EUR/USD Breaks Near-Term Bearish Channel, Bulls Eye 1.10 Next?

Global markets are in the midst of a classic “Turnaround Tuesday” as we go to press, with US index futures trading near “limit up” levels, commodities rallying, and bonds trading lower across the globe.

With little in the way of immediate progress on a “big bazooka” US fiscal package, the UK going on lockdown yesterday evening, and coronavirus cases continuing to rise in Europe and the US, there’s little on the fundamental front to support the bullish reversal yet. While we’ve repeatedly argued that markets will reverse when fundamental data is still ugly (i.e. when traders least expect it), we’re still skeptical that today’s moves will mark a long-term bottom, though we’re always willing to be proven wrong!

Focusing in on the world’s most widely-traded currency pair, there is nonetheless potential for a bigger rally in EUR/USD after an 800-pip shellacking in the past two weeks alone. The mad scramble to buy the US dollar at any costs is taking an apparent breather, helped along by crisis-era measures from the Federal Reserve to open swap lines with other central banks and purchase unlimited amounts of treasuries and MBS “to support smooth market functioning and effective transmission of monetary policy.”

Meanwhile, across the Atlantic, mainland Europe has seen its first release of major post-coronavirus pandemic data from the timely PMI surveys, and the news was ugly, though perhaps not as bad as some analysts had feared. On a headline basis, the manufacturing survey printed at 44.8 for the eurozone, above expectations of a 40.1 reading, though the more important service sector survey came in at just 28.4, well below the 40.0 reading anticipated by traders and economists. The euro’s performance as a top 3 major currency so far today underscores that in this environment, even ugly data can support a market if its better than traders’ low expectations.

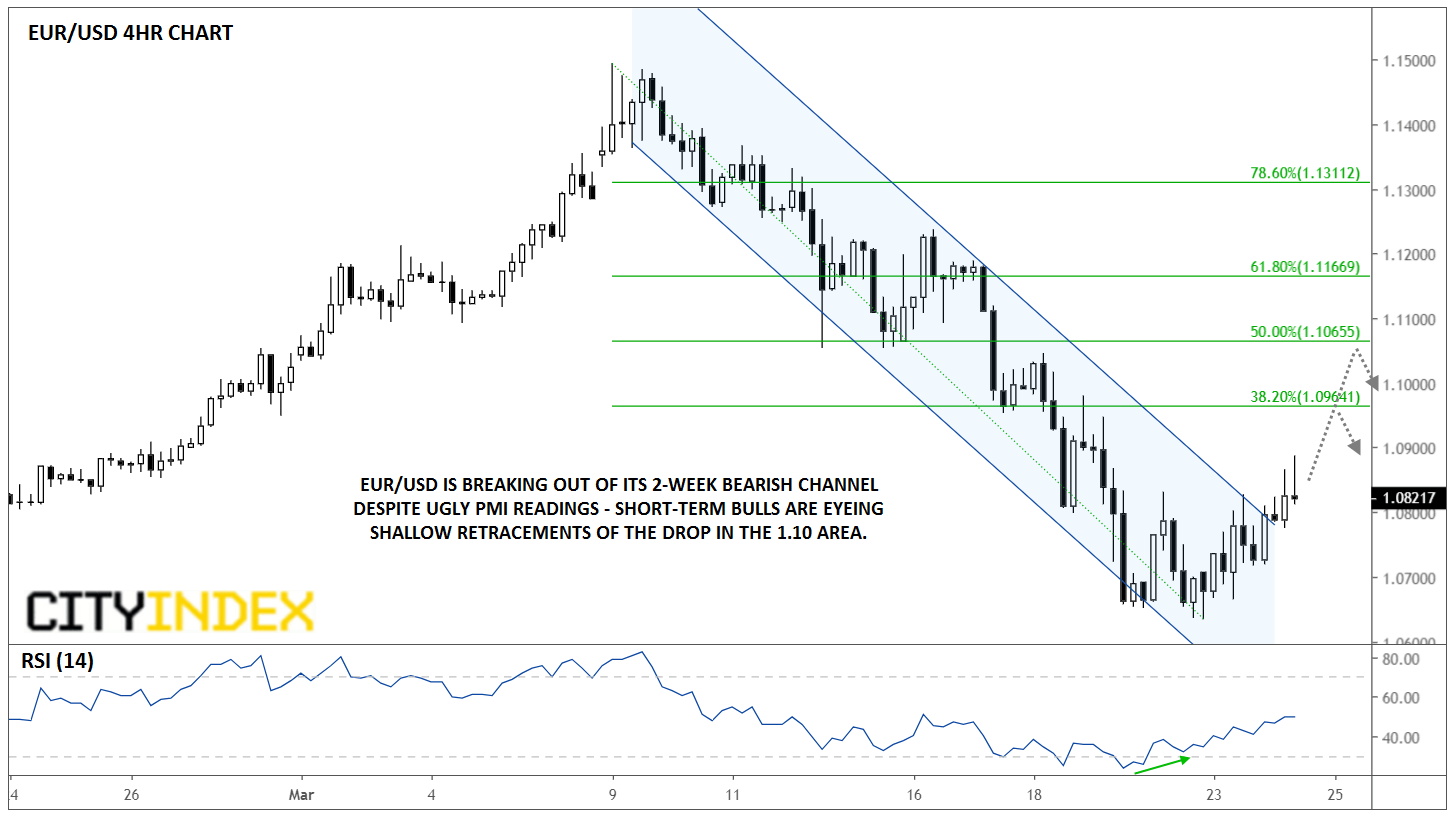

Technically speaking, EUR/USD appears to be rallying out of its two-week bearish channel, though it has yet to reach any of the significant retracements of the mid-March collapse. Given the strong selling pressure of late, bulls may want to consider taking profits quickly while bears will be looking for opportunities to re-enter short positions. Logical levels to watch this week include 1.0960 (the 38.2% Fibonacci retracement of the mid-month swoon), 1.1000 (key psychological resistance) and 1.1060 (the 50% retracement):

Source: TradingView, GAIN Capital