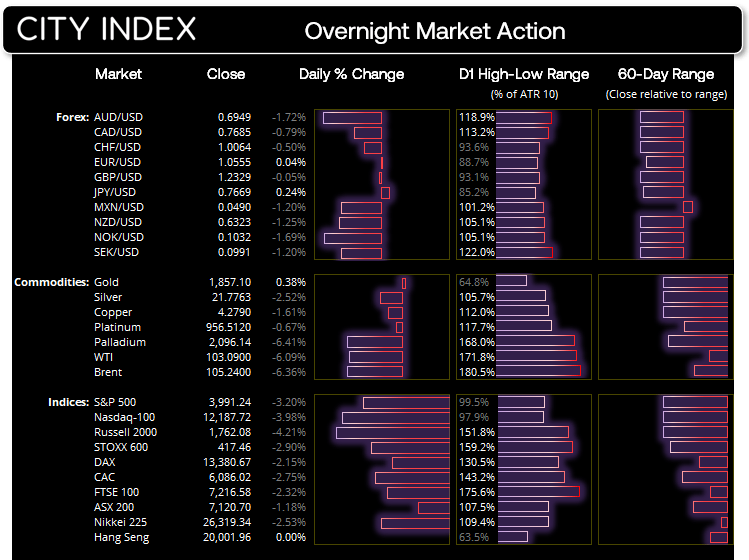

Monday US cash market close:

- The Dow Jones Industrial fell -653.67 points (-1.99%) to close at 32,245.70

- The S&P 500 index rose -132.1 points (2.51%) to close at 34,058.75

- The Nasdaq 100 index fell -505.814 points (-3.98%) to close at 12,187.72

Asian futures:

- Australia's ASX 200 futures are down -62 points (-0.87%), the cash market is currently estimated to open at 7,058.70

- Japan's Nikkei 225 futures are down -380 points (-1.44%), the cash market is currently estimated to open at 25,939.34

- Hong Kong's Hang Seng futures are down -181 points (-0.91%), the cash market is currently estimated to open at 19,820.96

- China's A50 Index futures are down -71 points (-0.55%), the cash market is currently estimated to open at 12,871.53

Of course, the money has to go somewhere and that is where the dollar comes in, which is being propped up by a combination of safe-haven flows and a hawkish Fed. But elsewhere, indices, bonds and commodities and broadly lower and that has taken its toll on AUD and NZD pairs.

AUD/USD is back below 70c and at its lowest level in 22-months. China’s lockdown’s plunging iron ore and yield differentials are the key driver’s behind the Aussie’s demise, and 69c is within easy reach for bears today. AUD/JPY – the classic barometer of risk – is also on the back ropes today and on the cusp of breaking April’s low. NZD/JPY hit our 82.50 target outlined in yesterday’s European Open report.

Oil was also sharply lower on demand concerns with WTI suffering its worst day in 26, with above-average volume. $100 is within easy reach for bears today. And gold was unable to benefit from any risk-off flows with spot prices close to testing the April low and breaking beneath $1850.

The S&P 500 closed below 4,000 for the first time in 14 months, all sectors were in the red (led by energy) and 85% of its stocks declined. The Nasdaq 100 closed below key support and to its lowest level since November 2020.

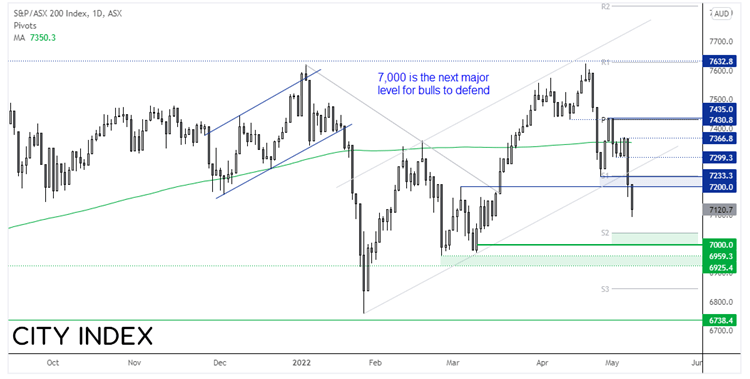

ASX 200:

We doubt the lead from Wall Street bodes well for the ASX 200 today. Since Friday we’ve seen 91.5% and then 80.5% of its stocks tank, and suspect we’ll see a similar figure by today’s close. 7,000 is the next obvious target for bulls to defend, with 7040 making a likely interim support level. The 14-day ATR is 89 points, which places a downside target of 7131.7 from yesterday’s close, so despite the negative sentiment for stocks at present we’d be surprised if we see a substantial break or close beneath 7k today.

ASX 200: 7120.7 (-1.18%), 09 May 2022

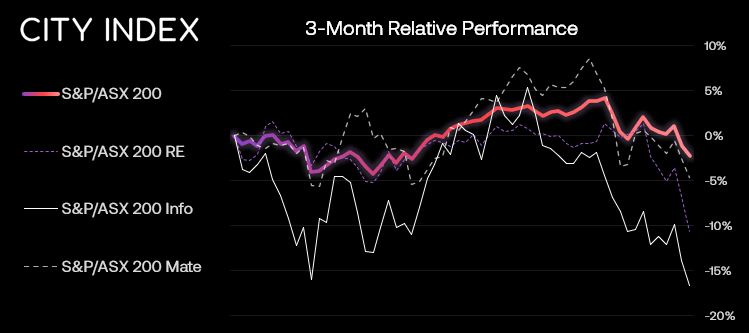

- Energy (0.53%) was the strongest sector and Real Estate (-4.13%) was the weakest

- 3 out of the 11 sectors closed higher

- 8 out of the 11 sectors closed lower

- 6 out of the 11 sectors outperformed the index

- 28 (14.00%) stocks advanced, 161 (80.50%) stocks declined

Outperformers:

- +3.23% - Westpac Banking Corp (WBC.AX)

- +2.63% - Whitehaven Coal Ltd (WHC.AX)

- +2.33% - TPG Telecom Ltd (TPG.AX)

Underperformers:

- -12.31% - Novonix Ltd (NVX.AX)

- -11.52% - Lake Resources NL (LKE.AX)

- -9.76% - Chalice Mining Ltd (CHN.AX)

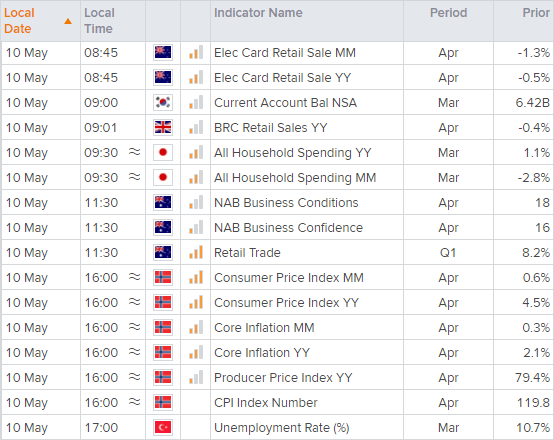

Up Next (Times in AEST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade