash market is currently estimated to open at 24,962.59

UK and Europe:

- UK's FTSE 100 index rose 65.89 points (0.92%) to close at 7,207.71

- Europe'sEuro STOXX 50 index rose 65.78 points (1.61%) to close at 4,149.06

- Germany's DAX index rose 213.34 points (1.4%) to close at 15,462.72

- France's CAC 40 index rose 87.83 points (1.33%) to close at 6,685.21

Thursday US Close:

- The Dow Jones Industrial rose 534.75 points (1.56%) to close at 34,912.56

- The S&P 500 index rose 74.46 points (1.71%) to close at 4,438.26

- The Nasdaq 100 index rose 277.82 points (1.88%) to close at 15,052.42

Indices:

It was a firm close for Wall Street with all major benchmarks closing above 1.5% and the VIX (Volatility Index) closing to a 5-week low. Strong earnings and from Citigroup (C), Bank of America (BAC) and Morgan Stanley (MS) alongside employment claims hitting a 19-month low gave sentiment a decent boost heading towards the weekend.

The Nasdaq 100 led the advance as yields continued to fall for a third day, and all US benchmarks closed firmly back above their 50-day eMA’s. Furthermore, the S&P and Nasdaq closed above their prior swing highs to confirm a change in trend and monthly pivot points, so it appears we are headed for a strong close for the week.

The ASX 200 teased us with a break above the 7332.2 high, only to revert below that key level after finding resistance at the 50-day eMA. At current levels the week is on track to close with a Spinning Top candle, so unless it can get its skates on today then we could end up with an underwhelming finish. Thankfully Wall Street gave a positive lead and futures point to a higher open, so we remain hopeful it can make use of its small bullish engulfing candle today and break to new highs and embark on its next leg higher.

ASX 200 Market Internals:

ASX 200: 7311.7 (0.54%), 14 October 2021

- Information Technology (4.07%) was the strongest sector and Energy (-0.89%) was the weakest

- 8 out of the 11 sectors closed higher

- 3 out of the 11 sectors closed lower

- 5 out of the 11 sectors outperformed the index

- 142 (71.00%) stocks advanced, 53 (26.50%) stocks declined

- 67% of stocks closed above their 200-day average

- 46% of stocks closed above their 50-day average

- 53.5% of stocks closed above their 20-day average

Outperformers:

- + 15.61%-Netwealth Group Ltd(NWL.AX)

- + 9.35%-Perseus Mining Ltd(PRU.AX)

- + 8.73%-Hub24 Ltd(HUB.AX)

Underperformers:

- ·-12.5%-Redbubble Ltd(RBL.AX)

- ·-2.87%-Insurance Australia Group Ltd(IAG.AX)

- ·-2.21%-AMP Ltd(AMP.AX)

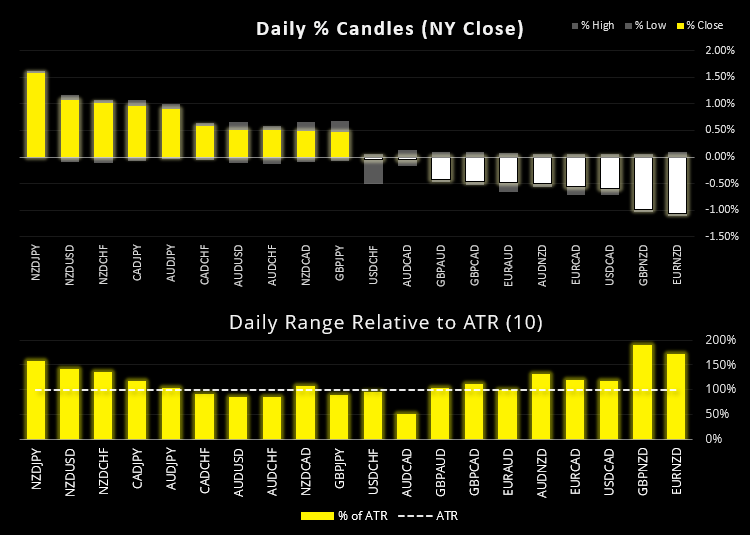

Forex: NZD/JPY was the storm trooper of the session

Commodity currencies were the strongest major currencies overnight (led by NZD) and JPY was the weakest with USD being the second to last. The higher-yielding New Zealand dollar (with one of the more hawkish central banks) is attracting the risk-on attention in current market conditions which placed NZD/JPY firmly at the top of the leader board with its 2nd most bullish day in 8-months. The trend and momentum favours an eventual breakout above 80.0 / May high although such levels rarely break on their first attempt. We shall see.

The US dollar index (DXY) fell to an 8-day low but later recovered to form a bullish hammer at the August high, raising the prospects of a minor bounce heading into the weekend. This coincides with a bearish pinbar at the 20-day eMA on EUR/USD and bullish pinbar on USD/CHF.

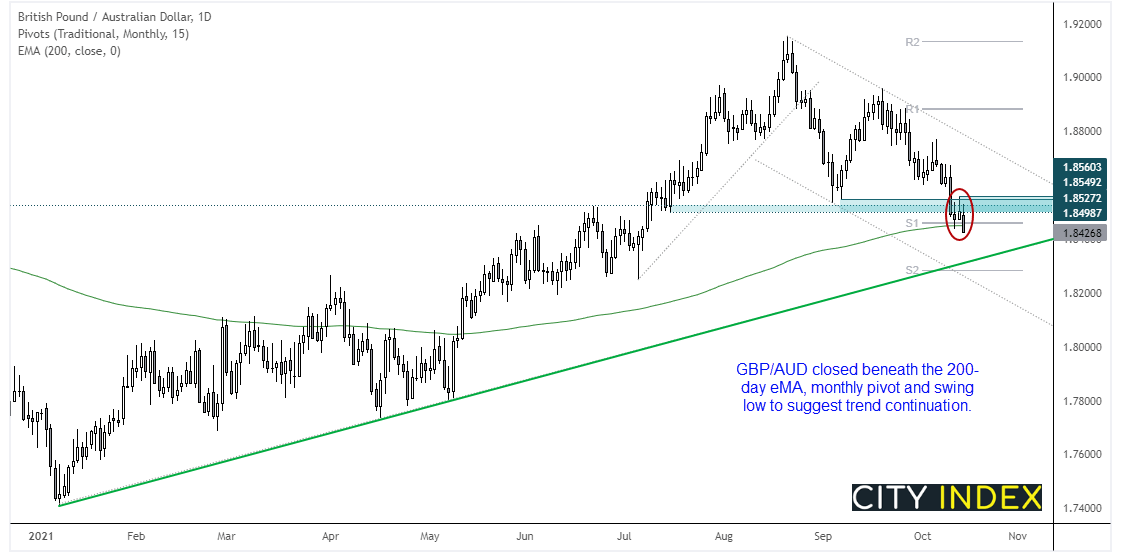

Yesterday we flagged the potential for GBP/AUD to form a base around its 200-day eMA and monthly pivot point. It failed. Instead, prices closed beneath both technical levels and recent lows to suggest the downside trend still has gas left in its tank. The daily trend structure remains bearish beneath 1.8560 although we’d also be keen on bearish setups within yesterday’s range, should it help increase reward to risk potential. The bullish trendline from the January low may act as dynamic support.

Learn how to trade forex

Commodities:

WTI closed to it to its highest level since November 2014, although remains beneath the intraday high set earlier this week. The IEA (International Energy Agency) raised their demand growth forecast for 2021 and 2022, whilst Saudi Arabia poured cold water on demands for additional OPEC+ supply. Whist the trend remains bullish take note of the declining volumes at these highs. Unless we see fresh buying activity then perhaps a break below $80 could trigger a countertrend move.

Gold edged higher by 0.17% but it is of little surprise that it found resistance at $1800 and its 200-day eMA. Still, with real interest rates falling (we’re using the TIPS as a proxy) it does point to further upside potential for the yellow metal once its current consolidation is complete.

Silver closed above trend resistance and the 50-day eMA, to invalidate the bearish channel and confirm an inverted Head and Shoulders pattern (H&S). The pattern projects a target around 24.40 and the daily trend structure remains bullish above 22.20. However, if this is part of an inverted H&S then prices should not trade back beneath the neckline. As these can be a little ambiguous we will use $23 as the invalidation point for the pattern if it is breached.

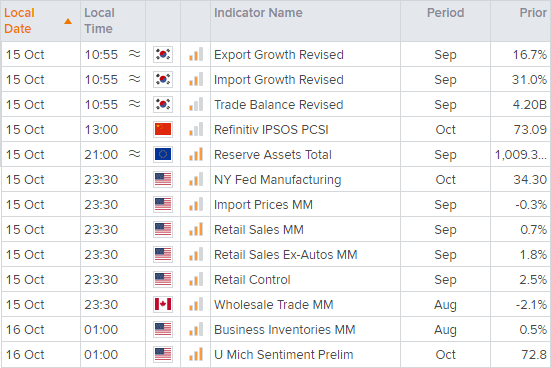

Up Next (Times in AEDT)

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade