- The payrolls figure in the NFP report is sold as being extremely important but it’s not really beyond the ultra-short term

- Average hourly earnings, unemployment rate, underutilisation and full-time employment are far more important for the US interest rate outlook

- Through a lens of what’s expected in the March NFP report, we look at the potential market reactions in USD/JPY and gold

The overview

Forget focusing on the payrolls figure in the US jobs report. It’s not as important as it’s made out to be. Traders would be better off looking at unemployment and average hourly earnings if they want to know how markets are likely to react.

We look at the pre-payroll’s setup for USD/JPY and gold, explaining how both are likely to react depending on the details.

The background

Payrolls aren’t as important as they're made out

The payrolls number is not as important as it's made out to be, at least not now.

It’s reliably unreliable, often beating market expectations before being revised months later. It double-counts multiple job holders, a big factor given growth in the gig economy. Rather than waiting weeks or months to become employed as was the case in the past, people can simply pick up their phone and become employed again in seconds. Boom, problem solved!

You’re not going to learn much about what’s happening in the US labour market from the payrolls figure. A gradual slowing trend is entirely expected now, with occasional bumps and troughs, making it far less relevant for policy settings than the mountain of analysis it receives.

But earning and unemployment are

What is important for the policy outlook, and markets, is wage pressures given the Fed have linked it to trends in services inflation, especially in discretionary areas.

That means the average hourly earnings figure carries far more weight than payrolls, meaning it should be among the first figures you look at. A beat on expectations increases the likelihood of rate cuts from the Fed being delayed, and vice versus.

As a lead indicator for wage pressures, the underutilisaton rate is important given it captures not only unemployed persons but also employed workers who are not working to their full capacity, be it voluntarily or forced. This is a better guide on slack that exists within the labour market than the unemployment rate. Full-time employment is another useful guide on deciphering spare capacity in the labour market.

On unemployment, even though it’s not the best predictor of wage pressures, it’s arguably the most important number to initially focus on, especially as Jerome Powell has cited rising unemployment as a catalyst to induce rate cuts, even if inflationary pressures are persistent

Even if payrolls growth remains firm, if unemployment comes in above expectations, it’s likely to bolster the case for rate cuts.

Despite the dismissal of the payrolls figure, there’s no denying the extreme focus on the number means it can and does drive the initial market reaction when the NFP report is released. The purpose of this note is to provide context as to what matters for policymakers, allowing traders to fade moves that don’t marry up with the message from earnings, underutilization, unemployment or the full-time employment change.

March NFP expectations

In the March, markets expect US unemployment to tick down a tenth to 3.8%. Average hourly wages is forecast to grow 0.3%, leaving the change on a year earlier 4.1%. Payrolls growth is tipped to slow from 275,000 to 214,000. They’ve purposely in that order as that’s the order of importance. That’s something to remember when looking at analysis below.

The trade setup

USD/JPY

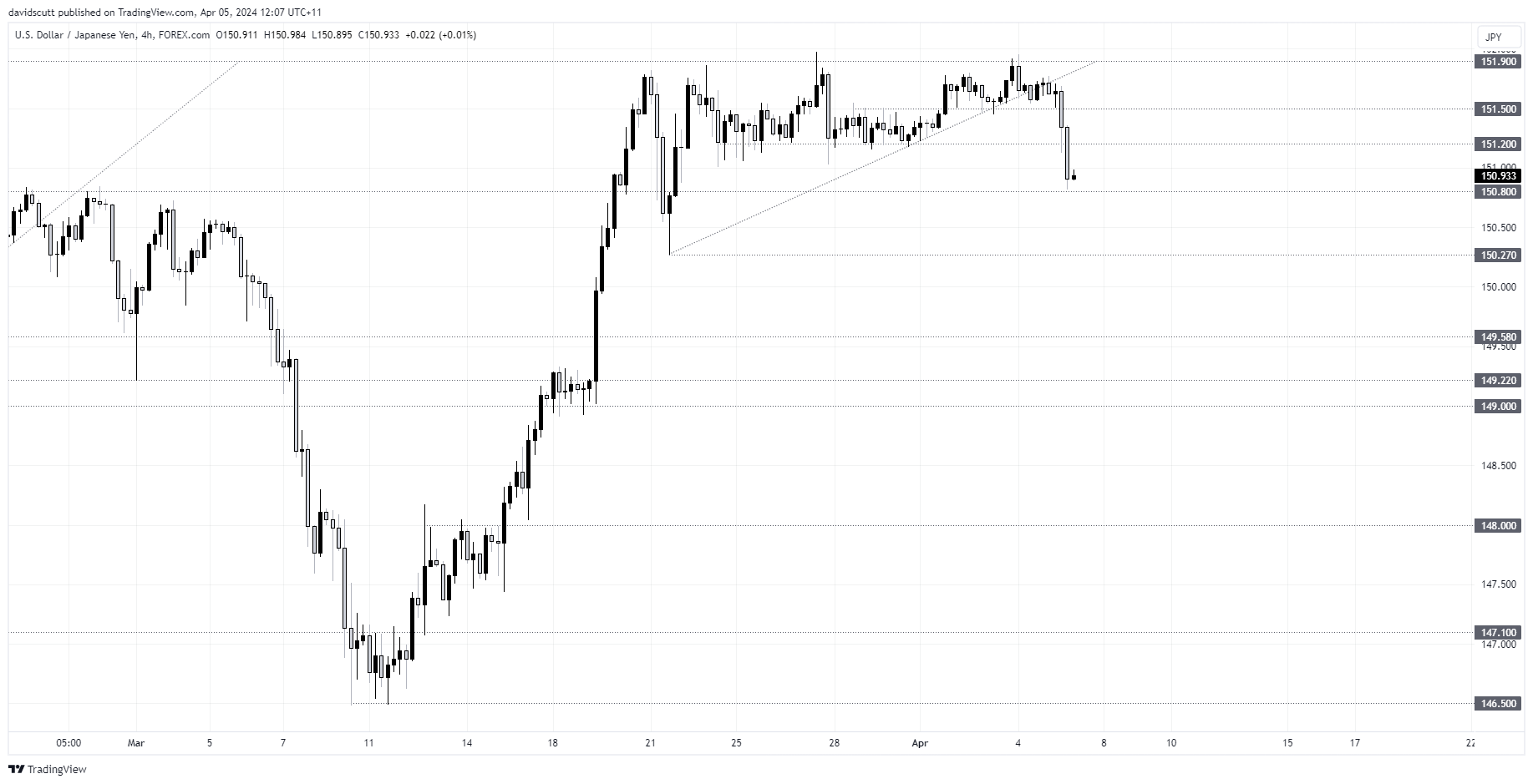

Declining US bond yields given the risk-off tone in markets saw USD/JPY decline on Thursday, reflecting lower yield differential between the US and Japan and increased volatility across riskier asset classes. The move has extended in early Asia trade on Friday following more jawboning from Japanese officials on the level of the Japanese yen, keeping the threat of BOJ intervention on the table.

Heading into payrolls, support is located at 150.80 and 150.27 with a break of the latter there opening the door to a larger flush towards a series of support levels between 149.58 to 149.00. On the topside, 151.20, 151.50 and 151.95 are the levels to watch.

Should unemployment fail to decline and average hourly earnings miss to the downside, it would likely act as a powerful downside force for USD/JPY. The opposite applies should unemployment decline more than expected and earnings top forecasts, putting USD/JPY on a collision course with sellers parked ahead of 152, including potentially the BOJ.

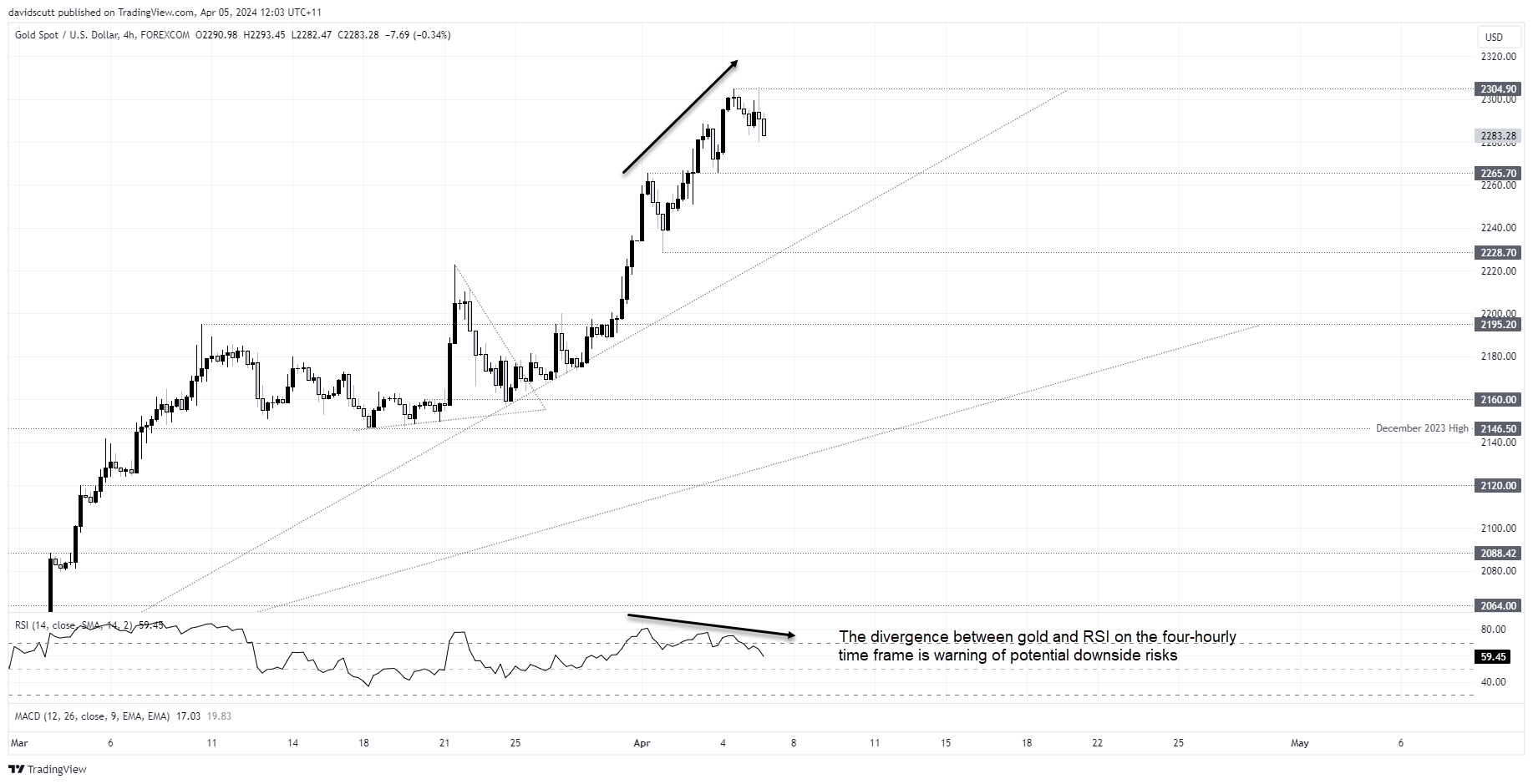

Gold

For gold, should unemployment fall more than expected with wage pressures exceeding forecast, US bond yields and dollar would likely rally, creating headwinds for bullion at the margin. On the downside, $2265.70, $2228.70, uptrend support around $2225 and $2195.20 are the levels to watch. Should unemployment and earnings disappoint relative to expectations, a retest of the double top at $2304.90 would likely be on the cards.

The wildcards

Aside from payrolls, the other major consideration traders need to consider is the geopolitical situation in the Middle East. Should tensions escalate further (or headlines imply they are), USD/JPY would likely come under further downside pressure while gold would be expected to rally.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade