Gold has not enjoyed a stellar run recently, sliding on the back of rising real US bond yields and resurgent US dollar. That move continued Tuesday following the release of strong US retail sales for July, reinforcing the view the US may experience a soft economic landing, or perhaps no landing at all, renewing concern that the Federal Reserve may need to continue hiking interest rates.

A glimmer of light for gold bulls

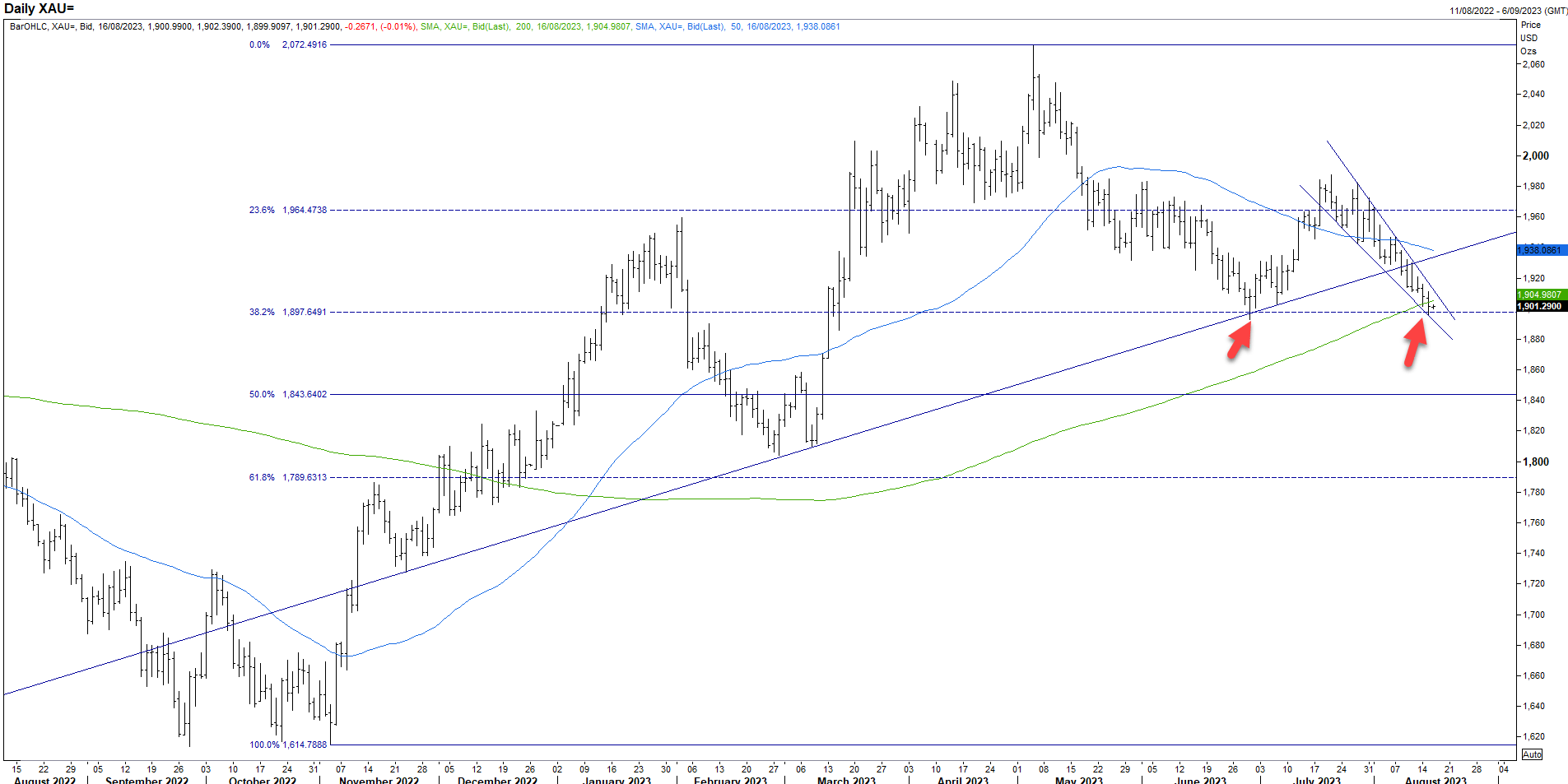

The report saw gold close below its 200-day simple moving average for the first time since December, maintaining the downtrend it’s been stuck in during August. But as was the case in June, buyers stepped as bullion lurched below US$1,900, seeing prices tag a low US$1,895.50 before rebounding higher. The bounce corresponds with the 38.2% retracement Fibonacci retracement of the November-May move, suggesting this level may be one to watch for clues as to where gold may head in the short-to-medium term.

Two-year US note yields stall above 5% again

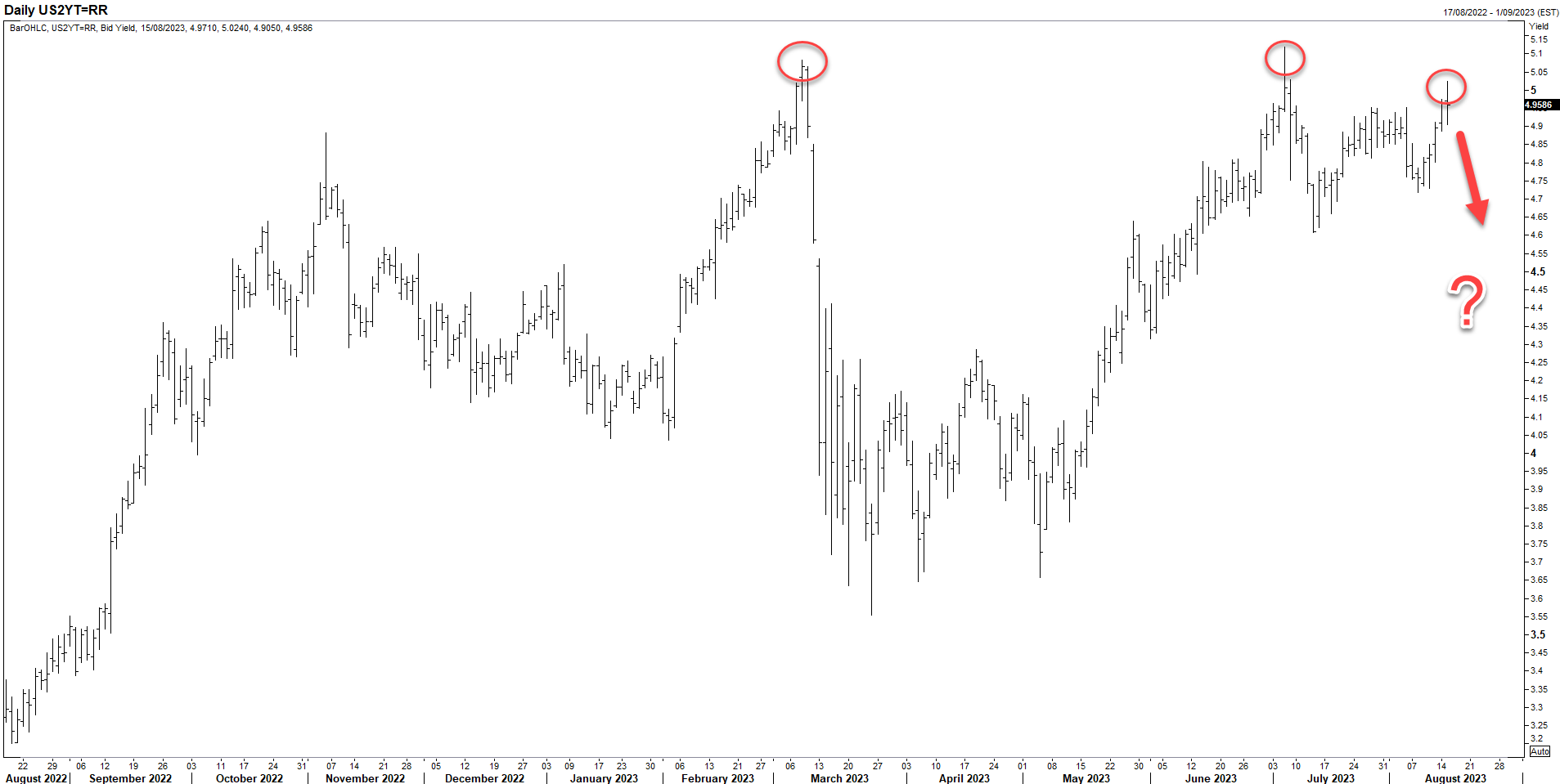

Along with the bullion price action, it may also be useful to keep an eye on 2-year Treasury notes given the role yield differentials have played in supporting the US dollar recently, hitting assets priced in dollars, especially those with little to no yield. Despite the latest retail spending figures only enhanced the case for the greenback given the strength contrasts significantly with weakness in other parts of the world, it’s noteworthy 2-year yields could not sustain a move above the 5% level on Tuesday, adding to the failures seen in March and July this year.

Peak yield tailwinds in for USD?

It makes you ask whether we’ve seen peak yield tailwinds for the US dollar given the inability for nominal yields to push meaningfully higher? If that is the case, it suggests we may see some reprieve for recently beaten down assets in the short-term; think not only gold but currencies such as the JPY and AUD.

Looking ahead, the release of the minutes from the Federal Reserve’s July FOMC meeting are likely to go some way when they are released later in today’s session.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade