What is OPEC?

The Organization of the Petroleum Exporting Countries (OPEC) is a group of 13 of the world’s largest oil-exporting nations. It was founded in 1960 by the Islamic Republic of Iran, Iraq, Kuwait, Saudi Arabia and Venezuela to coordinate petroleum policies and create a support system between the countries.

OPEC’s members collectively control a significant portion of global petroleum supply, which means they can effectively set the price of oil and avoid any volatility that might negatively impact members’ economies.

Who is in OPEC?

The current 13 members of OPEC include:

- Iran (founder)

- Iraq (founder)

- Kuwait (founder)

- Saudi Arabia (founder)

- Venezuela (founder)

- Algeria

- Angola

- Congo

- Equatorial Guinea

- Gabon

- Libya

- Nigeria

- The United Arab Emirates

The organisation does distinguish between founders and full members in terms of voting rights. In order to be accepted into OPEC, a country has to have a substantial net export of crude petroleum, fundamentally similar interests to those of Member Countries and must be accepted by a majority of three-fourths of Full Members, including the concurring votes of all Founder Members.

There is another class of membership to OPEC known as an ‘Associate Member’, which is a net petroleum-exporting country that does not qualify for full membership. They may still receive special conditions provided their interests are aligned to the group.

What is the role of OPEC?

The role of OPEC is to coordinate and unify the petroleum policies of its member countries and establish ways of safeguarding their interests – both as individual countries and as a collective entity.

OPEC does this by devising means of stabilising oil prices in international markets to effectively eliminate fluctuations that could be harmful to members. The organisation intends to secure a steady income for oil-producing countries and a steady supply of oil to consuming nations.

OPEC was also created to prevent the United States from dominating the oil market. Up until 1960, the US was the largest producer and consumer of oil, which meant that prices were generally set by the country’s oil companies. By combining forces, OPEC members could limit US interference in global markets and position itself as a rival.

This was first seen in the 1973 oil embargo, which prevented exports to targeted nations and cut oil production. As a result, the US experienced a run on gas stations.

How does OPEC influence oil prices?

OPEC influences oil prices by increasing and decreasing production capacities. Oil prices are not just based on current levels of supply and demand, but future output expectations. By changing how much oil is going to enter circulation, OPEC can keep the price of oil high – assuming demand remains constant – to maximise the group’s profits.

There is a balance, however, as cutting the supply of oil too much would reduce revenues for OPEC members.

Decisions about OPEC’s policies will be announced in its twice-yearly sessions, when quotas are set for each of its 13 members. Oil prices tend to be volatile in the build up to these announcements as markets price in expectations.

Keep an eye on the economic calendar for the next OPEC meeting.

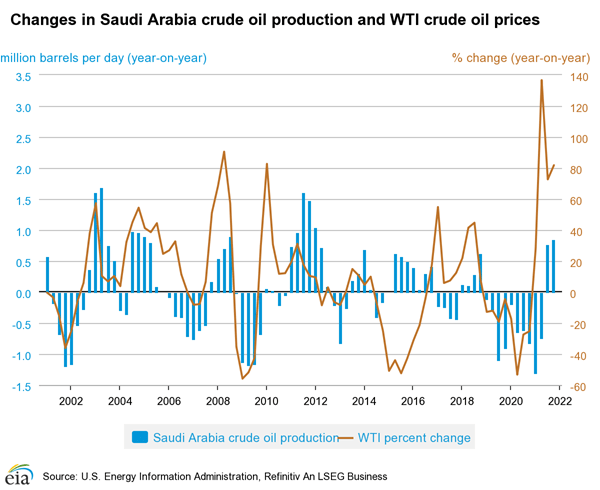

The relationship between OPEC production and oil prices can be seen especially clearly when looking at supply outputs from Saudi Arabia – OPEC’s largest oil producer. In fact, many choose to use Saudi Arabia alone as an indicator of global oil market liquidity.

The key factor in this relationship is spare production capacity – which is the amount of oil production that can be increased within 30 days and maintained for a further 90 days. Saudi Arabia has the largest spare capacity, keeping more than 1.5 - 2 million barrels per day on hand for market management.

The total capacity of OPEC provides a clear indication to markets of the organisation’s ability to manage financial crises that could reduce oil supply. If OPEC’s spare capacity is low, it could cause concern in markets and lead to rising oil prices.

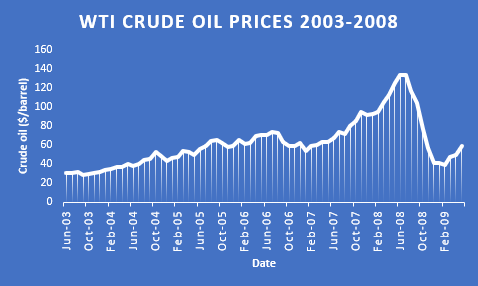

For example, from 2003 to 2008, OPEC’s capacity was only around 2 million barrels per day – 3% of global supply. Concerns over supply, and OPEC members (such as Libya) threatening to cut oil production, caused oil prices to rise from $25 per barrel in September 2003 to $147.02 in July 2008.

Unexpected changes in production outputs can also have a significant effect on oil prices. These can occur for a number of reasons, such as:

- An OPEC member’s unwillingness to meet targets

- Disruptions to supply chains caused by strikes

- Geopolitical events and global crises

That’s why it’s important to keep up to date on any news concerning OPEC.

Learn how to start trading oil online, or open a live account if you’re ready to take a position.

Does OPEC control the world’s oil reserves?

OPEC controls about 79.4% of oil reserves according to its website. It’s also said to collectively produce 40% of the world’s crude oil, and account for 60% of internationally traded petroleum.

But with the arrival of other technologies, such as fracking, OPEC’s power on the global market has been reduced. The five largest producers of oil as of 2020 were the United States, Saudi Arabia, Russia, Canada and China – only one of whom is an OPEC member. Collectively, these non-OPEC countries control over 40% of the world’s oil supply.

However, US companies are subject to antitrust provisions, which means that unlike OPEC they cannot enter into coordinating supply schemes. This prevents the US from having the same power over international markets as OPEC.

Difference between OPEC and non-OPEC countries

OPEC countries are the members of the non-governmental organisation, while non-OPEC members are centres of production not included in the cartel. Major production hubs include North America, regions of the former Soviet Union and countries adjoining the North Sea.

In 2016, OPEC agreed to coordinate crude oil supply with 10 non-OPEC countries under what became the OPEC+ umbrella. Members of OPEC+ are Russia, Kazakhstan, Azerbaijan, Malaysia, Mexico, Bahrain, Brunei, Oman, Sudan and South Sudan.