As of Tuesday 30th November 2021:

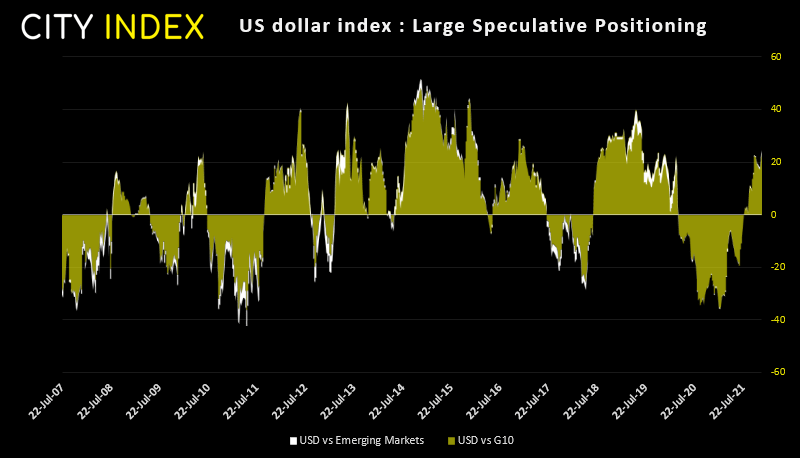

- Traders added US $2.5 billion to USD net-long exposure, taking it to $24.4 billion – its most bullish level since June 2019

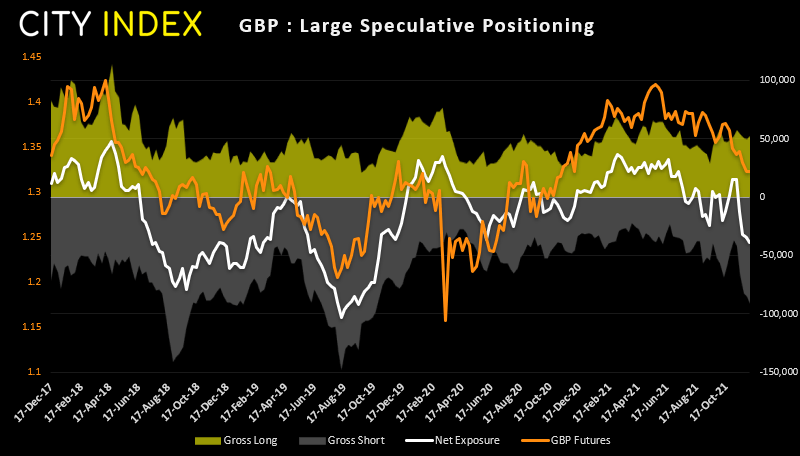

- Net-short exposure to British pound futures were at their most bearish in over 2-years

- Bears added +16.9k short contracts last week

Dollar bulls go from strength to strength

According to data compiled by IMM (International Money Markets) traders are their most bullish on the US dollar since June 2019. The chart below shows exposure to G10 currencies and emerging market currencies in a ‘stacked’ chart, which when combined represents the total exposure. Its last peak was around +$34 billion and its record sits around $51 billion so do not yet appear to be at a sentiment extreme.

Traders are theist most bearish on GBP futures in 2.5 years

Traders increased their gross-short exposure on GBP futures to 91k contracts, which is the highest levels since October 2019. As gross longs remained effectively flat it has pushed net-short exposure to its most bearish level in 2.5 years. Historically, traders have been much more bearish than this so there are no immediate signs of a reversal, and perhaps we’ll see more extreme net-short exposure if longs begin to close out.

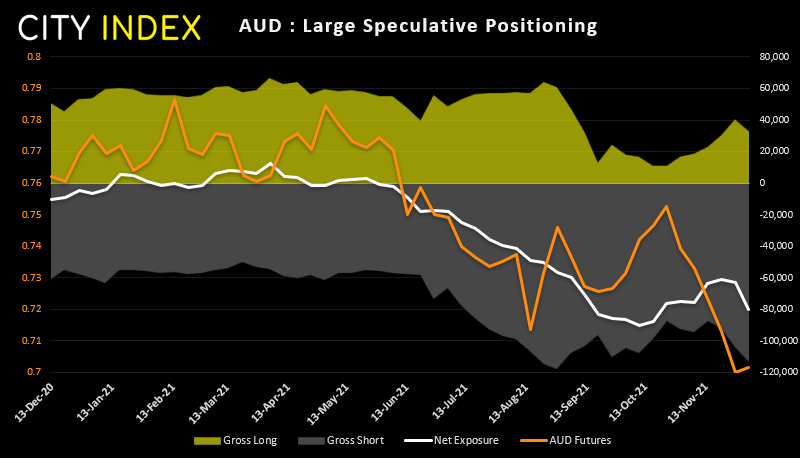

Bears return to the Aussie

Traders reached a record-level of net-bearish exposure in October on AUD futures, which is usually a red flag for a sentiment extreme. Needless to say, many of those bears were forced to cover as AUD prices refused to drop but we have since noted a sudden increase of gross short bets last week – where 16.9k new short contracts were initiated which has dragged net-short exposure to an 8-week low. And with a hawkish Fed and stubbornly dovish RBA we could see further selling pressure on the Australian dollar which closed below 70c on Friday.

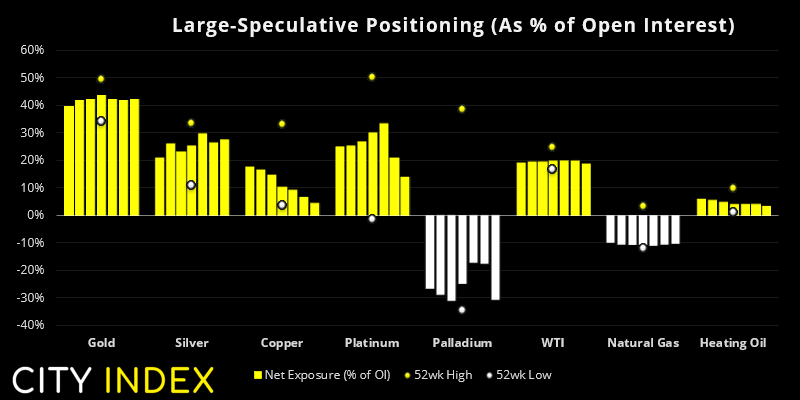

As of Tuesday 30th November 2021:

- Bulls and bears continued to trim exposure to gold futures

- Net-short exposure to platinum futures rose to a 4-week high

- The closure of bullish bets on copper futures dragged net-long exposure to a 3-month low

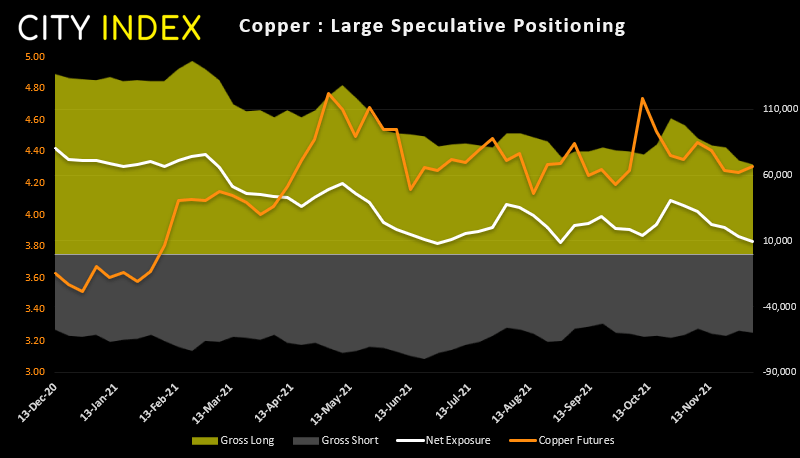

Bullish bets on copper continued to decrease

Net-long exposure to copper futures fell for a sixth consecutive week and now sits at a 3-month low. The main driver behind this move is due to long contracts being closed, as opposed to fresh shorts being initiated. Whilst this does not make a compelling argument for a bearish case, it does explain why copper prices are struggling to rally and trade in a choppy range around $4.30. Ultimately, we maintain a bullish bias above $4.00 overall but have braced ourselves for some further sideways action over the near-term.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade