FX Brief: Tight Ranges Ahead Of Key Data

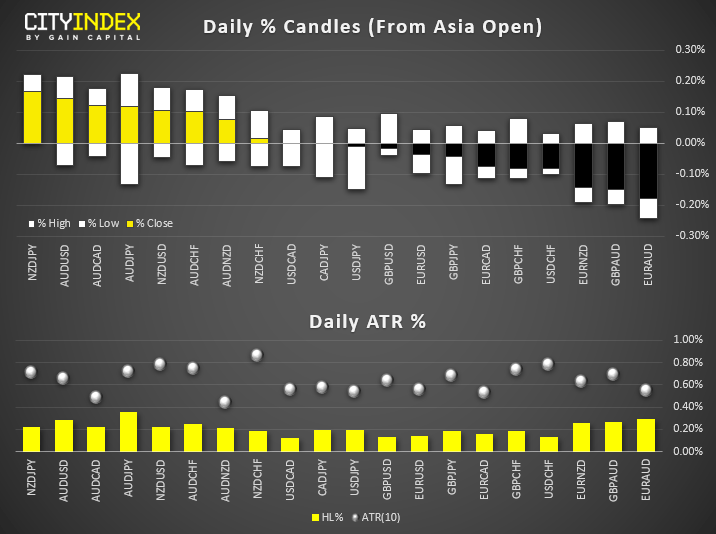

- Very minor ranges across FX markets so far, as traders eagerly await RBA’s meeting up at half past the hour.

- Index futures are slightly higher, gold remains near yesterday’s lows and beneath $1,390 after its most bearish day in a year.

- On trade, the US government turned their attention to Europe and threatened tariffs of a $4bn on European goods. Trump also said any trade deal with China would have to be tilted towards the US side.

- China’s Premier Li Keqiang pledged to lower rates and use RRR cut to help smaller businesses, and ‘not resort to currency devaluation’.

- NZ business confidence plunged to its most pessimistic level since March 2009. 34% of businesses expect conditions to deteriorate, compared with 29% last quarter. Building consents jumped +13.2% in May.

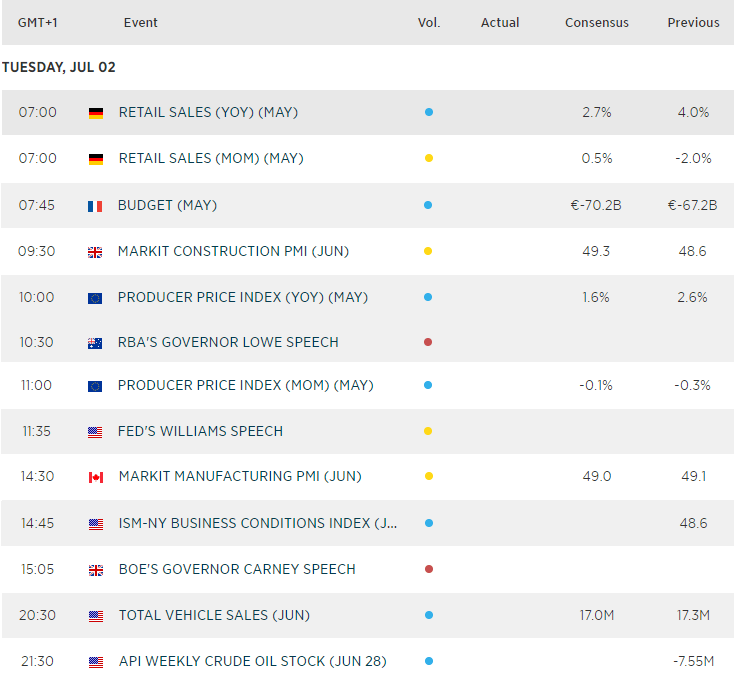

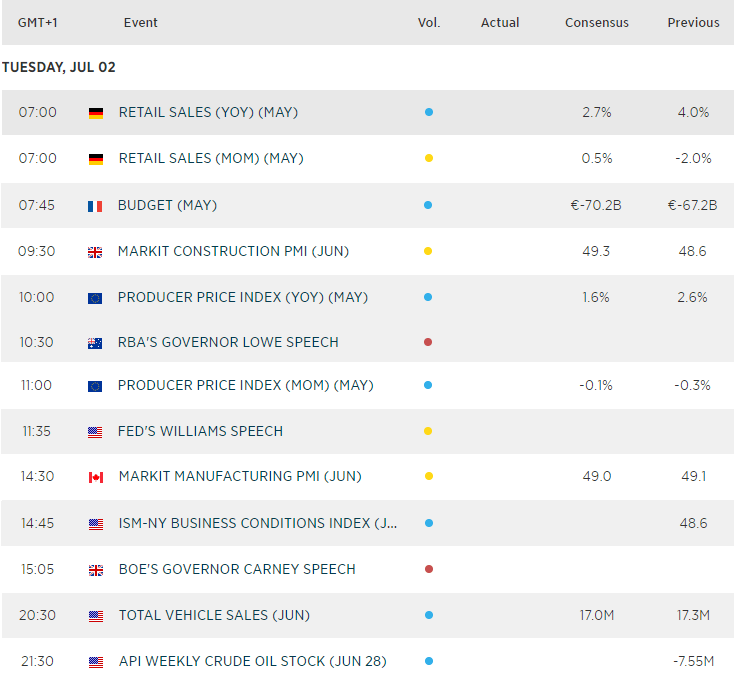

Up Next:

- RBA are expected to cut rates in just under 30 minutes. Although if recent history is anything to go by, we may need to wait for Philip Lowe to deliver the dovish message when he speaks later today.

- EU producer prices are expected to soften to 14-month low, potentially adding further fuel to the dovish (Euro bearish) fire.

- Global PMI has largely disappointed this week, so concerns of softer global growth are resurfacing despite the positive sentiment form the G20. UK construction PMI is polled to contract at a weaker pace – but given the weak lead from elsewhere and the fact it contracted at its fastest pace since November 2012, we have low hopes for a turnaround.

Related analysis:

RBA Preview: AUD/USD Holds Above 70c Ahead Of Expected Rate Cut

Featured Trade: Bullish exhaustion seen in AUDJPY ahead of RBA

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM