Last week the Nasdaq closed -2.28% lower, snapping a four-week winning streak that helped the tech-heavy index extend its rebound ~25% from the June lows.

The sell-off came about as central bankers remained hawkish, inflation readings globally remained high and on nerves ahead of this week’s Jackson Hole Economic Symposium for central bankers.

The subject of the Jackson Symposium is “Reassessing Constraints on the Economy and Policy”. One that lends itself relatively easily to another round of hawkish Fed speak and higher yields - a scenario that would see the cracks that re-emerged in tech stocks last week widen.

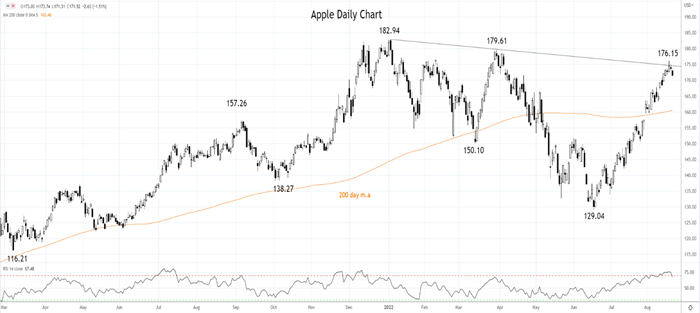

Almost a month has passed since Apple reported third-quarter earnings that beat expectations and propelled the share price above the critical 200-day moving average near $159.00 to last week’s high at $176.15.

Notably, at its earnings release, Apple refrained from providing fourth-quarter guidance. Since then, there has been a host of warnings from chipmakers and other computer vendors of weaker demand for smartphones and PCs.

Apple’s share price last week tagged trendline resistance from the bull market $182.94 high of early January. Even after last week’s pullback, the share price still appears highly overbought.

Based on the above factors, we feel that a pullback in the Apple share price is in the offering. As such, we favour selling Apple shares at Friday’s closing price of $171.50 or better.

The stop loss is a daily close above last week’s $176.15 high, and the profit target is $161, where the 200-day moving average now resides.

Source Tradingview. The figures stated are as of August 22nd, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade