EUR/USD must be one of the most well-behaved FX pairs in the world right now, sitting comfortably in a long-running downtrend, refusing to stray too far from the current trajectory no matter what the world is throwing at it.

EUR/USD downtrend remains strong

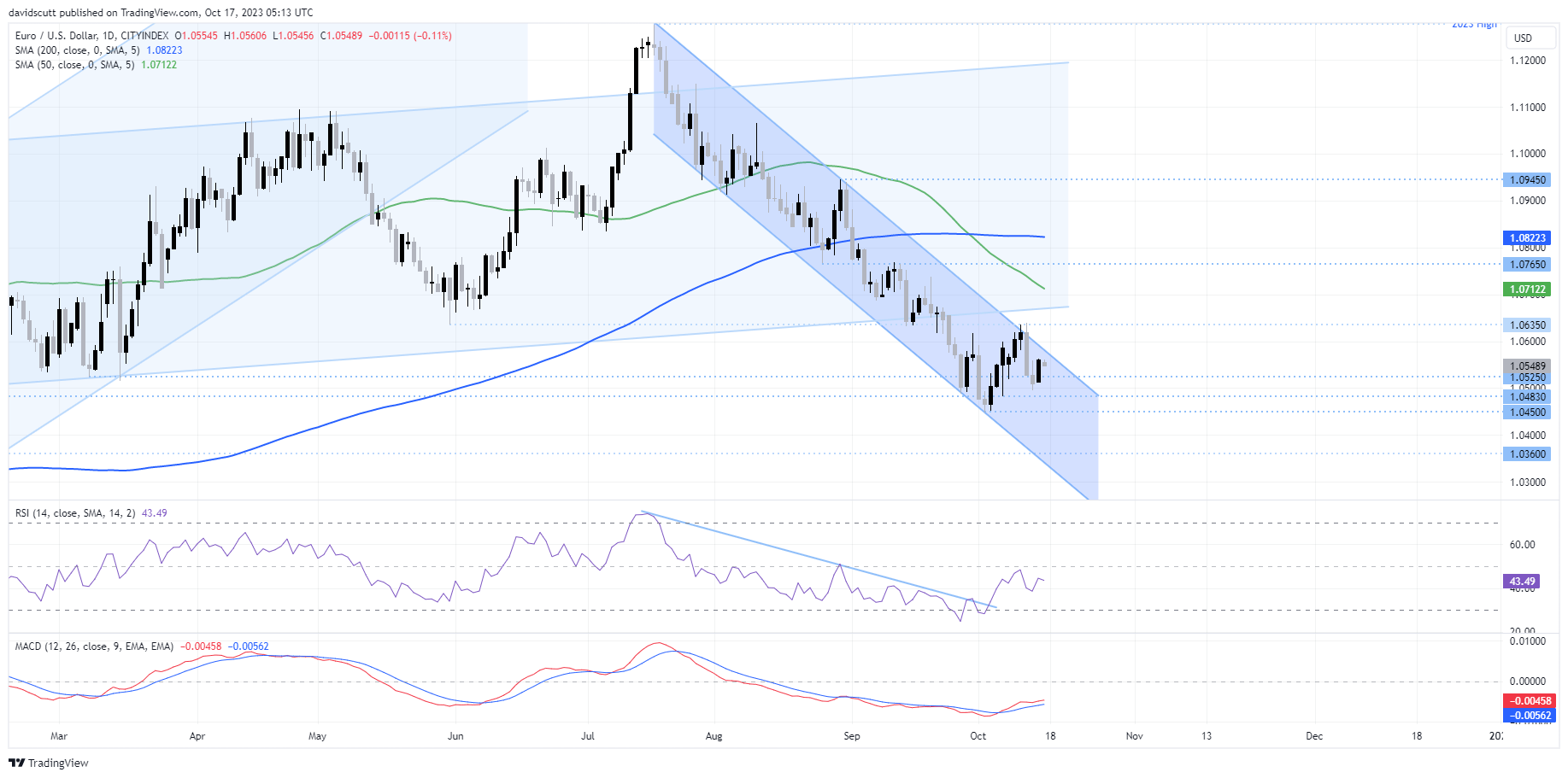

The daily chart speaks for itself, setting lower high after lower high with corrective rallies in between, largely reflecting the deterioration in the macroeconomic outlook relative to the United States in recent months. Lacking domestic energy supply, and with one war ongoing to the east and another about to erupt a little further south, it’s hard to get excited about euro right now. In contrast, the US dollar is not only outperforming on the economic front, but also energy rich and a notable safe haven. Check. Mate.

Having failed to sustain a topside break following the US consumer price inflation report last week, EUR/USD was hammered back into the downtrend on the escalation of the conflict between Israel and Hamas, reinforcing the view it remains a sell-on-rallies play.

Right now, those contemplating initiating short EUR/USD positions may want to place protective stops above downtrend resistance, currently located around 1.0580. It has found buyers on dips between 1.0480 over the past fortnight, making that the first logical target for potential shorts. 1.0450, the low hit in early October, and 1.0360 are the next downside levels to watch.

Alternatively, a clean break of the downtrend may open the door for a possible bounce back towards 1.0635, the highs struck after the US inflation report.

EUR/USD to remain headline-driven near-term

Like other risk assets, headlines relating to the Israel-Hamas conflict will continue to drive the price action in EUR/USD near-term with other information coming in a distant second in terms of relevance, including the latest German ZEW survey and US retail sales which will top the data calendar on Tuesday.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade