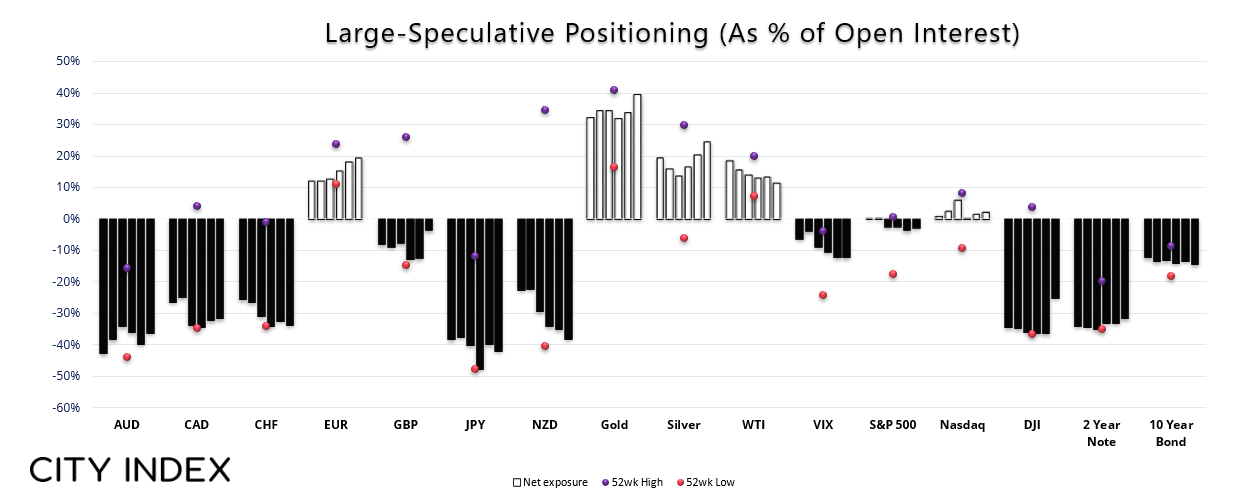

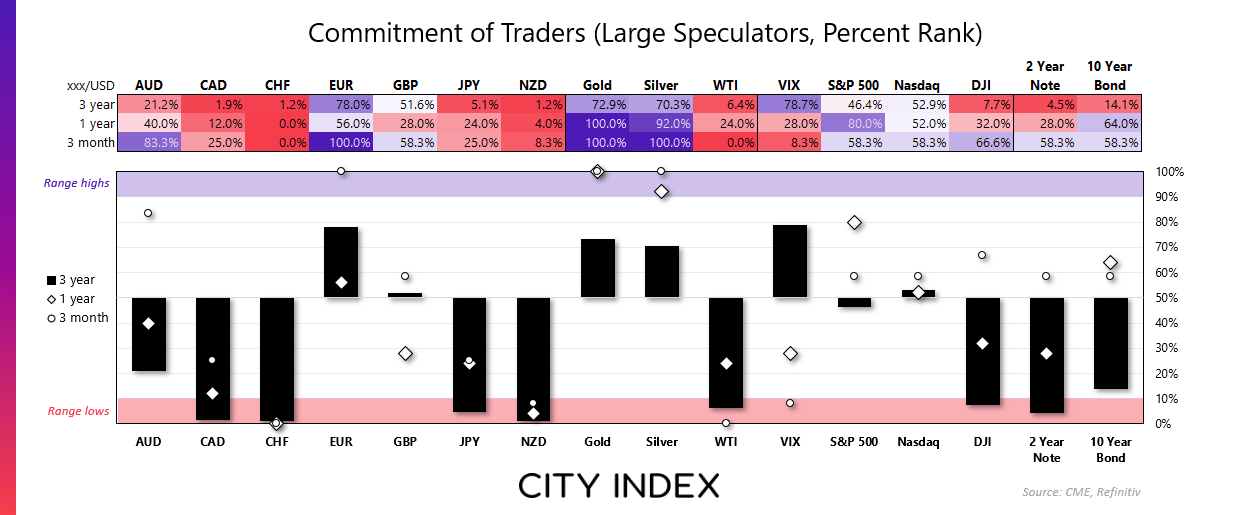

Commitment of traders – as of Tuesday 28th Nov, 2023:

- Large speculators increased their long exposure to GBP futures by 42% last week

- They also increased long exposure to CAD futures by 19% and trimmed shorts by -3%

- Gross-short exposure to US dollar index futures rose by 24%

- Bulls increased their long exposure to NZD futures by 27% ahead of the RBNZ’s hawkish hold last week

- Asset managers flipped to net-long exposure to Dow Jones futures

- Asset managers increased their net-long exposure to Nasdaq futures to a fresh near 8-year high

EUR/USD (Euro dollar futures) positioning – COT report:

Market positioning among large speculators and asset managers repeated the familiar pattern of adding to long exposure while trimming shorts. Yet a slew of weak data including inflation weighed on European bond yields and dragged the euro lower in the second half of the week, which saw EUR/USD formed a bearish outside week.

With markets now pricing in ECB cuts while the ECB already have the lower interest rate compared to the Fed, I suspect the euro has now entered a corrective phase.

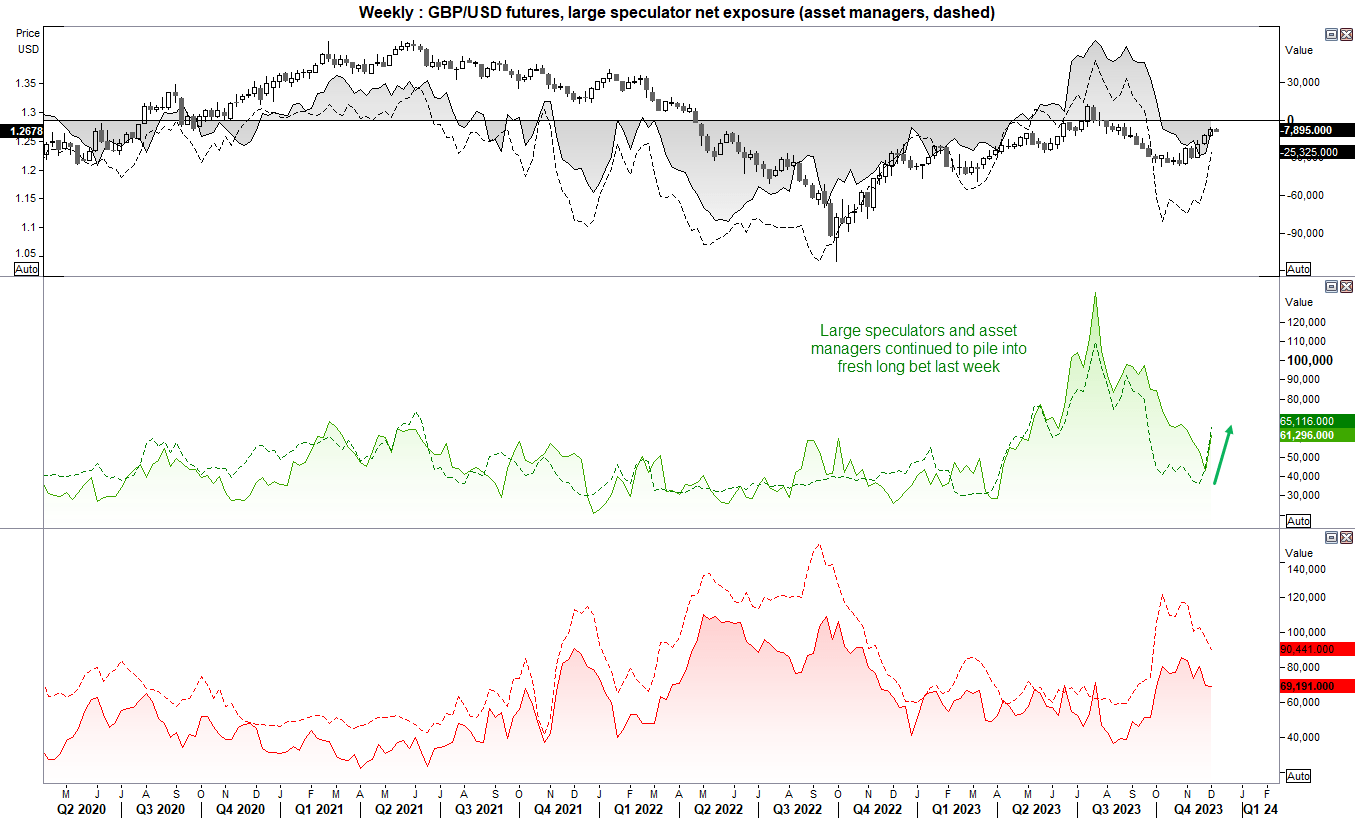

GBP/USD (British pound futures) positioning – COT report:

Hawkish comments from BOE members saw asset managers and large speculator ramp up their bullish bets on GBP/USD futures, which pushed net-short exposure fall to an 8-week low. IN fact large specs increased their long exposure last week by 42%, although shorts remained effectively unchanged at just -207k contracts. With traders pricing in cuts from the Fed, we may see traders flip to net-long exposure on GBP/USD sooner than later.

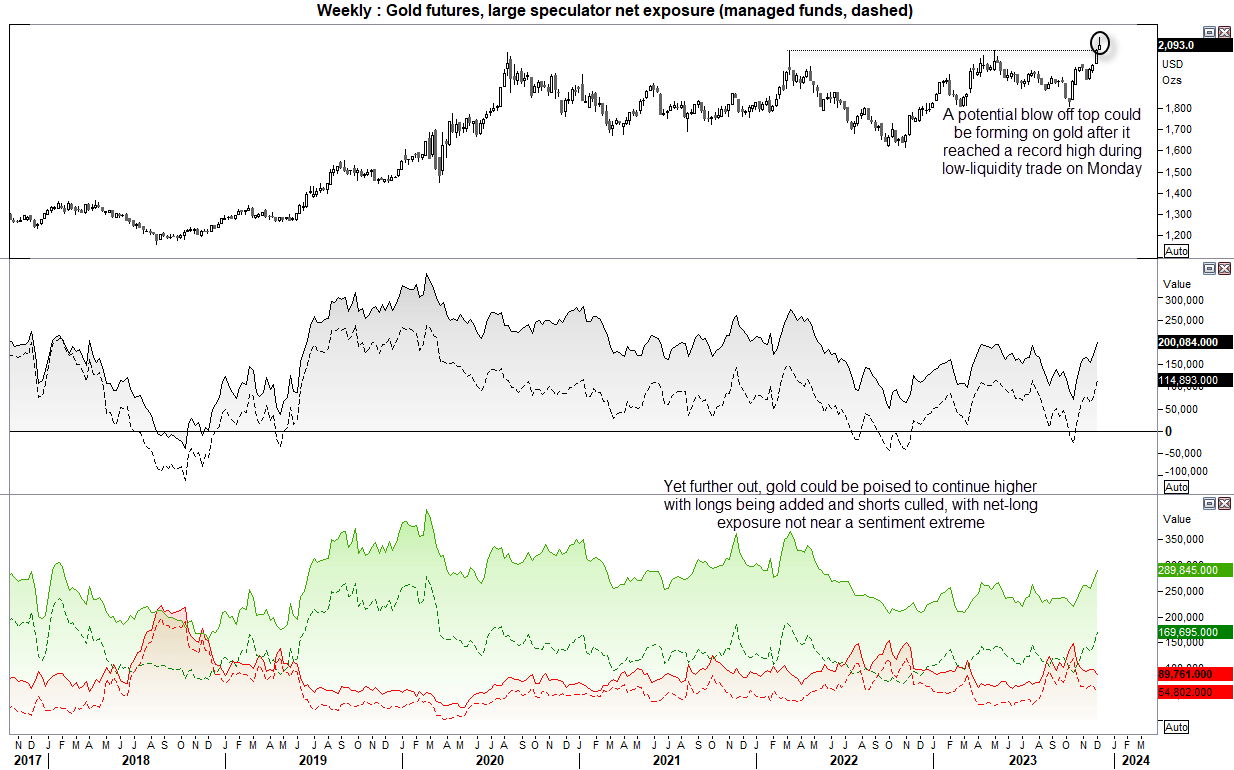

Gold futures (GC) positioning – COT report:

Gold made minced meat out of the 2022 high / previous all-time high during early Asian trade on Monday, rising $75 at the open and blowing past it’s 1week implied volatility band. Lots of gold headlines are to be expected. But I remain suspicious of the move, given it occurred during low liquidity trade, and we have already seen gold hand bac much of these early gains.

Still, we can see that large speculators and managed funds continued to add to longs and trim short exposure, yet met-long exposure is far from a sentiment extreme. If bond yields keep falling then the path of least resistance seems to be higher for gold. But traders may want to be on guard for some volatility around those previous highs before its next real move unfolds.

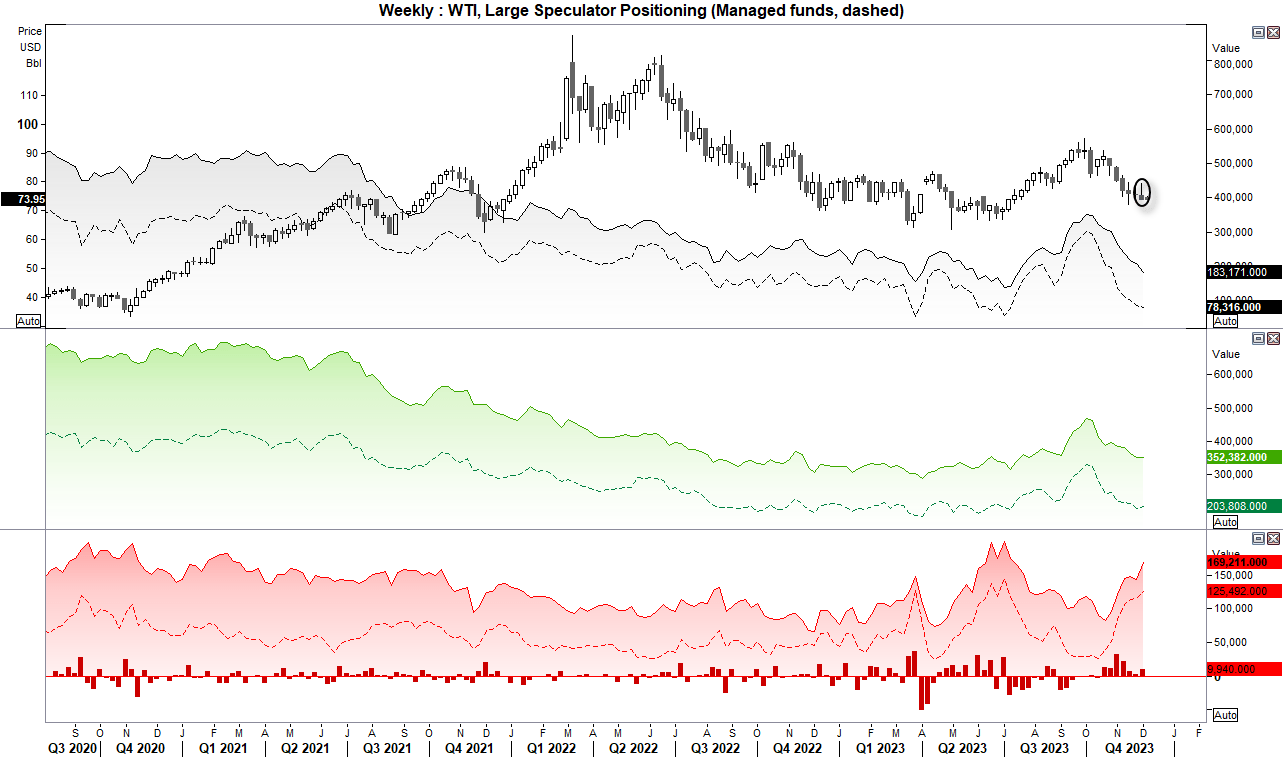

WTI crude oil (CL) positioning – COT report:

Crude oil closed lower for a sixth week as traders were unimpressed with OPEC’s anticipated oil production cuts. Short bets increased for a sixth week and at their fastest pace in three, whilst long bets remained effectively unchanged from managed funds and large speculators. A a bearish outside week having met resistance just beneath $80, my bias is now for a move towards the original lower target of $70.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade