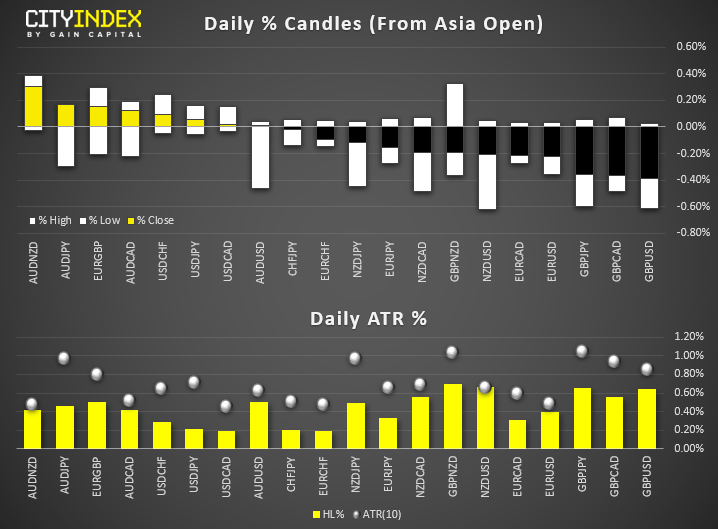

- USD remained firmly in control throughout the session and is today’s strongest major. DXY hit its highest level since May 2017 and EUR/USD has broken trend support after hitting new lows. GBP and NZD are currently the strongest major, weighed down by Brexit developments and trade concerns, respectively.

RBA held rates at 1% as widely expected, AUD pared most losses it sustained heading into the meeting but remains above key support ahead of tomorrow’s key GDP data. - Australia posted their first current account surplus since the 1970’s today, as exporters enjoyed stronger sales last quarter. Analysts expect this could add 0.6 percentage points to Q2 GDP. However, retail sales declined by -0.1%, it’s first negative print in 11 months to underscore sluggish consumer consumption. Vehicle sales also dropped 11.5% in August.

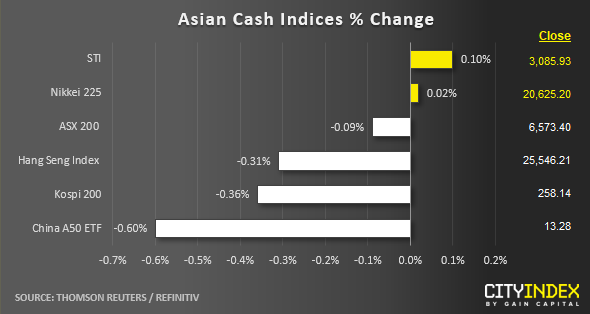

- A mixed picture for equity markets saw shares in Japan and Singapore trade higher, whilst Chinese shares traded in the red.

- Minor ranges overall and traders are waiting further direction from US traders returning from the long weekend.

- NZD50 closed to a fresh record high, the ASX200 traded lower for the session with today’s RBA statement lacking a dovish tone.

Up Next:

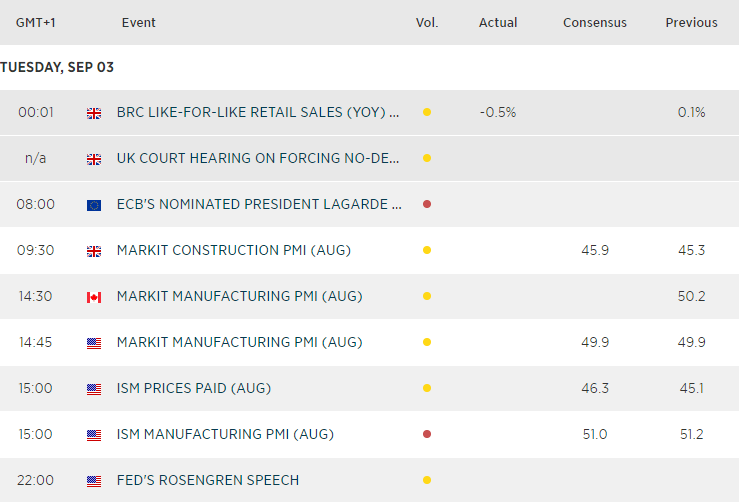

- Traders in the US and Canada return to their desks after the 3-day weekend

- Markit and ISM release manufacturing PMI data for the US, with the former expecting it to remain just within contraction mode. ISM remains expansive (above 50) but is expecting to soften slightly to 51 from 51.2 prior, yet we could expect quite a market reaction should ISM dip below 50 as these reads are considered leading indicators for GDP (and therefore, Fed policy). Keep USD, gold and US indices on your radar. View more in Friday’s Week Ahead post

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM