EUR/USD holds above 1.07 ahead of ECB Lagarde & Powell’s speech

- Hawkish comments from ECB Chief economist support EUR

- Recession concerns linger

- EUR/USD holds above 1.07, resistance seen at 1.0750

EUR/USD is holding steady above 1 07 after modest gains in the previous session. Investors wait cautiously for speeches from ECB president Christine Lagarde and Federal Reserve chair Jerome Powell.

The euro found support yesterday from hawkish comments from ECB chief economist Philip Lane. He said that sufficient progress hadn't been made in cooling inflation, suggesting that more interest rate hikes may be needed. Bundesbank President Joachim Nagel and Ireland central bank chief Gabriel Makhlouf also supported the view that further rate hikes shouldn't be ruled out.

Attention will be on ECB president Christine Lagarde for her views on the future path of interest rates. At the ECB’s October meeting, the central bank left interest rates on hold and hinted that it may be done hiking rates given the deteriorating economic outlook for the region.

Recent macroeconomic indicators, including PMIs have fueled concerns that the euro area could tip into recession in the final quarter of the year.

The ECB's economic bulletin will also gain interest with the central bank's views on the economy, inflation, and monetary policy in focus.

Meanwhile, the US dollar is holding steady against its major pairs after four days of gains, boosted by hawkish Federal Reserve commentary.

Attention will be on Federal Reserve chair Jerome Powell, who is due to speak, as well as US jobless claims.

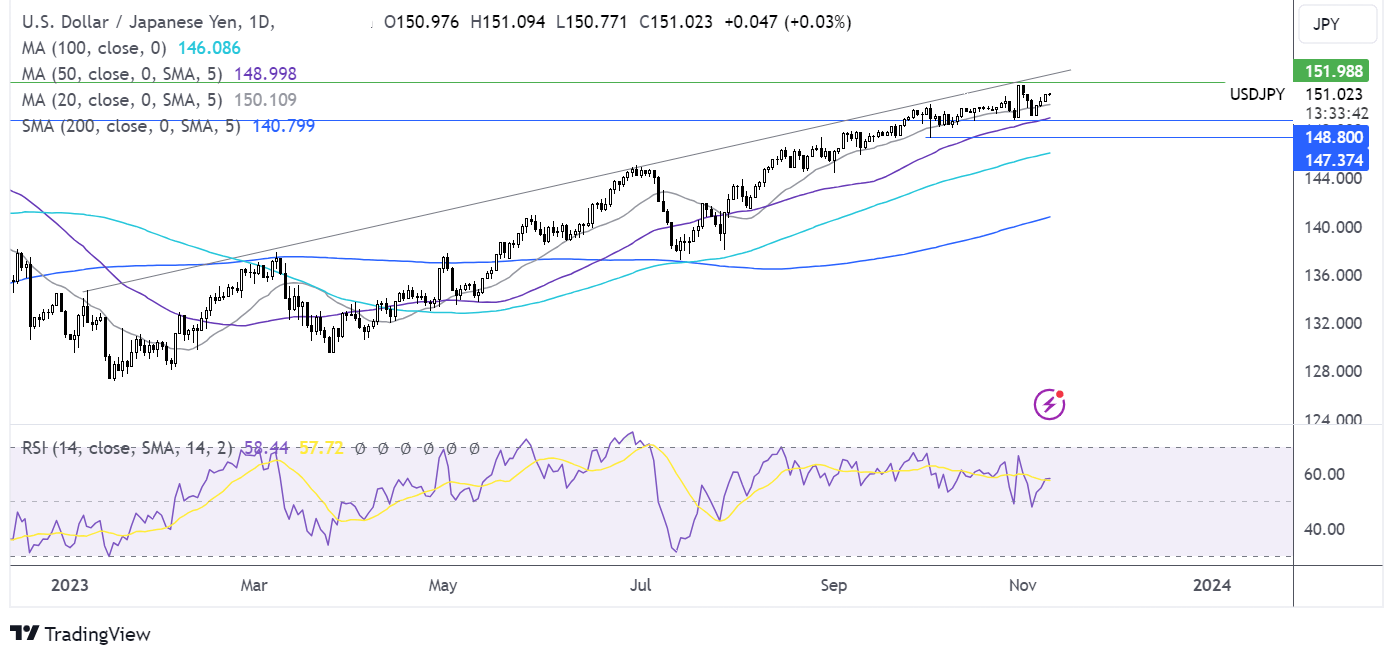

EUR/USD outlook -technical analysis

EUR/USD ran into resistance at 1.0755, the top of the rising channel and the price eased lower. The RSI supports further upside while it remains above 50 and out of overbought territory.

Buyers will look for a rise above 1.0750 to create a higher high and expose the 200 sma at 1.08 before bringing the September high of 1.0880 into focus.

USD/JPY on intervention watch ahead of Fed Chair Powell & jobless claims

- Hawkish Fed comments boosted the USD this week

- US jobless claims are set to rise to 218k from 217k

- USD/JPY grinds higher to 151.00

USD JPY is holding steady at 151, with the yen on intervention watch once again.

The pair has risen for the past three days as Federal Reserve speakers have pushed back on expectations that the Fed is done hiking interest rates.

Fed officials such as Michelle Bowman and Neel Kashkari supported the possibility of additional rate hikes owing to sticky inflation and the resilience of the US economy.

Their comments come after a perceived dovish tilt from the FOMC meeting last week and weaker than expected US non-farm payrolls.

Federal Reserve chair Jerome Powell didn't comment on interest rates or the economy in his appearance yesterday. Investors will be watching again today for any clues over the future path of interest rates.

Policymakers are walking a fine line, given the Fed cited tighter financial conditions due to higher treasury yields as a reason for not needing to necessarily raise rates further. However, any sense that the Fed has finished hiking could bring yields lower wiping out that benefit.

In addition to Federal Reserve chair Powell, US jobless claims will also be in focus and are expected to tick higher to 218K, up from 217K in the previous week.

Meanwhile, continuous claims rose for a sixth straight week, suggesting that the unemployed are having a harder time finding new jobs.

The market will be watching to see where these trends continue. A cooling labour market could support the view that the Fed is done hiking, which could pull the US dollar.

Meanwhile, the yen has broadly shrugged off comments by Bank of Japan's chief Ueda as he acknowledged that firms were actively raising prices and wages, which would help Japan move towards sustainably hitting the central bank's 2% inflation target. However, he said any exit from the ultra-dovish policy would need more data to show that targets have been met.

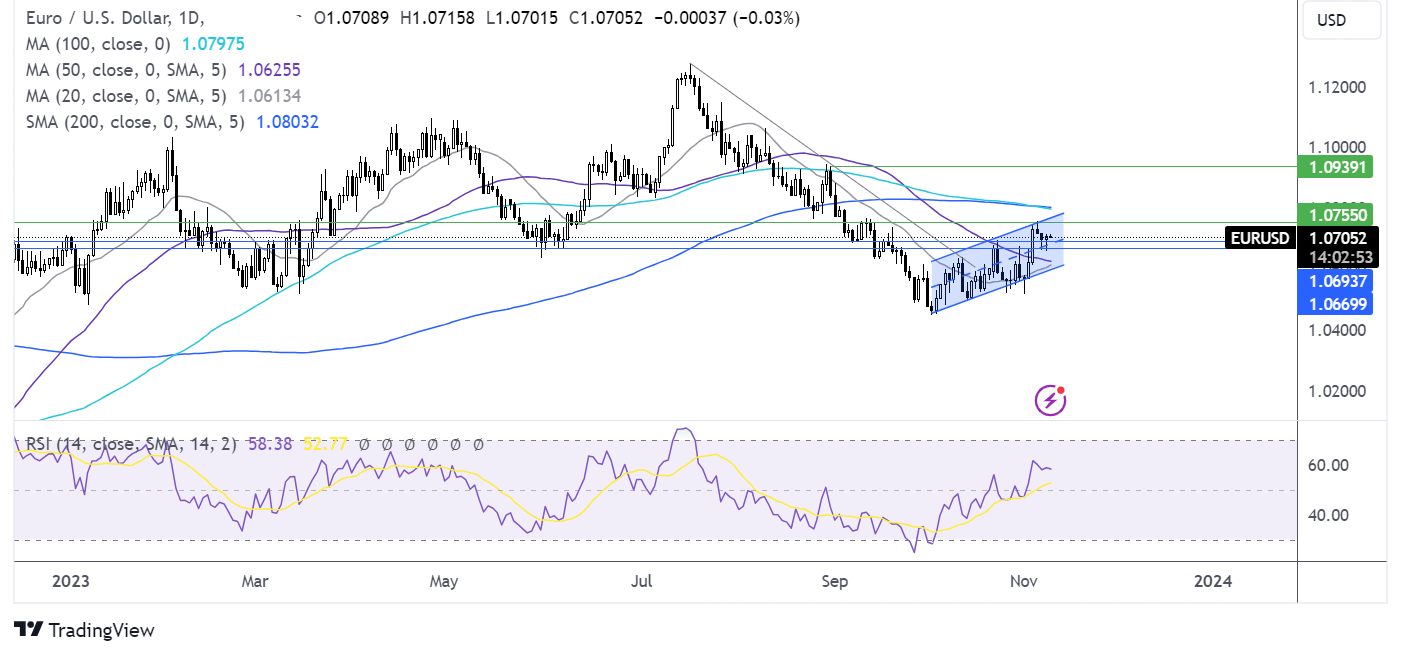

USD/JPY outlook – technical analysis

USD/JPY once again found support around the 50 sma and has risen back above the 20 sma tgo 151.00.

The moving averages and the RSI support a move high, which could help the pair grind northwards to 151.70 the October high ahead of 151.96, a level last seen 33 years ago.

Strength in the yen could see USD/JPY test the 20 sma at 150.00 the psychological level, ahead of 149.00 the 50 sma and the November low.