US futures

Dow futures -0.6 % at 32530

S&P futures -0.8% at 4065

Nasdaq futures -1.26% at 12468

In Europe

FTSE -0.1% at 7280

Dax +0.02% at 13630

Euro Stoxx -0.3% at 3612

Learn more about trading indices

Peak inflation may have passed, but don’t expect a quick drop

US stocks are falling after US inflation slowed for the first time since August last year but was still ahead of forecasts.

US CPI rose 8.3% YoY in April, down from 8.5% in March but above the 8.1% that was forecast. The data suggests that elevated consumer prices and the squeeze on households and businesses will persist, fueling bets of a hawkish Federal Reserve.

Whilst there is a good chance that inflation has peaked, it is not expected to drop away rapidly. Instead, given the breadth of price rises across the economy, combined with higher wages, the picture suggests that elevated inflation is here to stay.

The data supports the Fed’s more hawkish approach after a 50bp rate hike last week and most likely several more to come.

COVID lockdowns in China mean more supply chain disruptions, which, combined with high oil prices and resilient services demand, point to a long road to get inflation back towards the 2% target.

In corporate news:

More news on the stocks to watch

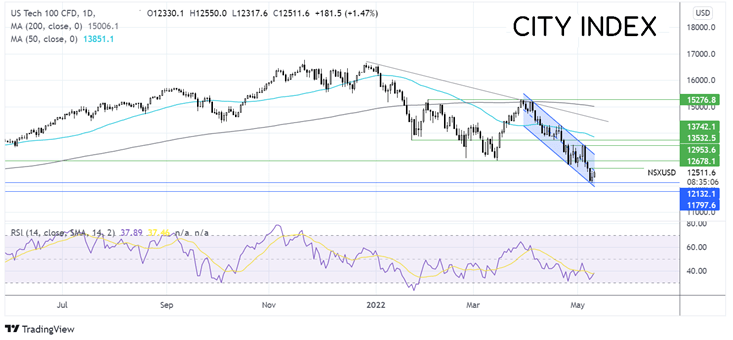

Where next for the Nasdaq?

The Nasdaq has traded within a falling channel since the start of April, reaching a fresh 2022 low of 12100 yesterday before rebounding. The RSI remains out of oversold territory, suggesting that there is more downside to be had. Sellers need a move below 12100 to continue the bearish trend towards 11800, the late late November low. Buyers will be looking for a move over 12678, the weekly high, to bring 12950 into play.

FX markets USD rises

USD is rising after the inflation data boosts hawkish Fed bets. Inflation was higher than forecast and suggests that the Fed will need to keep acting firmly to rein in consumer prices that remain around a 4-decade high.

AUD/USD – is rises higher after Chinese inflation data revealed that consumer prices rose 2.1%. However, PPI fell to its lowest level in a year, giving the PBoC headroom to inject further stimulus into the slowing economy.

EUR/USD falls on the stronger USD and after German CPI confirmed the 7.4% preliminary print and ECB Governor Christine Lagarde fueled a July rate hike expectations.

GBP/USD -0.23% at 1.2340

EUR/USD -0.15% at 1.0560

Oil rises after a steep selloff.

Oil is rebounding higher after falling around 10% in just two days, as supply concerns once again take center stage. The EU ban on Russian oil is looming large over the market ahead of a vote this week. While Hungary is still digging in its heels, an agreement could see the oil market, which is already tight, tighten further as oil flows slow.

The fact that the deal still hasn’t been agreed upon, but oil prices are rising anyway, suggests that firstly the recent selloff was overdone, and secondly, that the market is confident that Hungary will get onside sooner rather than later through exemptions, concessions, or some workaround.

Adding to the upbeat mood in the oil market was the prospect of further stimulus from Beijing. Factory gate inflation eased to a one-year low giving policymakers headroom for further stimulus. After all the disappointment regarding future demand amid the Chinese COVID lockdowns, the prospect of the additional stimulus was just the sugar rush that the oil market needed.

Before today oil prices had fallen sharply on demand concerns as China’s COVID lockdowns tightened amid fears of slowing global growth.

EIA data is expected later, and if API data is anything to go by, it could highlight demand concerns capping gains.

WTI crude trades +4.7% at $102.78

Brent trades +3.9% at $105.74

Learn more about trading oil here.

Looking ahead

15:30 EIA crude oil stock piles

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade