According to the Bank for International Settlements, forex markets are more highly traded than any other market, with transactions worth trillions of dollars taking place every day. In this forex trading guide, we’ll explain how the currency markets work and how you can trade them.

Follow the links below to skip to a section, or start reading from the beginning.

- How currency markets work?

- Forex trading examples

- How to start trading forex

- Type of currency pairs

- What moves forex markets?

- Start forex trading

- Forex trading FAQs

How do you trade forex?

You trade forex via a global network of banks, businesses and individuals that are constantly buying and selling currencies. Unlike most financial assets – such as shares or commodities – the foreign exchange market has no physical location and trades 24 hours a day, 5 days a week.

This is called an over-the-counter market, and it means that currency prices are constantly fluctuating in value against each other, potentially offering a greater number of forex trading opportunities.

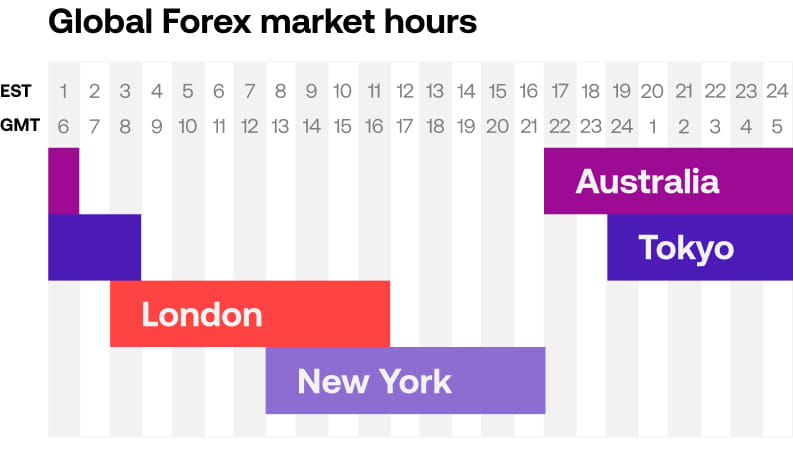

There are four main forex trading hubs: London, Tokyo, New York, and Sydney, with significant overlap between most sessions.

However, forex is also traded across Zurich, Frankfurt, Hong Kong, Singapore and Paris. Learn more about the market hours of forex.

At City Index, you can speculate on the future direction of currencies, taking either a long (buy) or short (sell) position depending on whether you think a currency will go up or down. The below video shows you how to trade the EUR/USD currency pair via a CFD.

Here’s a quick run down of some of the concepts you’ll encounter when trading forex.

Base currencies and quote currencies

Forex is always traded in pairs. That means when you buy one currency, you do so by selling another. And when you sell one currency, you do so by buying another.

When you buy EUR/USD, for example, you're buying the euro while selling the US dollar.

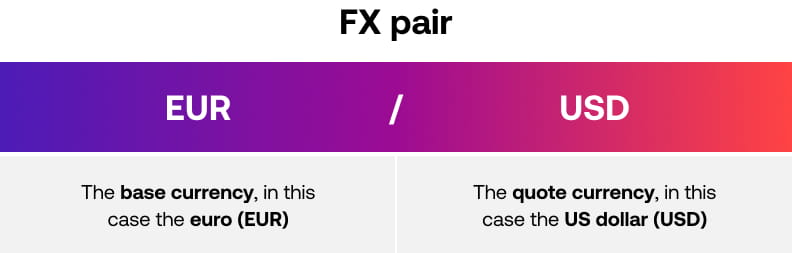

The two currencies in a pair are known as the base and the quote.

- The base is the first currency. In EUR/USD, it is the euro

- The quote is the second currency. In EUR/USD, it is the dollar

A currency pair tells you how much of the quote currency you'll need to exchange for a single unit of the base. If EUR/USD is trading at 1.1810, then you'll need to sell 1.1810 USD to buy a single euro.

Forex traders look to take advantage of changes in the relative value of the base and quote currency in a pair. You could, for instance, buy euros for dollars when EUR/USD is at 1.1810. If the euro strengthens against the US dollar, then your euros will be worth more dollars – so you can sell euros for dollars and keep the difference as profit.

If EUR/USD had dropped in price, though, you might have to sell your euros for less than you bought them. In this case, you would make a loss.

For more information on currency pairs, look at our what is forex trading? page.

Pips, lots and margin

Pips measure how much a currency pair has moved. A single pip is equivalent to a one-digit move in the fourth number after the decimal point. If EUR/USD moves from 1.1810 to 1.1817, it has gone up seven pips.

One key exception to this rule is when the Japanese yen is the quote currency. In this case, a pip is calculated as a one-digit move in the second number after the decimal point. If USD/JPY moves from 110.05 to 110.01, it has fallen four pips.

As you may have noticed, even a 50-pip move won't earn you much if you trade 100 or 500 units of currency. That’s why most forex traders buy and sell forex in lots – batches of currencies that enable you to take advantage of even relatively small price moves.

A standard lot is equivalent to trading 100,000 units of currency. Buying one lot of EUR/USD means purchasing 100,000 euros for their value in US dollars.

To avoid having to tie up all their capital when opening one position, most forex traders use leverage. With leverage, you only put up a fraction of your position's full value to open a trade. The amount you are required to put up is known as your margin.

Find out more about forex leverage and margin.

Finally, here are a couple of in-depth forex examples to see how this works in practice. You can follow along with these examples using a free City Index demo account.

Forex trading examples

Forex trading example 1: buying AUD/USD

AUD/USD is trading at 0.7200. It costs 0.7200 USD (the quote currency) to buy one unit of AUD (the base).

Our $1000 USD buys (1000 / 0.7200) $1,388 AUD.

If AUD/USD rises to 0.7300, then AUD is worth more in USD. We can sell our $1,388 AUD for (1,388 * 0.7300) $1,013.24 USD, a $13.24 profit.

If AUD/USD falls to 0.7100 instead, our $1,388 AUD is only worth (1388 * 0.7100) 985.48 USD, a USD$14.52 loss.

Essentially, we've used our USD to buy the AUD/USD pair. If its price goes up, we make a profit. If it falls, we make a loss.

Forex trading example 2: Selling USD/CHF

You sell one mini lot of USD/CHF at 0.9198. A mini lot is equivalent to trading 10,000 units of the base currency instead of 100,000. Here, you’re selling $10,000 by buying CHF 9198.

USD/CHF also has a margin requirement of 3.33%. This time, you’ll only need CHF 306 (3.33% * CHF 9198) in your account to open the position.

The pair falls 70 points to 0.9128. Your mini lot earns you 1 franc for every point that it falls, giving you a total profit of (70 * 1) 70 francs.

If the pair had risen instead, you’d make a loss.

For an in-depth breakdown of how a forex trade works, look through our list of forex trading examples.

How to start trading forex

1. Choose a currency pair

The first step to opening a forex trade is to decide which currency pair you wish to trade. There are over 80 currency pairs to choose from.

Types of currency pairs

There are three main categories of currency pairs: majors, minors (or major crosses) and exotics.

- Major currency pairs consist of the world’s biggest currencies against the US dollar and make up around 85% of forex trading volume. The majors are EUR/USD, USD/JPY, GBP/USD, AUD/USD and USD/CHF.

- Minor currency pairs are all other combinations of the world’s biggest currencies, such as AUD/GBP and AUD/JPY. These are also often referred to as major cross pairs

- Exotic currency pairs are pairs that include less-traded currencies, such as the Turkish lira (TRY) or Mexican peso (MXN)

Most new traders will pick one or two major currency pairs to focus on, often starting out with euro-dollar (EUR/USD). This is the world’s most traded currency pair, and typically has the tightest spreads.

2. Decide how you want to trade forex

There are two main ways to trade forex: derivatives such as CFDs, or spot forex trading. They both enable you to go long and short on currency pairs, but they work in slightly different ways.

What is spot FX?

Spot FX is when you buy and sell currencies – for instance by buying US dollars and selling euros. You open your trade by deciding how much of the base currency you want to buy or sell.

What are forex CFDs?

Forex CFDs are markets that enable you to speculate on the price movements of forex pairs without buying or selling any currencies. Instead, you’re trading a contract that tracks the price of a forex pair.

3. Decide to buy or sell your currency

Now you know which currency you’re trading – and how you want to trade it – it’s time to decide whether to go long (buy) or short (sell).

All forex is quoted in terms of one currency versus another. As we’ve covered, each currency pair has a ‘base’ currency and a ‘quote’ currency. The base currency is the currency on the left of the currency pair and the quote currency is on the right. Essentially, when trading foreign currencies, you:

BUY a currency pair if you believe that the base currency will strengthen against the quote currency, or the quote currency will weaken against the base currency.

- This is a long position, so your profits will rise if the currency pair’s value rises

- However, for every point the pair falls below your open level, you will incur a loss

SELL a currency pair if you believe that the value of the currency pair will decrease – meaning the base currency will weaken in value against the quote currency, or the quote currency will strengthen against the base currency.

- This is a short position, so your profits will rise if the pair’s price falls

- However, for every point the pair rises above your open level, you will incur a loss

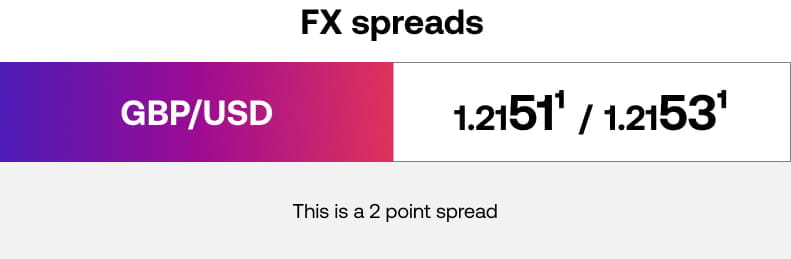

What is the spread in forex trading?

The spread is the difference between the buy and sell price of a currency pair. When you trade forex, you will see two prices listed: the first is the sell price (or bid) and the second is the buy price (or offer). The difference between them is the spread, which covers the cost of the trade.

If you want to go long on a pair, you will open your trade at the offer price. Then when you want to close your position, you’ll sell at the bid price. If you are going short, you will do the opposite.

4. Manage your risk in forex trading

Risk management is crucial for successful forex trading – and a key element of risk management is the use oforders .

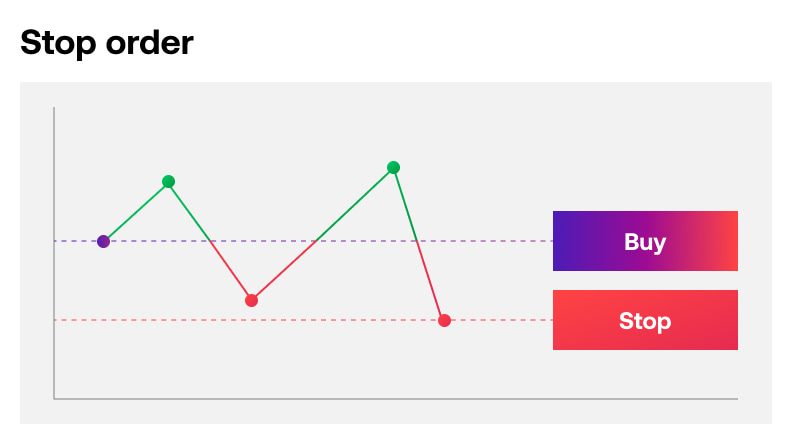

There are two main types of orders: stop loss orders and take profit orders (sometimes called a limit). Both act as instructions to automatically close a position when its price reaches a specific level predetermined by you.

What is a stop loss?

A stop loss order is an instruction to close out a trade to help minimise losses. There are three types of stop loss orders: standard, trailing and guaranteed.

A standard stop loss order, once triggered, closes the trade at the best available price. There is a risk therefore that the closing price could be different from the order level if market prices gap.

A guaranteed stop loss however, for which a small premium is charged upon trigger, guarantees to close your trade at the stop loss level you have determined, regardless of any market gapping.

A trailing order follows your position, so if you are long and the market moves up, your stop loss will also move higher, but it remains in place if the market falls.

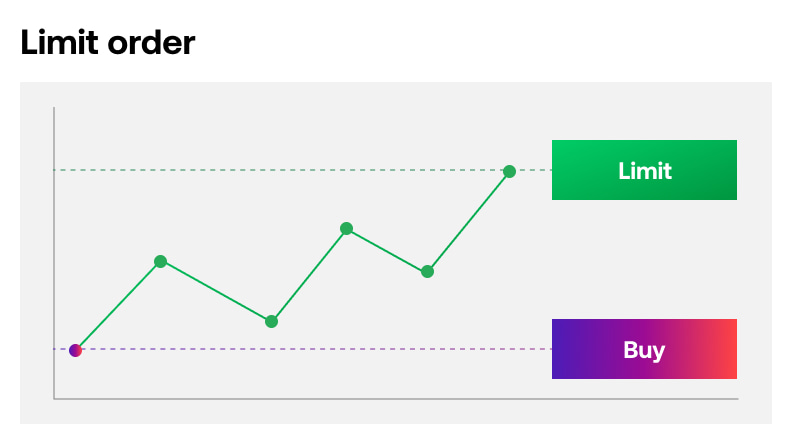

What is a limit order?

A limit order (or take profit) is an instruction to close out a trade at a price that is better than the current market level and is used to help lock in price targets.

Standard stop losses and limit orders are free to place and can be implemented in the dealing ticket when you first place your trade, and you can also attach orders to existing open positions.

Learn more about risk management.

5. Monitor and close your forex trade

Once open, your trade’s profit and loss will fluctuate as the forex market’s price moves.

You can track forex market prices, see your unrealised profit/loss update in real time, attach orders to open positions and add new trades or close existing trades from your computer or smartphone.

When you are ready to close your trade, you do the opposite to the opening trade. If you bought three CFDs to open, you would sell three CFDs to close. By closing the trade, your net open profit and loss will be realised and immediately reflected in your trading account cash balance.

Please note that City Index CFD trading accounts are FIFO- a forex trading policy set by the National Futures Association. To read more about this please visit our help and support section.

Start forex trading

To begin forex trading with City Index, simply follow our three-step guide to creating a trading account and you could be placing your first forex trade within minutes (subject to review and approval).

Step 1: Create a City Index or MT4 trading account

- You need to create a trading account with us in order to start trading forex. Our application process is simple and secure, and you can apply for an online trading account at any time by filling in our online application form

- Once we’ve successfully completed the verification process, we’ll send you an account number by email to confirm that your trading account is open

- Shortly after that, our account managers may give you a call, in case you have any additional questions

Step 2: Fund your trading account

- Once your trading account is open, you’ll need to transfer funds into it to start trading forex. You can do this in a variety of ways via the 'Account Funding' tab in the trading platform.

- Your initial deposit must be at least $150.

- For more information on how you can transfer funds in and out of your trading account, see our help and support section.

Step 3: Start trading

- Now you have an online trading account and have deposited funds, you can start trading forex.

- Log in, choose whether to trade Forex through CFDs or spot FX, pick your currency pair and open a position.

- You can access live price feeds, streaming charts and news instantly and trade 24-hours a day.

- We offer a range of trading platforms including our innovative Web Trader and mobile apps, as well as an MT4 account

- For more details of the markets available to trade, click on the online market Information icon in the trading platform

- Watch the 'How to trade forex?' video above to see how to place your first trade