USD/JPY pulls back ahead of Fed rate decision

USD/JPY is falling lower after booking 0.8% gains in the previous session. The pair trades over 4.5% higher this month alone.

Central bank divergence has lifted the pair to a 23-year high as the BoJ remains one of the most dovish major central banks and as the Fed considers hiking interest rates by 75 basis points.

The CME Fed Watch tool shows that the market is pricing in a 98.1% probability of a 75 basis point hike, which would be the first since 1994.

In addition to the rate decision, Fed forecasts are expected to see CPI upwardly revised and GDP lowered.

A 75 basis point rate hike could boost the pair. However, a 50 basis point hike could see the pair initially fall on disappointment.

Read more about what to expect from the Fed.

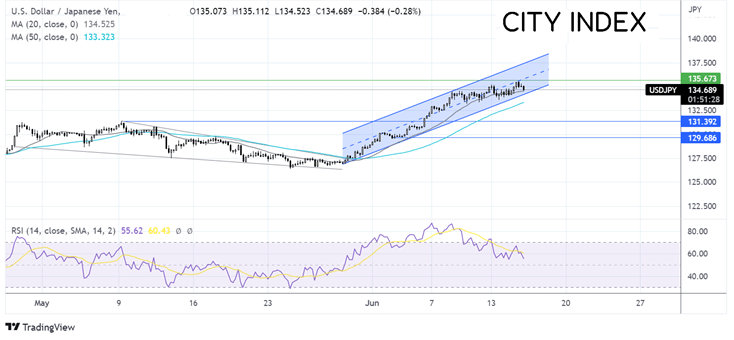

Where next for USD/JPY?

USD/JPY has been trading within a rising channel since the beginning of the month, hitting a 23-year high of 135.50 overnight, before easing lower.

Despite the pullback, the price remains within the rising channel supporting the bullish outlook.

The pair is testing the 20 sma, with a break below here opening the door to 134.00 the rising channel support. A break below here could suggest that a near-term top has formed.

On the upside immediate support is seen at 135.10 ahead of 135.50 the 2-decade high and mid-point of the channel, ahead of 136.00 round number and 137.3 the upper band of the rising channel.

Oil steady ahead of Fed rate decision, EIA inventories

Oil prices are holding steady after earlier losses after the US said it was selling 45 million barrels from its strategic reserves as part of the historic SPR sale previously announced by the Biden administration.

Oil prices are instead holding steady ahead of the Fed rate decision as hot inflation has raised the prospect of a 75-basis point hike.

An aggressive Federal Reserve will raise concerns that the US economy is heading for a recession, which will weaken demand. The move may also push investors away from riskier assets such as oil toward safe-havens.

Further COVID breakouts in China are adding to the downbeat mood towards oil. Although OPEC+ stuck to its forecast that global oil demand will exceed pre-pandemic levels in 2022.

API data revealed a build of 0.736 million barrels for the week ended June 10. EIA data is due later.

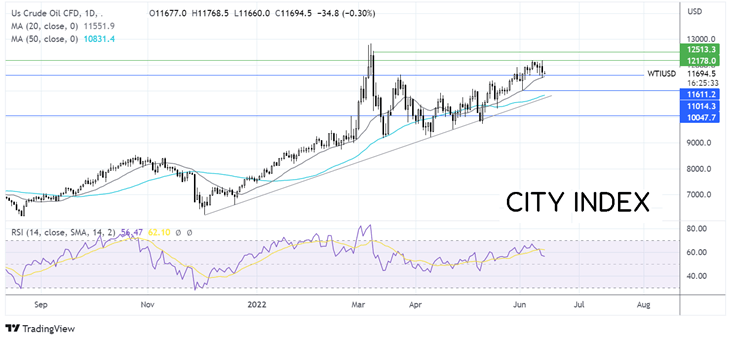

Where next for WTI crude oil?

WTI oil found support on the 20 sma at 115.00 and rebounded higher, retaking 116.30 the March 24 high.

The RSI remains in bullish territory, suggesting that there could be more upside. Should support hold, the price could aim back towards 122.00 the June high.

Failure for the support to hold could see oil prices head back towards 110.00 the June low which would create a lower low and expose the 50 sma the 50 sma 108.60.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade