- GBP/USD outlook: Next week US data will include GDP and PCE inflation

- Pound supported as UK services returns to growth

- GBP/USD technical analysis point higher

The GBP/USD was on course to finish higher for the second consecutive week, boosted by stronger UK data and ongoing weakness in US dollar. After a dip to 1.2450 in mid-week, the cable hasn’t looked back much, as buyers have come in to defend broken resistance levels. The pound has been boosted this week by stronger-than-expected PMI data, while the dollar has remained largely out of favour owing to the “peak interest rates” narrative.

This week saw a relatively light data calendar. The significance of the FOMC minutes was diminished by the preceding week's subdued CPI and PPI figures, coupled with an increase in jobless claims. Collectively, these data points tempered the impact of recent hawkish statements from the Federal Reserve, maintaining downward pressure on yields. As global stock markets gained ground on the belief that major central banks are leaning toward a more dovish approach, and with indications of global inflationary pressures gradually easing, this has further disheartened those bullish on the dollar.

GBP/USD outlook: Next week US data will include GDP and PCE inflation

The focus will remain on data and next week we have at least two important macro pointers to look forward to from the world’s largest economy.

The preliminary estimate of the US GDP for the third quarter is scheduled for release on Wednesday, November 29, at 13:30 GMT. Despite being labeled as "preliminary," it is not the first estimate (i.e., advanced). If there is a significant revision from the initial estimate of a 4.9% annualized growth reported last month, it could have an impact on the markets. The previous estimate exceeded expectations, leading to a positive response in the US dollar. The question now is whether we will observe a similar reaction this time, or if the markets are more focused on forward-looking data, considering that GDP information is now a couple of months old.

On the following day, Thursday, the core PCE price index is set to be released at 13:30 GMT. Given that the US headline CPI readings were below expectations, softening the Federal Reserve's hawkish stance prior to the report, traders are now interested in seeing if this trend persists in the upcoming PCE inflation figures. This is crucial for maintaining the belief that the Fed might decrease interest rates in the coming year. The core PCE is typically the Fed's preferred inflation metric due to its lower volatility compared to traditional CPI measures. Therefore, a stronger core PCE reading could negatively impact risk appetite, strengthen the US dollar, and prompt traders to reconsider their expectations of an earlier-than-expected rate cut in 2024. A +0.2% reading or lower would likely align with the current market narrative of peaking interest rates and a potential rate cut in the first half of 2024, potentially weakening the US dollar and supporting risk assets.

Pound supported as UK services returns to growth

The GBP/USD found support earlier this week after the UK's services sector experienced an unexpected increase, surpassing the expansion threshold of 50.0 in November, as reported by surveyed purchasing managers in the industry. The PMI recorded a reading of 50.5, exceeding both the anticipated 49.5 and the previous figure. Although the manufacturing sector remained in contraction at 46.7, the pace was less concerning than the previous month's 44.8 and surpassed expectations of 45.0.

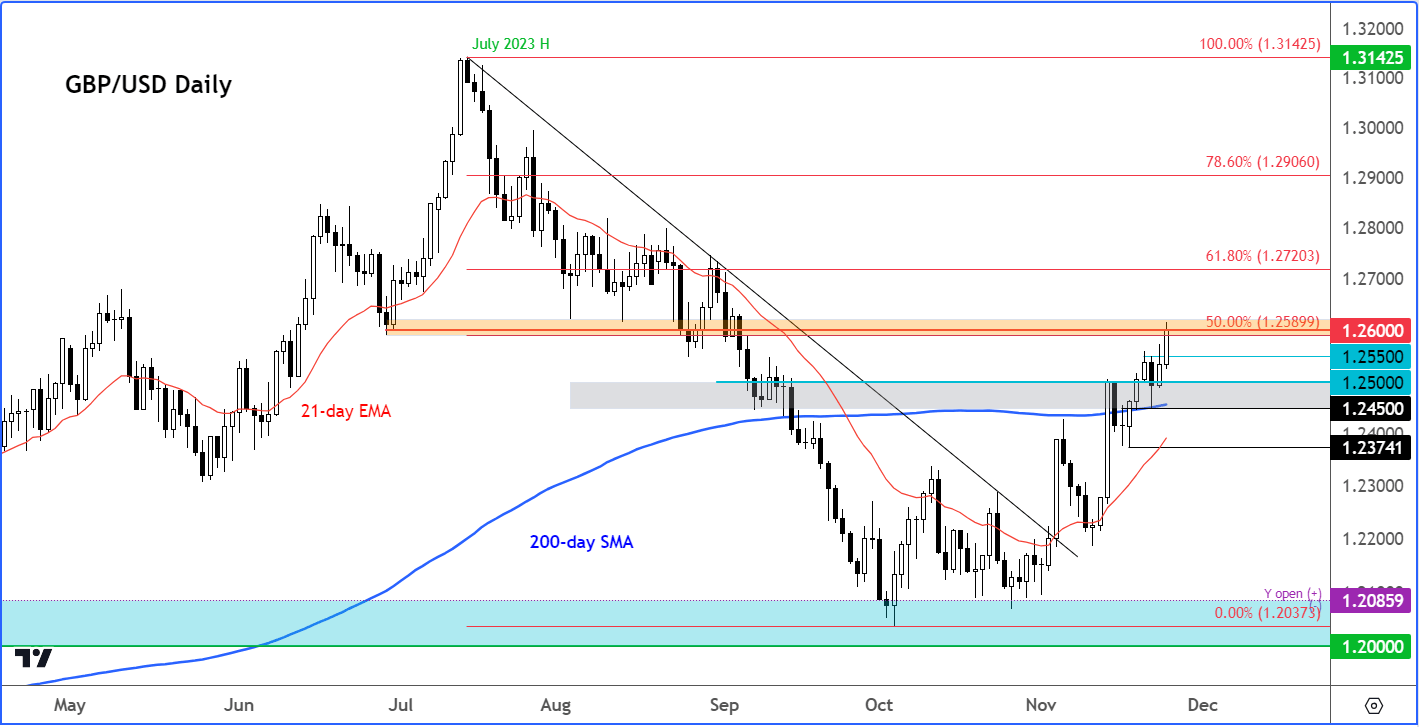

GBP/USD outlook: Technical levels to watch

Source: TradingView.com

The higher highs and higher lows in the GBP/USD observed over the past few weeks means momentum is with the bulls as we head towards the end of what has been a largely quiet week for global markets.

Next week, the key support levels that the GBP/USD will need to defend will be around 1.2550, followed by 1.2500. The line in the sand is now around 1.2450, the base of the latest rally and where we have the 200-day average coming into play. If the cable were to break below this level, this would be a bearish development.

On the upside, the area around 1.2600 is important to watch, given that it was the previous support area. Price has tested this level today and so far, we haven’t seen a major reaction. Let’s see what the early parts of next week bring. If the rally gets extended then 1.2720 will be the next major upside target, where the 61.8% Fibonacci retracement level lies.

Video analysis: FTSE, Silver, EUR/USD, USD/CAD and NZD/USD

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade