Market Brief: Will “Turnaround Tuesday” be Short-Lived?

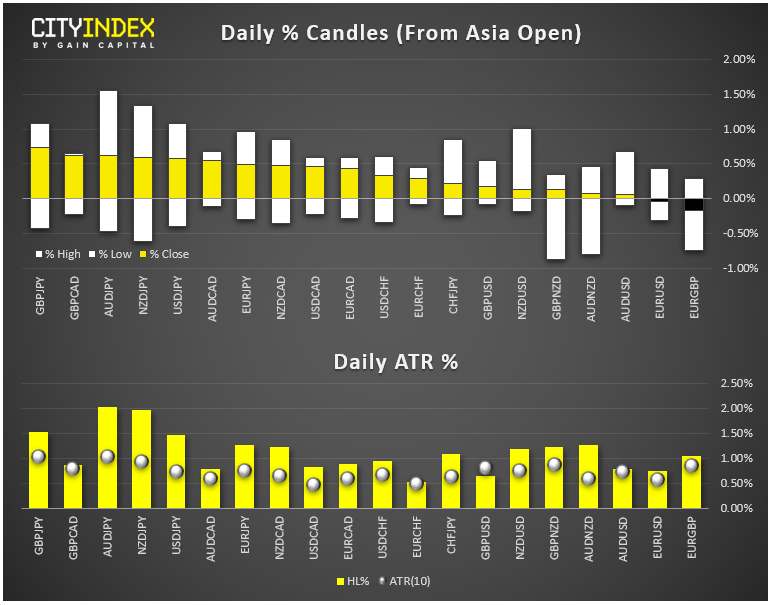

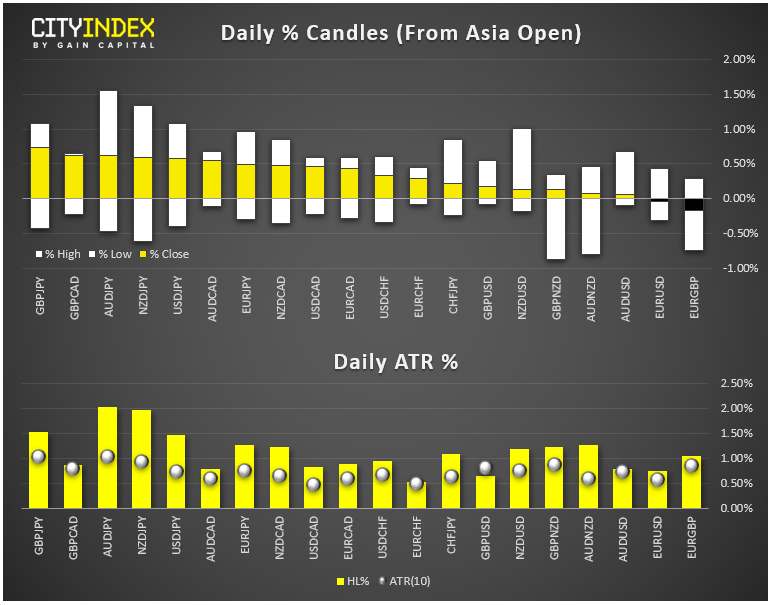

- FX:The loonie was the weakest major currency as Canadian traders returned to their desks after a holiday yesterday; a nearly 2% drop in oil prices didn’t help matters. The pound sterling was the strongest major currency on the day.

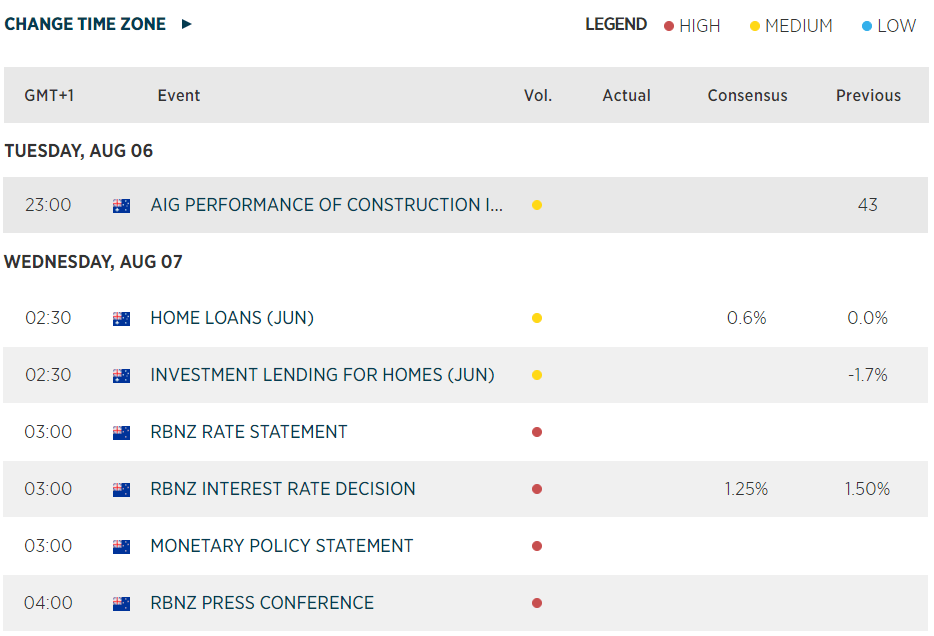

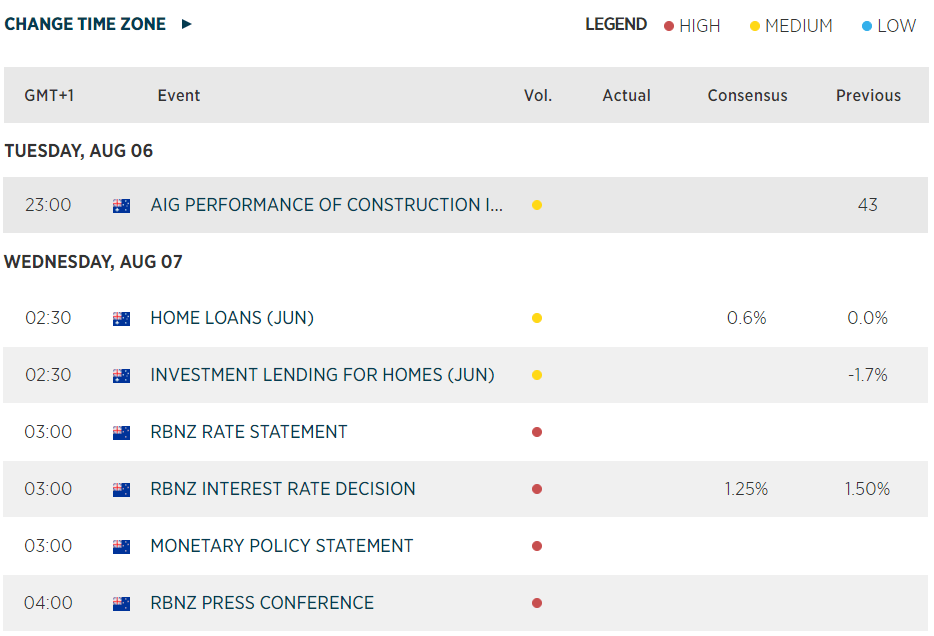

- Traders are looking ahead to a likely interest rate cut from the RBNZ in this morning’s Asian session trade.

- AUD/JPY bounced back today, but the longer-term downtrend remains intact.

- Commodities: Gold nudged higher in quiet trade to peek above $1480.

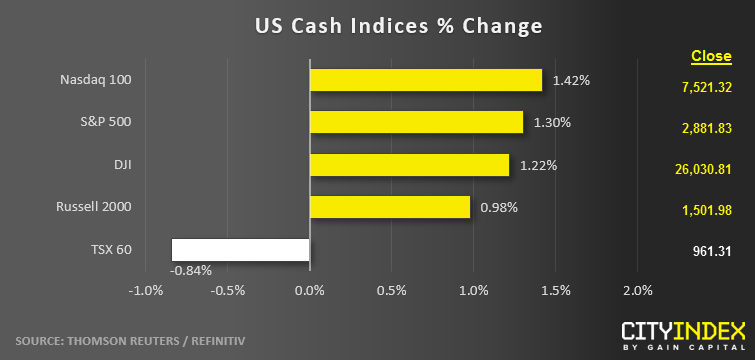

- US indices recovered some of yesterday’s big losses after China opted not to weaken its currency as much as some analysts had feared. Talk of the next round of US-China trade negotiations continuing as planned in early September and PBOC assurances about the value of the yuan contributed to calming traders’ nerves.

- That said, long-term bond yields finished flat on the day, suggesting that bond traders are skeptical of today’s “Turnaround Tuesday” price action.

- Technology (XLK) was the strongest sector on the day, while Energy (XLE) was the weakest (and the only sector to trade lower).

- Stocks on the Move:

- Shake Shack (SHAK) rose nearly 15% after beating earnings estimates and raising full year guidance.

- Video game company Take-Two (TTWO) tacked on 3% after earnings.

- Aurora Cannabis (ACB) gained 8% after issuing strong guidance for the rest of the year.

- Chesapeake Energy (CHK) dumped 11% to hit its lowest level in 20 years after a bigger-than-expected quarterly loss.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM