US futures

Dow futures +0.18% at 35448

S&P futures +0.77% at 4578

Nasdaq futures +1.4% at 15204

In Europe

FTSE +0.9% at 7590

Dax +0.45% at 15653

Euro Stoxx +0.4% at 4242

Learn more about trading indices

Apple & AMD smash forecasts

Stellar earnings from Alphabet and AMD are helping to send the Nasdaq futures 1.4% higher. The tech heavy index is outperforming its Wall Street peers, which are set for milder but still positive opens, in a complete turnaround to what we were seeing in January.

AMD trades 11% higher pre-market after forecasting 2022 revenue above expectations as demand for semiconductors remains strong.

Alphabet jumped 10% pre-market after reporting record Q4 revenue of $75.33B up 32% on the year.

Last month the Nasdaq at one point was down 19% from its recent high on fears of a more aggressive Fed. The bottom line here is that fundamentals in some of these tech stocks are still extremely impressive and as such didn’t deserve the hammering that they received Iast month.

The market is expecting the Fed to hike rates around 5 time this year. Fears of the Fed acting too aggressively saw stocks plunge lower in January. However, this week Fed members have been talking down the prospect of an overly aggressive Fed, bringing in bargain hunters which have driven stocks sharply higher this week.

Separately the ADP report revealed that private payrolls unexpectedly declined in January by 301k as Omicron hit the US and impacted the labour market. This data came after an unexpectedly high 776k reading in December.

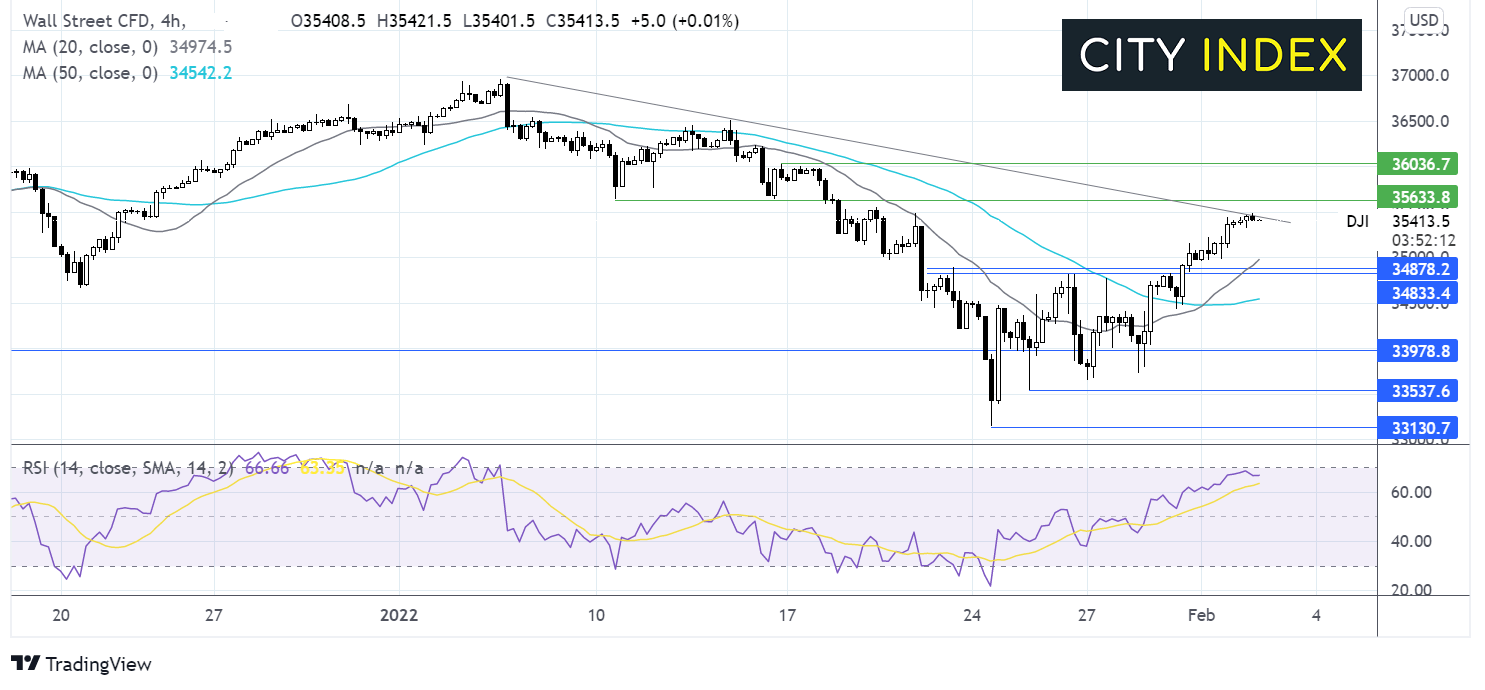

Where next for the Dow Jones?

The Dow Jones is extending its recovery from 33145 2022 low, breaking above the 20 & 50 smas and is currently testing the descending trendline from the start of the year. The 20 sma has crossed above the 50 sma in a bullish signal. The RSI is supportive of further gains whilst it starts out of overbought territory. A break above he trendline resistance could open the door to 35630 the Low January 10 & 14 and opening the door to 36000 round number. On the flip side 34900 could offer some support ahead of 34000.

FX markets USD falls, EUR rises as inflation hits a record high

The USD is falling lower extending losses for a third session amid a risk on mood in the market. The upbeat mood, combined with calming Fed chatter, pushing back against aggressive Fed moves is pulling on the greenback.

EUR/USD is rising after inflation unexpectedly rose in January and hit a record high of 5.1%, piling pressure on the ECB, which meets tomorrow to tighten monetary policy. Expectations had been for inflation to decline to 4.4%.

GBP/USD +0.40% at 1.3575

EUR/USD +0.44% at 1.1320

Oil jump as OPEC+ agrees to raise output

Oil prices are rising to fresh 7 year highs, after OPEC+ have agreed to raise output by 400,000 bpd from March. Despite the increase in production quota the price is rising suggesting that concerns surrounding tight supply still exist.

OPEC+ members have so far failed to increase production to reach the upwardly revised quotas of 400,000 extra barrels per day. The group missed its output target again in January, as it did in December due to a range of reasons including under investment and militia unrest.

The Joint Technical Committee (JTC) kept the world demand forecast unchanged for the year at 4.2 million barrels per day. It added that it expects oil to reach pre-pandemic levels in the second half of the year. The report added that it still expects a crude surplus this year of 1.3 million barrels per day.

Looking ahead the EIA crude oil inventory data is due later.

WTI crude trades +1.36% at $88.60

Brent trades +1.1% at $90.04

Learn more about trading oil here.

Looking ahead

15:30 Crude oil inventories

20:00 BoC Governor Macklem speaks

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.