EUR/USD inches higher but lacks conviction

- USD volumes low due to holiday-thinned trading

- Eurozone PMI & FOMC minutes in focus this week

- EUR/USD tests 100 SMA resistance

EUR/USD is inching higher but lacks conviction and remains below 1.08.

The USD is falling modestly in holiday thin trading as U.S. markets will remain closed in observance of the President’s Day holiday.

Meanwhile, there is no high-impacting Eurozone economic data to be released today; instead, investors are looking ahead toward eurozone PMI figures and the FOMC minutes, which will be released later in the week.

The pair continues to struggle after data on Friday showed that US PPI was hotter than expected, causing investors to continue reining in Fed rate cut expectations. Last week, Federal Reserve Chair Jerome Powell also said that the central bank wants to see more evidence that inflation is trending towards 2% before it considers cutting rates.

ECB president Christine Lagarde struck a similar chord when she spoke last week, warning of the risks of cutting interest rates too soon. The market is now expecting 110 basis points worth of cuts from the ECB this year, down from 150 basis points previously expected just over a week earlier.

Well, both central banks are attempting to push back on rate-cut expectations; divergence between the two economies is keeping the euro under pressure. The gloomier eurozone economic outlook could result in the ECB cutting interest rates ahead of its US counterpart.

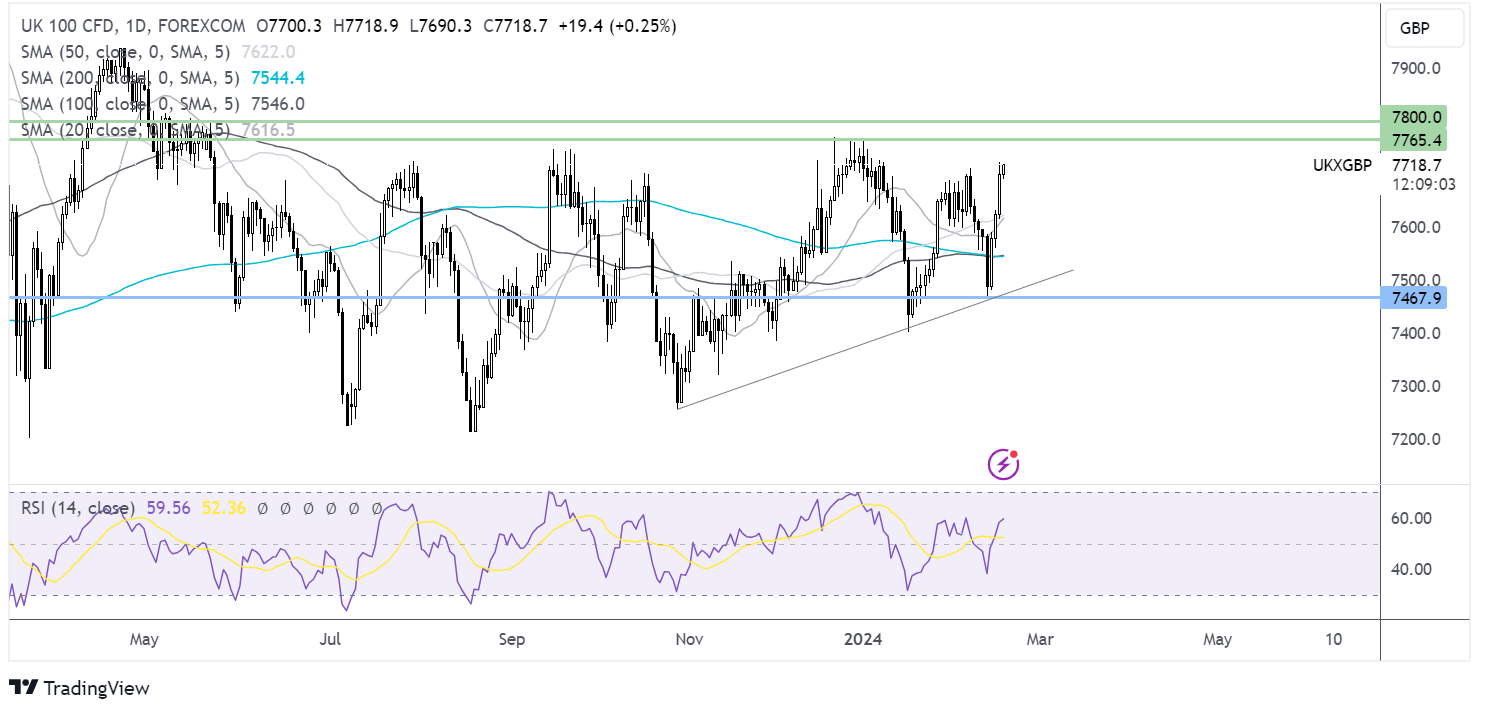

EUR/USD forecast – technical analysis

EURE/USD trades within a falling channel, the price ran into support at 1.07 and has rebounded higher.

The price is testing the 100 SMA dynamic resistance at 1.08. Encouraged by a bullish crossover on the MACD buyers will need to rise above 1.08 to expose the 200 SMA at 1.0830. A rise above here brings 1.09, the February high into focus.

Failure to rise above the 100 SMA could see sellers retest support at 1.07, with a break below here needed to create a lower low.

FTSE struggles to extend gains as miners falls

- Miners drop after mixed China data

- FTSE volumes are low amid a lack of data & due to US holiday

- FTSE hovers around a monthly high

The FTSE is struggling for direction and the start of the week with no market-moving economic data in the UK and volumes at around 15% lower than average as the US is closed for a public holiday.

The FTSE is holding steady as investors weigh up hopes of interest rate cuts by global central banks and as miners come under pressure following mixed data from China.

On the one hand, recent figures concerning the Lunar New Year holiday were encouraging as official figures revealed signs of a revival in domestic tourism and consumption. However, deflation and ongoing stresses in the property market mean a sustainable recovery in the service sector remains uncertain. Additional policy easing may be needed to improve household finances and boost demand; however, the People Bank of China left rates on hold.

Also hurting the miners was news that foreign businesses' direct investment into China increased at the slowest pace since the early 1990s, highlighting challenges Beijing faces as it looks to bring more overseas funds into the economy.

Elsewhere, Curry’s shares surged by a record amount after rejecting a takeover offer, and another possible suitor came forward for the electronics retailer.

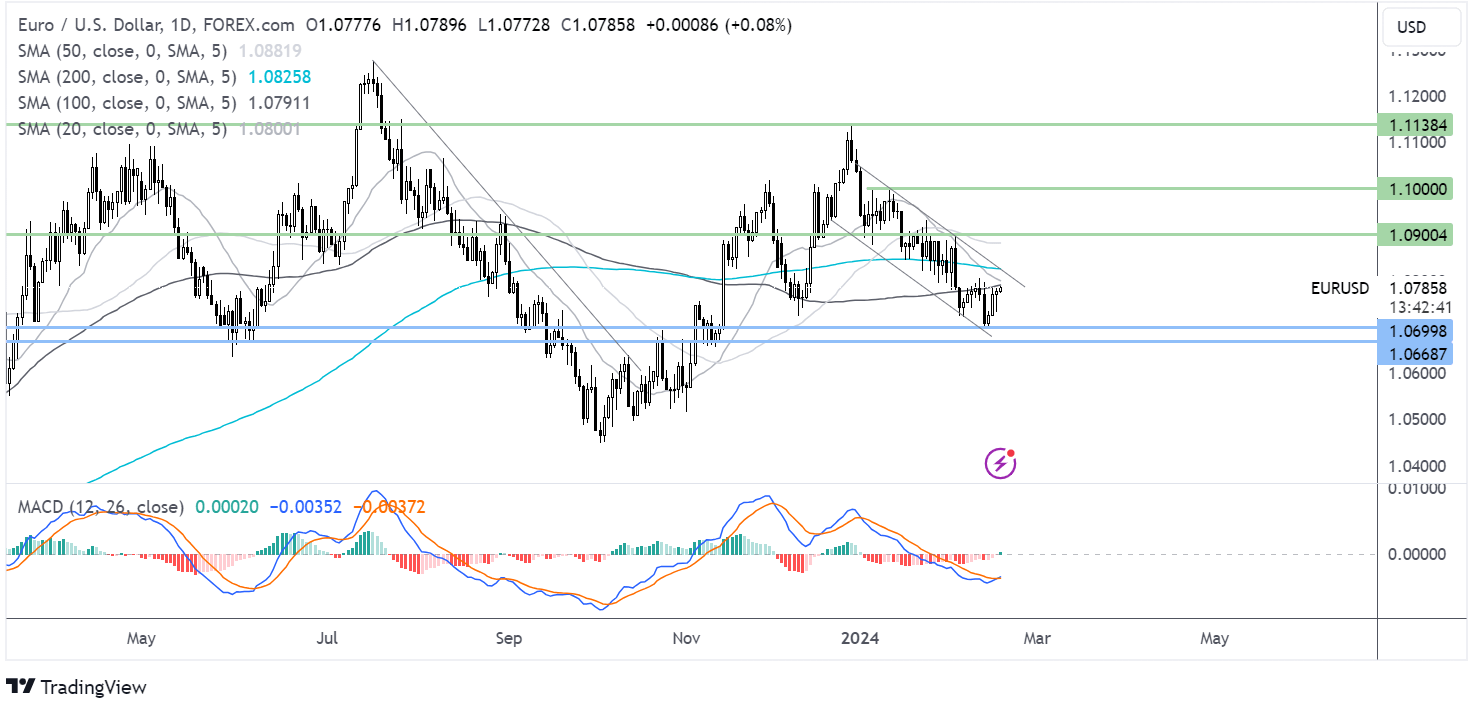

FTSE 100 forecast – technical analysis

FTSE created a higher low last week, before rebounding above the 200 SMA and 7700 a monthly peak. This combined with the RSI above 50 keeps buyers hopeful of further upside.

A meaningful rise above 7700 could see buyers target 7760 to December high ahead of 7800.

Meanwhile, sellers need a close below the 200 SMA at 7540 to regain control and bring 7460 the February low into focus.