- Euro to dollar analysis: EUR/USD’s ongoing momentum may be enough to ensure it ends 2023 above $1.10 in 2023

- EUR/USD is modestly higher in 2023, thanks largely to US dollar weakness in Q4

- Ongoing Fed rate cut expectations, positive risk appetite and hawkish ECB could support EUR/USD in early parts of 2024

The EUR/USD has faced significant challenges in 2023, but still looks set to close the month and year on a positive note. The euro has gained about 2.3% against the dollar in 2023 in a relatively tight yearly range of just 827 pips, marking a relatively uneventful year for EUR/USD traders. While it added slight gains in the first and second quarters, those were all wiped out in the third quarter. In the fourth quarter, it has managed to recover a significant portion of those losses, although it remains below the year's peak of 1.12375 recorded in July. Persistent weak economic data from the Eurozone has hindered a more substantial rebound for the euro, but it appears poised to avoid a third consecutive year of losses. So, 2023 has been a glass-half-full type of a story for the EUR/USD as we transition to a new year.

Euro to dollar analysis: Can EUR/USD extend its recovery?

Buoyed primarily by a positive sentiment across financial markets and a falling US dollar, the EUR/USD may see a further extension of its recovery in the early parts of 2024, especially if any signs of weakness emerge in US data. Such indications would likely prompt the Federal Reserve to implement rate cuts earlier and more aggressively than initially anticipated. Recent data releases from the US have generally surpassed expectations, raising question marks about the likelihood of the world's largest economy entering a recession. Despite grappling with high inflation and increasing interest rates, the US economy has demonstrated resilience compared to many other regions globally. Nevertheless, the Fed has communicated its intention to cut interest rates about 3 times in the coming year, causing bond yields and the dollar to tumble. If signs of weakness in US economy emerges, then this could further depress bond yields, providing support to risk assets, including the EUR/USD, in 2024.

However, it is important to consider risks facing the EUR/USD and on that front, the is one major caveat in my slightly positive outlook. The risk lies in the possibility of a stronger dollar due to additional signs of resilience in the US economy. In such a scenario, bond yields might not weaken significantly further, reinforcing the attractiveness of fixed income and limiting the upside potential of the EUR/USD.

Meanwhile, on the euro side of the EUR/USD equation, the European Central Bank is likely to remain hawkish in early 2024. At its most recent meeting last week, the ECB resisted expectations of imminent interest rate cuts, reiterating its commitment to maintain rates at record levels. ECB President Christine Lagarde cautioned that inflation could rebound soon, emphasising the need to remain vigilant and stating that "there is still work to be done."

Euro to dollar analysis: EUR/USD technical factors and levels to watch

Source: TradinVIew.com

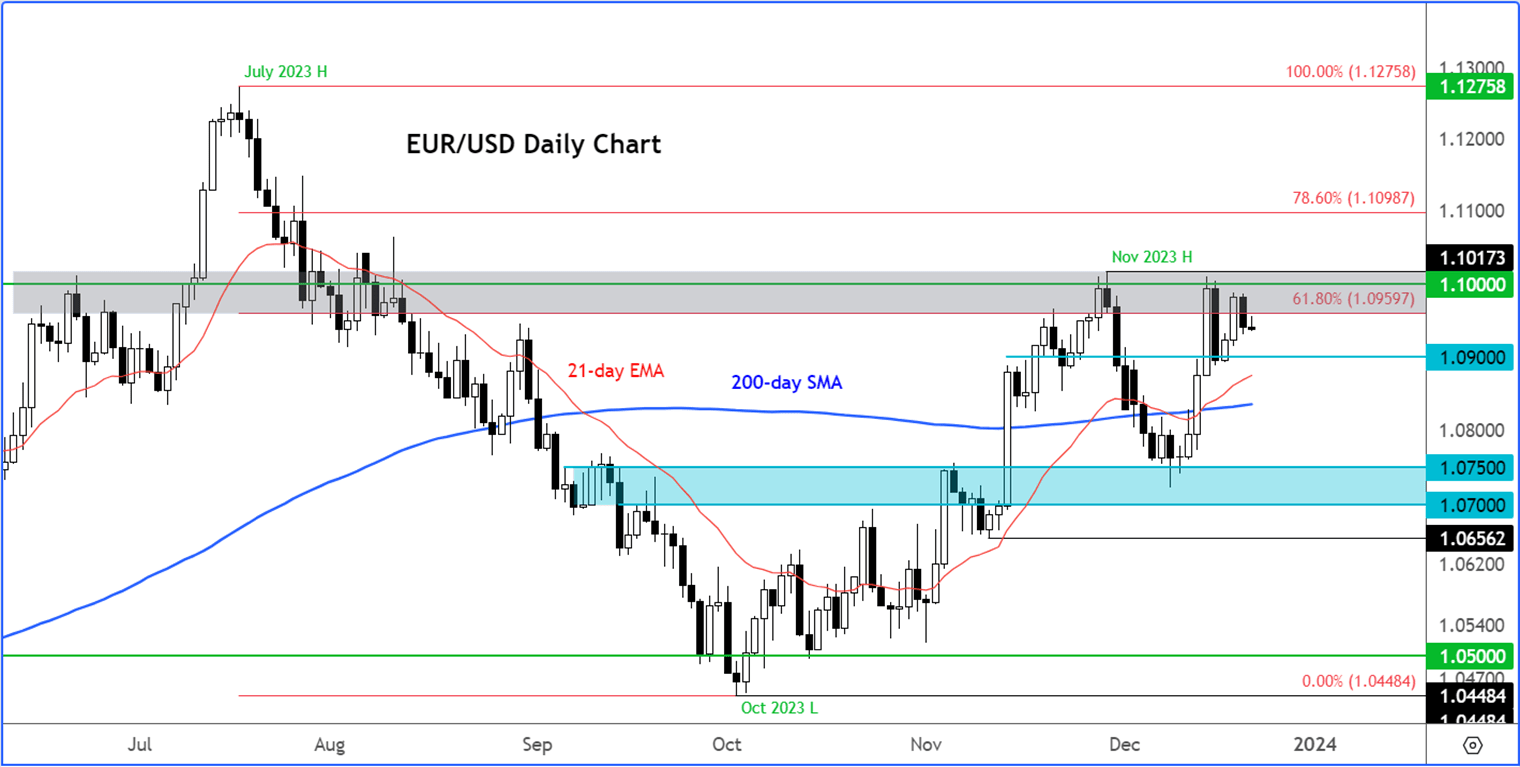

Despite showing some signs of weakness and facing challenges in surpassing the 1.10 area convincingly, the underlying trend of the EURUSD remains bullish. Objective indicators, such as moving averages, indicate a positive trend in rates. Notably, the 21-day exponential average has recently crossed above the 200-day simple average on the chart. Both of these moving averages exhibit positive slopes and are positioned below current levels. In November, it closed up nearly 3% higher, forming a three-bar reversal pattern on the monthly time frame. Furthermore, ever since the EUR/USD bottomed in October at just below 1.0450, you can easily observe higher lows on this daily chart.

Given this technical context, the notion of shorting the EUR/USD is not under consideration until there are signals suggesting otherwise on the charts. The prevailing strategy has been dip-buying, making it more prudent to focus on bullish signals near support rather than becoming excessively optimistic about short-term bearish signals. Indeed, technical signals that have suggested rates have topped, like last Friday’s large bearish candle, have so far failed to lead to any significant downside follow-through. That candle has probably trapped and frustrated a few traders.

Despite displaying indications of weariness, in my view it is more likely that the EUR/USD is positioning itself for a decisive breakout above the key 1.10 resistance level than staging a sharp decline from its current position. The subsequent bullish targets beyond the 1.10 threshold are at 1.1100, representing the 78.6% Fibonacci retracement level from the July peak, and then the July peak itself at 1.1275. However, achieving these levels may require waiting until the early months of 2024.

On the downside, the initial line of defence for the bulls is at 1.0900, followed by the 200-day average at 1.0835. Considering the overall trend of the EUR/USD, I anticipate these levels to offer support and trigger a rebound if reached.

The line in the sand is at around 1.0700 for me. Any move below that level would be a bearish technical development.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade